06.11.2023 06:29 AM

06.11.2023 06:29 AMBitcoin

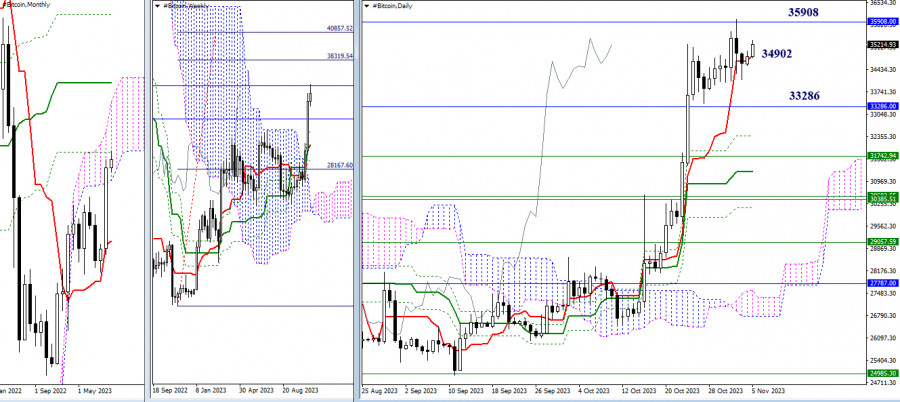

Higher timeframes

October provided bulls with moments of optimism, pushing the market away from the support of the monthly short-term trend towards the next resistance of the monthly death cross (35,908). Meanwhile, Bitcoin managed to close October within the monthly cloud (33,286), making the upper boundary of the Ichimoku cloud (40,490) the next upward target on this timeframe.

The result of October's activity was also the formation of an upward target for breaking the weekly cloud (38,320 - 40,858). These target levels (38,320 - 40,490 - 40,858) have been planned by the bullish players for November following the optimism and activity of October. This will only be possible if the bulls maintain and continue the October sentiment.

If priorities change and the bears return to the market. In that case, their focus will first be on exiting the monthly cloud (33,286) and then testing and liquidating the existing golden crosses of Ichimoku on the weekly and daily timeframes. The nearest supports from the golden crosses of Ichimoku at the moment can be noted at 32,380 - 31,743 - 31,261.

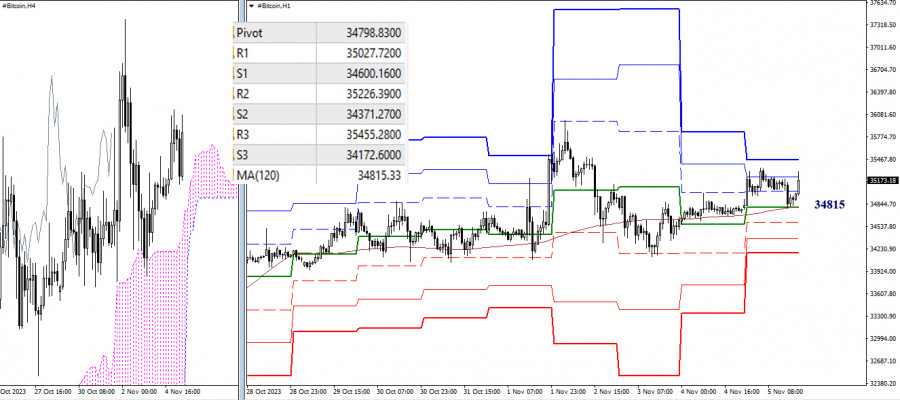

H4 - H1

As of writing, the main advantage on the lower timeframes remains with the bullish players. However, the balance of power is very fragile because the weekly long-term trend (34,815) has been acting as support for a long time, responsible for the distribution and balance of power. Bitcoin can lose this support at any moment, after which the market's attention will shift within the day to the supports of the classic pivot points. The primary priority in this case will be the strengthening of bearish sentiments.

Note that the loss of the key level of the lower timeframes—34,815 (weekly long-term trend), is currently associated with losing the center of attraction of the daily timeframe—34,902 (short-term trend). A secure consolidation below 34,902 - 34,815 opens up new prospects for bears, both within the day and on the higher timeframes.

***

The technical analysis of the situation uses:

Higher timeframes - Ichimoku Kinko Hyo (9.26.52) + Fibo Kijun levels

H1 - Pivot Points (classic) + Moving Average 120 (weekly long-term trend)

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

في يوم الخميس، تداول زوج اليورو/الدولار الأمريكي بشكل جانبي. لم يكن لنتائج اجتماع البنك المركزي الأوروبي تأثير يُذكر على معنويات السوق، وكان الاجتماع نفسه خالياً من الأحداث المهمة. ونتيجة لذلك،

على الرسم البياني لكل ساعة، ارتد زوج الجنيه الإسترليني/الدولار الأمريكي يوم الخميس من مستوى تصحيح 50.0% عند 1.3579، وانعكس لصالح الدولار الأمريكي، واستقر تحت مستوى فيبوناتشي 61.8% عند 1.3530. لذلك،

روابط مفيدة: مقالاتي الأخرى متوفرة في هذا القسم دورة InstaForex للمبتدئين التحليلات الشائعة افتح حساب تداول مهم: يجب على المبتدئين في تداول الفوركس أن يكونوا حذرين للغاية عند اتخاذ القرارات

يتداول الذهب حول 3,359، فوق الدعم المهم عند 6/8 Murray وتحت 21 SMA. بعد أن وصل الذهب إلى مقاومة قوية عند 8/8 Murray، قام بتصحيح تقني حاد ومن المحتمل الآن

إذا استمر البيتكوين في الانخفاض، ينبغي أن نتوقع حدوث تماسك تحت مستوى 5/8 Murray، ثم يمكن أن يصل سعر البيتكوين إلى حوالي $113,519 بالقرب من 200 EMA ومستوى 4/8 Murray

في وقت مبكر من الجلسة الأوروبية، يتداول زوج اليورو/الدولار الأمريكي حول مستوى 1.174، حيث يخضع لتصحيح تقني بعد محاولة كسر مستوى 1.1790. من المحتمل أن يستمر اليورو في الانخفاض

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.