Triple Bottom

was formed on 28.03 at 21:55:08 (UTC+0)

signal strength 1 of 5

The Triple Bottom pattern has formed on the chart of #AMZN M5. Features of the pattern: The lower line of the pattern has coordinates 193.15 with the upper limit 193.15/192.69, the projection of the width is 131 points. The formation of the Triple Bottom pattern most likely indicates a change in the trend from downward to upward. This means that in the event of a breakdown of the resistance level 191.84, the price is most likely to continue the upward movement.

The M5 and M15 time frames may have more false entry points.

انظر أيضا

- All

- All

- Bearish Rectangle

- Bearish Symmetrical Triangle

- Bearish Symmetrical Triangle

- Bullish Rectangle

- Double Top

- Double Top

- Triple Bottom

- Triple Bottom

- Triple Top

- Triple Top

- All

- All

- Buy

- Sale

- All

- 1

- 2

- 3

- 4

- 5

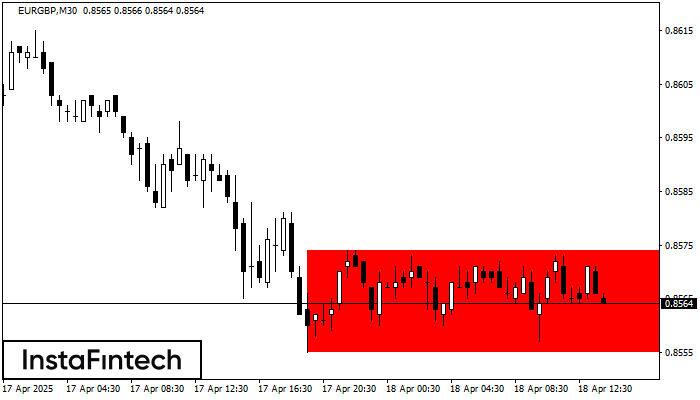

Bearish Rectangle

сформирован 18.04 в 13:00:27 (UTC+0)

сила сигнала 3 из 5

According to the chart of M30, EURGBP formed the Bearish Rectangle. This type of a pattern indicates a trend continuation. It consists of two levels: resistance 0.8574 - 0.0000

Открыть график инструмента в новом окне

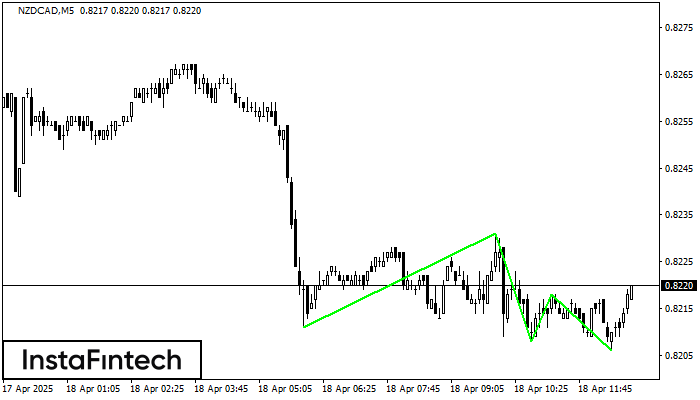

Triple Bottom

сформирован 18.04 в 11:50:33 (UTC+0)

сила сигнала 1 из 5

The Triple Bottom pattern has formed on the chart of the NZDCAD M5 trading instrument. The pattern signals a change in the trend from downwards to upwards in the case

The M5 and M15 time frames may have more false entry points.

Открыть график инструмента в новом окне

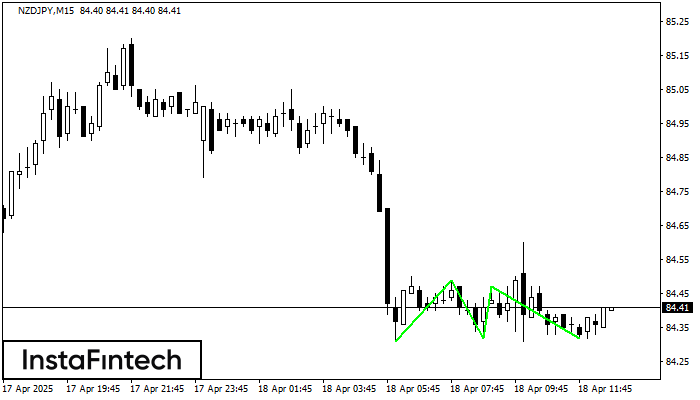

Triple Bottom

сформирован 18.04 в 11:45:33 (UTC+0)

сила сигнала 2 из 5

The Triple Bottom pattern has been formed on NZDJPY M15. It has the following characteristics: resistance level 84.49/84.47; support level 84.31/84.32; the width is 18 points. In the event

The M5 and M15 time frames may have more false entry points.

Открыть график инструмента в новом окне