Inverse Head and Shoulder

was formed on 28.04 at 21:45:21 (UTC+0)

signal strength 1 of 5

According to the chart of M5, #KO produced the pattern termed the Inverse Head and Shoulder. The Head is fixed at 71.31 while the median line of the Neck is set at 71.65/71.71. The formation of the Inverse Head and Shoulder Pattern clearly indicates a reversal of the downward trend. In means that in case the scenario comes true, the price of #KO will go towards 71.86.

The M5 and M15 time frames may have more false entry points.

انظر أيضا

- All

- All

- Bearish Rectangle

- Bearish Symmetrical Triangle

- Bearish Symmetrical Triangle

- Bullish Rectangle

- Double Top

- Double Top

- Triple Bottom

- Triple Bottom

- Triple Top

- Triple Top

- All

- All

- Buy

- Sale

- All

- 1

- 2

- 3

- 4

- 5

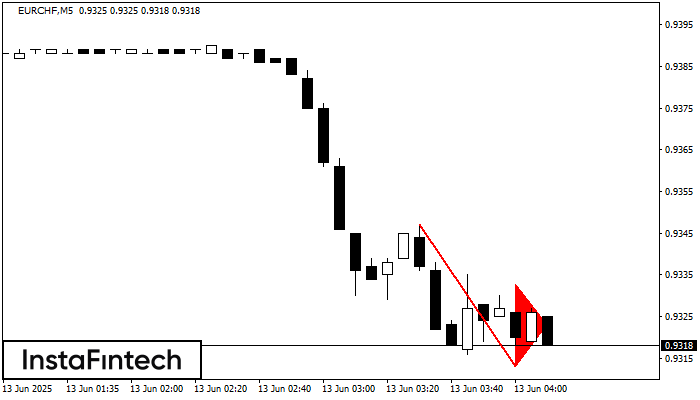

Bearish pennant

was formed on 13.06 at 03:11:27 (UTC+0)

signal strength 1 of 5

The Bearish pennant pattern has formed on the EURCHF M5 chart. The pattern signals continuation of the downtrend in case the pennant’s low of 0.9313 is broken through. Recommendations: Place

The M5 and M15 time frames may have more false entry points.

Open chart in a new window

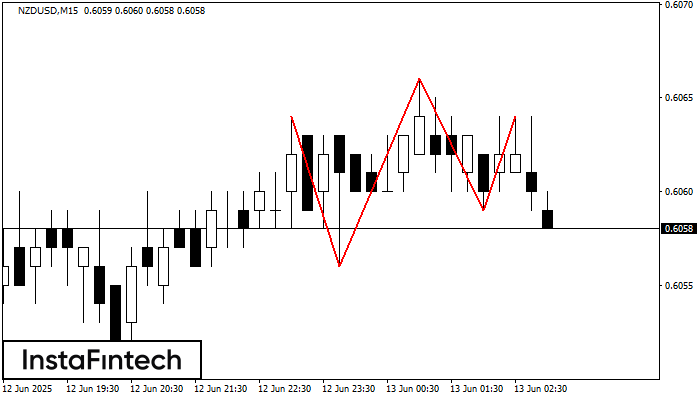

Triple Top

was formed on 13.06 at 02:00:45 (UTC+0)

signal strength 2 of 5

On the chart of the NZDUSD M15 trading instrument, the Triple Top pattern that signals a trend change has formed. It is possible that after formation of the third peak

The M5 and M15 time frames may have more false entry points.

Open chart in a new window

Double Top

was formed on 13.06 at 02:00:25 (UTC+0)

signal strength 3 of 5

The Double Top reversal pattern has been formed on NZDUSD M30. Characteristics: the upper boundary 0.6066; the lower boundary 0.6051; the width of the pattern is 15 points. Sell trades

Open chart in a new window