CADDKK (Canadian Dollar vs Danish Krone). Exchange rate and online charts.

Currency converter

15 Jul 2025 00:37

(0%)

Closing price, the previous day.

Opening price.

The highest price over the last trading day.

The lowest price over the last trading day

Price range high in the last week

Price range low in the last week

The CAD/DKK currency pair is not really popular among the traders of Forex market. This pair is the cross rate against the U.S. dollar. Although there is no U.S. Dollar in this currency pair, the CAD/DKK pair is under considerable influence of it. To make it clear, just combine two charts (CAD/USD and USD/DKK) in the same price chart and you will get an approximate the CAD/DKK chart.

The U.S. dollar affects both currencies deeply. That is why for better forecasting the future CAD/DKK rate, it is necessary to pay attention to the main economic indicators of the U.S. There are some indicators such as the interest rate, GDP, unemployment, new workplaces indicator and many others. These two currencies can react differently to the U.S. economy changes.

The world oil prices have a great influence on the Canadian dollar. As you know, Canada has the status of one of the largest world exporters of oil. So when the oil price is getting higher, the Canadian dollar value is also increasing, and vice versa. The fact speaks for itself: the CAD/DKK currency pair is directly dependent on the world oil prices.

Denmark is known as prosperous country with developed industrial and agricultural sectors. Its economic indicators are one of the highest in the world. Despite of the Danish large oil and gas reserves (in Jutland and in the North Sea), it is still dependent on export of other mineral resources. Denmark has stable economic and trade relationships with all the developed countries, mostly with the EU ones. They lead the active trade in machinery, electronics, agriculture, mining, etc.

That fact that the economy of Denmark is one of the strongest in the world allows the Danish krone to be stable in pairs with other major currencies on Forex market. There are some factors strengthening the Denmark economy such as low inflation and unemployment rates, large oil and gas reserves, high technology and highly qualified specialists in economic fields.

The economy of Denmark has one of the highest levels, but there are still some factors that make it weaker, such as high taxes and deterioration of the competitiveness on the world market. Traders working with this currency pair should take into account some economic indicators like prices for oil and for other minerals that can influence Denmark production.

Keep in mind that the spread for cross currency pairs can be higher than for popular ones. So before you start dealing with the cross rates, learn carefully broker’s conditions of trading with specified trade instrument.

See Also

- The USD/JPY pair continues to consolidate near a three-week high amid U.S. dollar strength and mixed market signals

Author: Irina Yanina

12:17 2025-07-14 UTC+2

1078

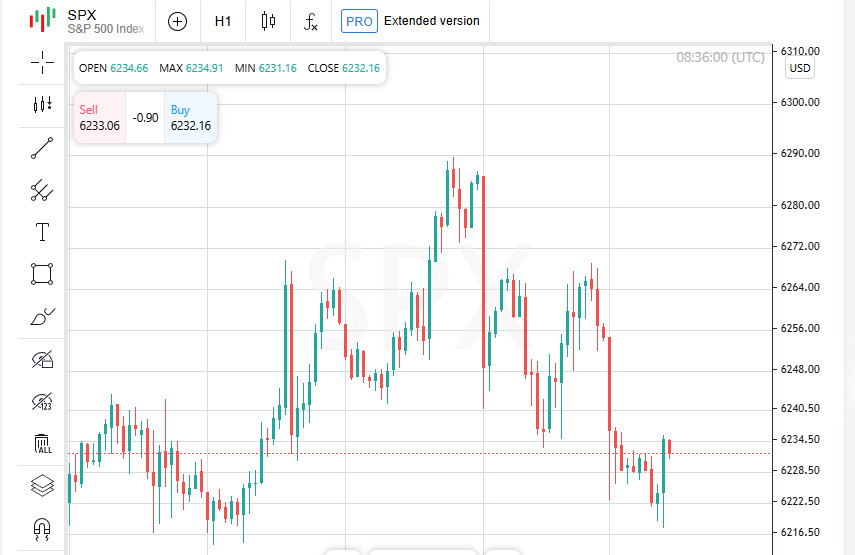

S&P 500 and EU futures fall, Nikkei steady Euro falls after Trump threatens 30% EU tariff US inflation and China growth data loom this weekAuthor: Thomas Frank

10:40 2025-07-14 UTC+2

943

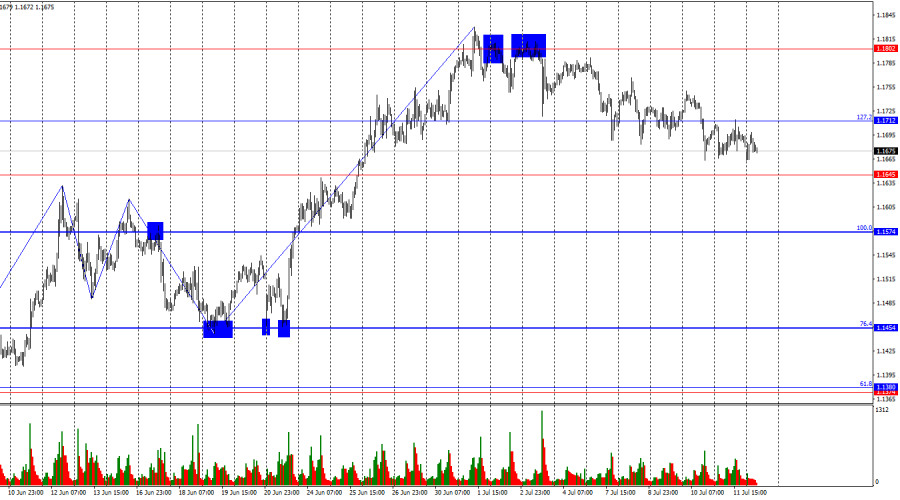

Last week, the pair moved downward and nearly tested the 23.6% retracement level at 1.1647 (blue dashed line), after which the price turned upward and closed the weekly candle at 1.1689. In the upcoming week, the price may continue its downward movement.Author: Stefan Doll

11:34 2025-07-14 UTC+2

898

- Wave analysis

Weekly Forecast Using Simplified Wave Analysis for EUR/USD, USD/JPY, GBP/JPY, USD/CAD, NZD/USD, and Gold as of July 14th

A sideways price movement is expected to continue in the upcoming week. A downward move toward the support zone is more likely in the first days, followed by a potential reversal and resumption of the upward trend. A change in direction may trigger a sharp increase in volatility.Author: Isabel Clark

10:57 2025-07-14 UTC+2

853

Bears still lack optimismAuthor: Samir Klishi

11:31 2025-07-14 UTC+2

793

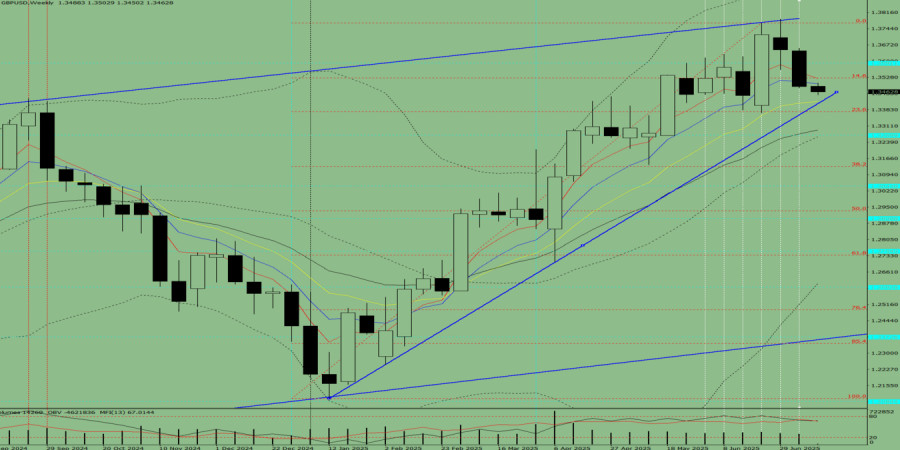

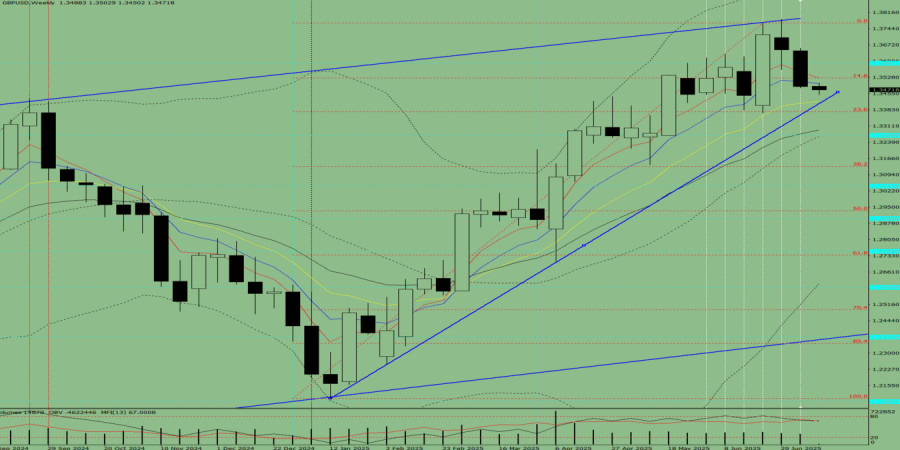

Last week, the pair moved downward and broke below the 8-period EMA at 1.3509 (thin blue line), closing the weekly candle at 1.3487. In the upcoming week, the price may continue to move lower.Author: Stefan Doll

11:40 2025-07-14 UTC+2

763

- Donald Trump announced 30% tariffs on goods from the EU and Mexico. The initial market reaction was negative, but the S&P 500 partially rebounded thanks to gains in large-cap stocks

Author: Ekaterina Kiseleva

14:36 2025-07-14 UTC+2

748

Wave analysisWeekly Forecast Using Simplified Wave Analysis for GBP/USD, AUD/USD, USD/CHF, EUR/JPY, AUD/JPY, and the US Dollar Index as of July 14th

Throughout the upcoming week, the British pound is expected to move in a generally sideways trajectory. A decline toward the support zone is likely in the first few days, followed by a potential reversal and the beginning of an upward movement. The highest volatility is anticipated toward the end.Author: Isabel Clark

11:12 2025-07-14 UTC+2

718

Bears in no rush to strengthen parity despite growing trade tensions and U.S. dollar appreciationAuthor: Irina Yanina

19:05 2025-07-14 UTC+2

703

- The USD/JPY pair continues to consolidate near a three-week high amid U.S. dollar strength and mixed market signals

Author: Irina Yanina

12:17 2025-07-14 UTC+2

1078

- S&P 500 and EU futures fall, Nikkei steady Euro falls after Trump threatens 30% EU tariff US inflation and China growth data loom this week

Author: Thomas Frank

10:40 2025-07-14 UTC+2

943

- Last week, the pair moved downward and nearly tested the 23.6% retracement level at 1.1647 (blue dashed line), after which the price turned upward and closed the weekly candle at 1.1689. In the upcoming week, the price may continue its downward movement.

Author: Stefan Doll

11:34 2025-07-14 UTC+2

898

- Wave analysis

Weekly Forecast Using Simplified Wave Analysis for EUR/USD, USD/JPY, GBP/JPY, USD/CAD, NZD/USD, and Gold as of July 14th

A sideways price movement is expected to continue in the upcoming week. A downward move toward the support zone is more likely in the first days, followed by a potential reversal and resumption of the upward trend. A change in direction may trigger a sharp increase in volatility.Author: Isabel Clark

10:57 2025-07-14 UTC+2

853

- Bears still lack optimism

Author: Samir Klishi

11:31 2025-07-14 UTC+2

793

- Last week, the pair moved downward and broke below the 8-period EMA at 1.3509 (thin blue line), closing the weekly candle at 1.3487. In the upcoming week, the price may continue to move lower.

Author: Stefan Doll

11:40 2025-07-14 UTC+2

763

- Donald Trump announced 30% tariffs on goods from the EU and Mexico. The initial market reaction was negative, but the S&P 500 partially rebounded thanks to gains in large-cap stocks

Author: Ekaterina Kiseleva

14:36 2025-07-14 UTC+2

748

- Wave analysis

Weekly Forecast Using Simplified Wave Analysis for GBP/USD, AUD/USD, USD/CHF, EUR/JPY, AUD/JPY, and the US Dollar Index as of July 14th

Throughout the upcoming week, the British pound is expected to move in a generally sideways trajectory. A decline toward the support zone is likely in the first few days, followed by a potential reversal and the beginning of an upward movement. The highest volatility is anticipated toward the end.Author: Isabel Clark

11:12 2025-07-14 UTC+2

718

- Bears in no rush to strengthen parity despite growing trade tensions and U.S. dollar appreciation

Author: Irina Yanina

19:05 2025-07-14 UTC+2

703