NZDHUF (New Zealand Dollar vs Hungarian Forint). Exchange rate and online charts.

Currency converter

15 Jul 2025 03:12

(0%)

Closing price, the previous day.

Opening price.

The highest price over the last trading day.

The lowest price over the last trading day

Price range high in the last week

Price range low in the last week

NZD/HUF is not in great demand on Forex. The currency pair symbolizes the cross rate against the U.S. dollar. Although the U.S. currency cannot be found in this pair, it still has a significant influence on it. This can be seen, if you combine two charts: NZDUSD and USDHUF. By combining these two charts in the same price chart, you can get an approximate NZDHUF chart.

The U.S. dollar has a significant influence on both currencies. For this reason it is necessary to take into account the major U.S. economic indicators for the correct prediction of a future course of this financial instrument. These indicators include: the discount rate, GDP, unemployment, new created workplaces indicator and many others. Is necessary to note that discussed currencies could respond with different speed on changes in the U.S. economy, therefore, NZDHUF currency pair may be a specific indicator of change at these currencies.

When trading on the NZDHUF trading instrument, it is necessary take into account many features of the New Zealand economy, such as GDP, the discount rate, economic activity, the level of trade with other countries and many others. New Zealand is the largest producer of wool in the world, as well as its products. Therefore it is necessary to know the detail information about this indicator of New Zealand economy. It should be noted that New Zealand's economy is highly dependent on its main partners - the U.S., Australia and the Asia-Pacific. For this reason, you should also take into account a variety of economic indicators of main trading partners of New Zealand.

Hungary is a country with a high proportion of foreign capital in the economy. For this reason, the Hungarian economy is highly dependent on those organizations and countries that operate in the territory of this Central European state.

Hungary is an advanced industrial country in Central Europe. The main economic sectors in Hungary are engineering, metallurgy and chemical industry. Also Hungary has a very developed agriculture, a significant proportion of which are gardening and wine-making industries. Much of the products are exported abroad. A significant proportion of Hungarian income is international tourism. Millions of foreigners visit this country annually, because they attracted by the nature of the country and its ancient traditions and architecture. Hungary's main trading partners are EU countries and Russia. For this reason, when you assess the further course of the Hungarian forint, you should pay special attention to economic indicators of these regions.

This trading instrument is relatively illiquid if we’ll compare it with major currency pairs, such as: EURUSD, USDCHF, GBPUSD and USDJPY. Therefore, when you make a prognosis for the financial instrument, you should primarily focus on those currency pairs that include a U.S. dollar in tandem with each of the considered currencies.

If you trade cross rates, it is necessary to remember that brokers are usually set a higher spread than the more popular currency pairs, so before you start working with the cross-rates, it should be carefully acquainted with the conditions offered by the broker to trade with specified trade instrument.

See Also

- The USD/JPY pair continues to consolidate near a three-week high amid U.S. dollar strength and mixed market signals

Author: Irina Yanina

12:17 2025-07-14 UTC+2

1108

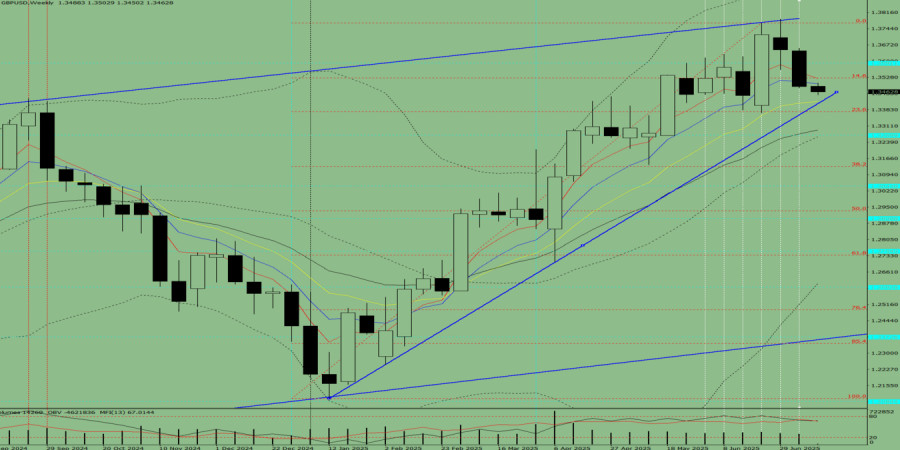

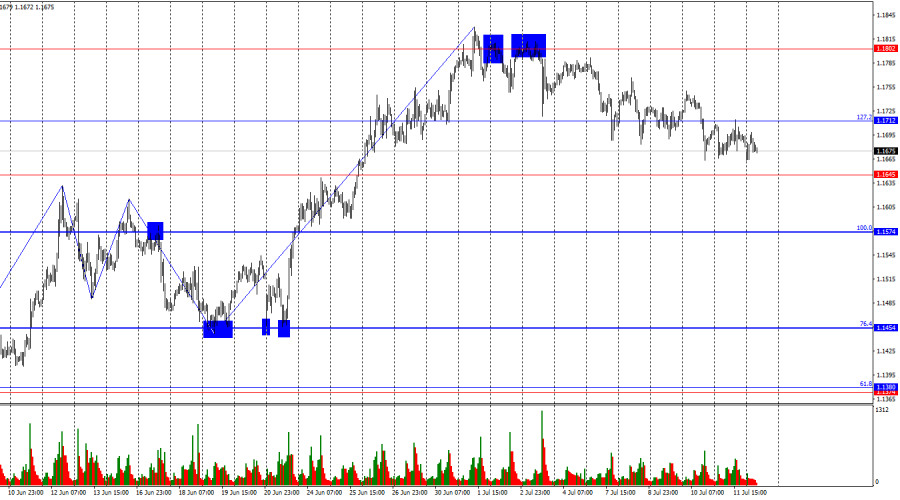

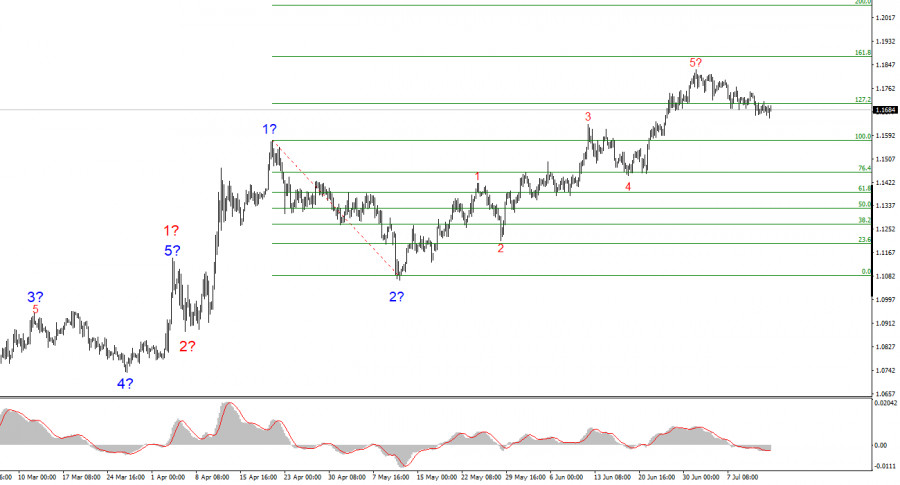

Last week, the pair moved downward and nearly tested the 23.6% retracement level at 1.1647 (blue dashed line), after which the price turned upward and closed the weekly candle at 1.1689. In the upcoming week, the price may continue its downward movement.Author: Stefan Doll

11:34 2025-07-14 UTC+2

898

Bears in no rush to strengthen parity despite growing trade tensions and U.S. dollar appreciationAuthor: Irina Yanina

19:05 2025-07-14 UTC+2

838

- Bears still lack optimism

Author: Samir Klishi

11:31 2025-07-14 UTC+2

793

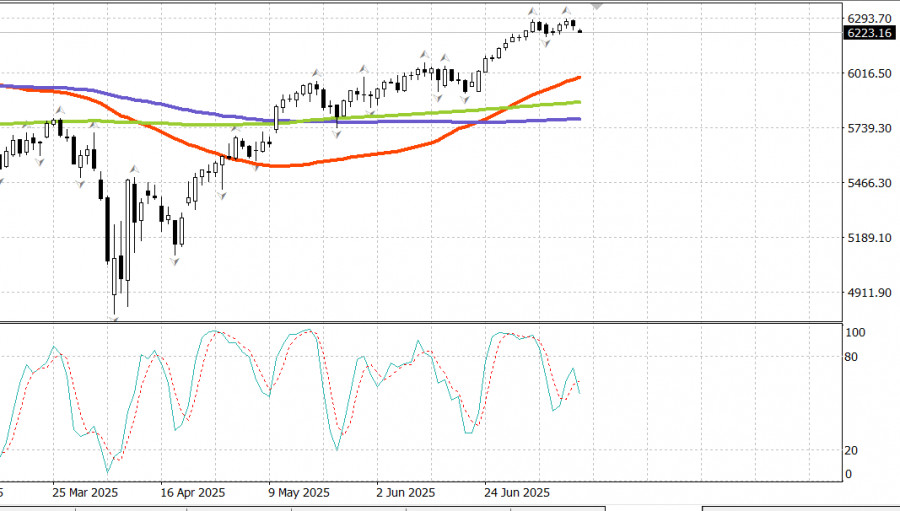

Donald Trump announced 30% tariffs on goods from the EU and Mexico. The initial market reaction was negative, but the S&P 500 partially rebounded thanks to gains in large-cap stocksAuthor: Ekaterina Kiseleva

14:36 2025-07-14 UTC+2

793

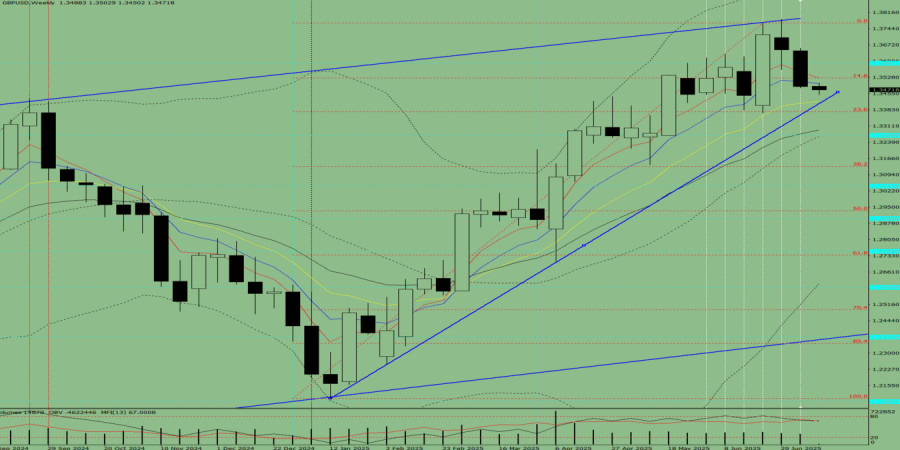

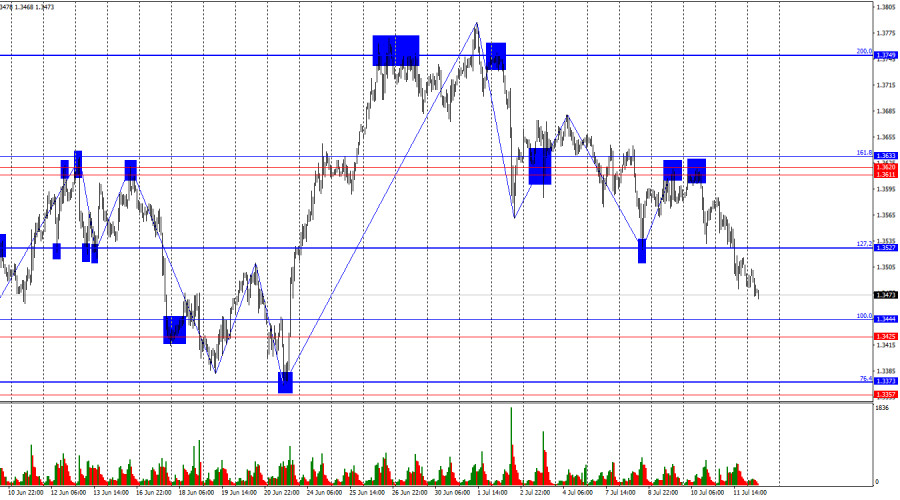

Last week, the pair moved downward and broke below the 8-period EMA at 1.3509 (thin blue line), closing the weekly candle at 1.3487. In the upcoming week, the price may continue to move lower.Author: Stefan Doll

11:40 2025-07-14 UTC+2

778

- Bears are attacking, but this is a temporary phenomenon.

Author: Samir Klishi

11:25 2025-07-14 UTC+2

733

Trump returns to tariff warAuthor: Jozef Kovach

14:53 2025-07-14 UTC+2

718

The EUR/USD rate remained virtually unchanged on MondayAuthor: Chin Zhao

22:19 2025-07-14 UTC+2

703

- The USD/JPY pair continues to consolidate near a three-week high amid U.S. dollar strength and mixed market signals

Author: Irina Yanina

12:17 2025-07-14 UTC+2

1108

- Last week, the pair moved downward and nearly tested the 23.6% retracement level at 1.1647 (blue dashed line), after which the price turned upward and closed the weekly candle at 1.1689. In the upcoming week, the price may continue its downward movement.

Author: Stefan Doll

11:34 2025-07-14 UTC+2

898

- Bears in no rush to strengthen parity despite growing trade tensions and U.S. dollar appreciation

Author: Irina Yanina

19:05 2025-07-14 UTC+2

838

- Bears still lack optimism

Author: Samir Klishi

11:31 2025-07-14 UTC+2

793

- Donald Trump announced 30% tariffs on goods from the EU and Mexico. The initial market reaction was negative, but the S&P 500 partially rebounded thanks to gains in large-cap stocks

Author: Ekaterina Kiseleva

14:36 2025-07-14 UTC+2

793

- Last week, the pair moved downward and broke below the 8-period EMA at 1.3509 (thin blue line), closing the weekly candle at 1.3487. In the upcoming week, the price may continue to move lower.

Author: Stefan Doll

11:40 2025-07-14 UTC+2

778

- Bears are attacking, but this is a temporary phenomenon.

Author: Samir Klishi

11:25 2025-07-14 UTC+2

733

- The EUR/USD rate remained virtually unchanged on Monday

Author: Chin Zhao

22:19 2025-07-14 UTC+2

703