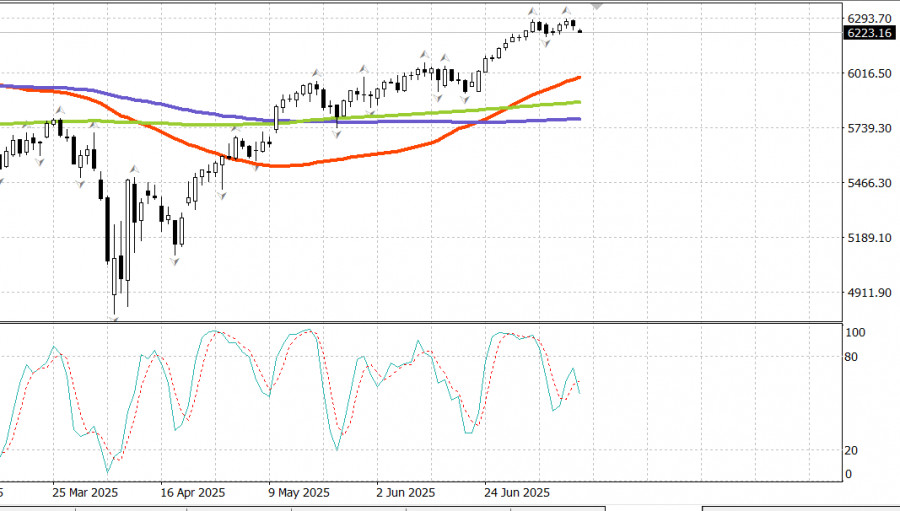

#SMI (Swiss Market Index). Exchange rate and online charts.

Currency converter

Euro

US Dollar

EUR

USD

#SMI

11941.5 USD

14 Jul 2025 22:59

14 Jul 2025 22:59

Price Change (% chg)

$0

(0%)

(0%)

Prev Close

$11912.7

Prev Close

Closing price, the previous day.

Closing price, the previous day.

Open

$12109.9

Open

Opening price.

Opening price.

Day's High

$11953

Day's High

The highest price over the last trading day.

The highest price over the last trading day.

Day's Low

$11833

Day's Low

The lowest price over the last trading day

The lowest price over the last trading day

Week High

$12029.7

Week High

Price range high in the last week

Price range high in the last week

Week Low

$11833

Week Low

Price range low in the last week

Price range low in the last week

See Also

- The USD/JPY pair continues to consolidate near a three-week high amid U.S. dollar strength and mixed market signals

Author: Irina Yanina

12:17 2025-07-14 UTC+2

1108

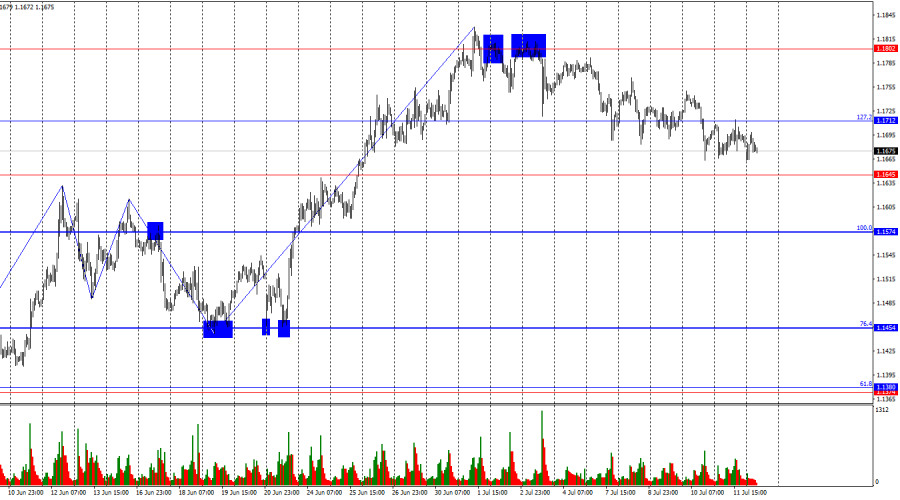

Last week, the pair moved downward and nearly tested the 23.6% retracement level at 1.1647 (blue dashed line), after which the price turned upward and closed the weekly candle at 1.1689. In the upcoming week, the price may continue its downward movement.Author: Stefan Doll

11:34 2025-07-14 UTC+2

898

Bears in no rush to strengthen parity despite growing trade tensions and U.S. dollar appreciationAuthor: Irina Yanina

19:05 2025-07-14 UTC+2

838

- Bears still lack optimism

Author: Samir Klishi

11:31 2025-07-14 UTC+2

793

Donald Trump announced 30% tariffs on goods from the EU and Mexico. The initial market reaction was negative, but the S&P 500 partially rebounded thanks to gains in large-cap stocksAuthor: Ekaterina Kiseleva

14:36 2025-07-14 UTC+2

793

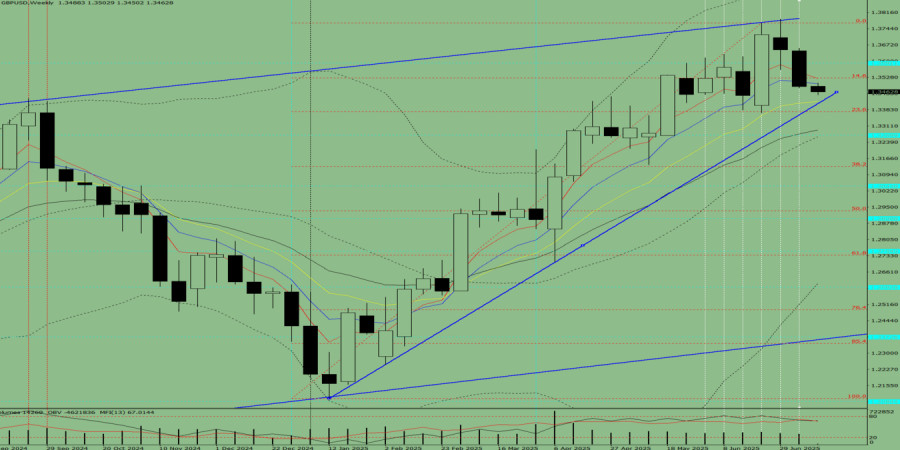

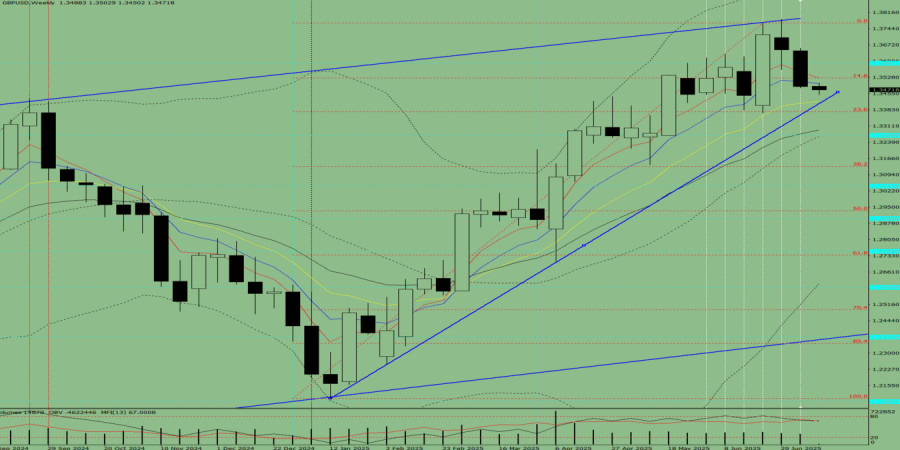

Last week, the pair moved downward and broke below the 8-period EMA at 1.3509 (thin blue line), closing the weekly candle at 1.3487. In the upcoming week, the price may continue to move lower.Author: Stefan Doll

11:40 2025-07-14 UTC+2

778

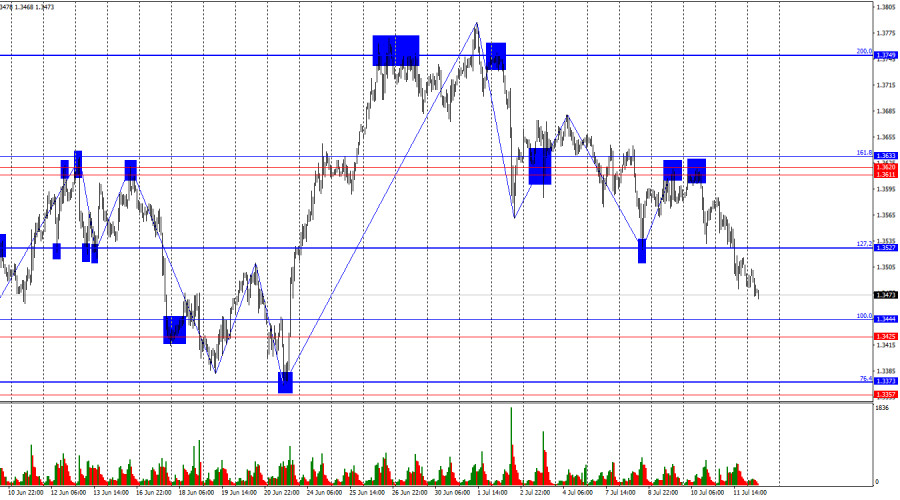

- Wave analysis

Weekly Forecast Using Simplified Wave Analysis for GBP/USD, AUD/USD, USD/CHF, EUR/JPY, AUD/JPY, and the US Dollar Index as of July 14th

Throughout the upcoming week, the British pound is expected to move in a generally sideways trajectory. A decline toward the support zone is likely in the first few days, followed by a potential reversal and the beginning of an upward movement. The highest volatility is anticipated toward the end.Author: Isabel Clark

11:12 2025-07-14 UTC+2

733

Bears are attacking, but this is a temporary phenomenon.Author: Samir Klishi

11:25 2025-07-14 UTC+2

733

- The USD/JPY pair continues to consolidate near a three-week high amid U.S. dollar strength and mixed market signals

Author: Irina Yanina

12:17 2025-07-14 UTC+2

1108

- Last week, the pair moved downward and nearly tested the 23.6% retracement level at 1.1647 (blue dashed line), after which the price turned upward and closed the weekly candle at 1.1689. In the upcoming week, the price may continue its downward movement.

Author: Stefan Doll

11:34 2025-07-14 UTC+2

898

- Bears in no rush to strengthen parity despite growing trade tensions and U.S. dollar appreciation

Author: Irina Yanina

19:05 2025-07-14 UTC+2

838

- Bears still lack optimism

Author: Samir Klishi

11:31 2025-07-14 UTC+2

793

- Donald Trump announced 30% tariffs on goods from the EU and Mexico. The initial market reaction was negative, but the S&P 500 partially rebounded thanks to gains in large-cap stocks

Author: Ekaterina Kiseleva

14:36 2025-07-14 UTC+2

793

- Last week, the pair moved downward and broke below the 8-period EMA at 1.3509 (thin blue line), closing the weekly candle at 1.3487. In the upcoming week, the price may continue to move lower.

Author: Stefan Doll

11:40 2025-07-14 UTC+2

778

- Wave analysis

Weekly Forecast Using Simplified Wave Analysis for GBP/USD, AUD/USD, USD/CHF, EUR/JPY, AUD/JPY, and the US Dollar Index as of July 14th

Throughout the upcoming week, the British pound is expected to move in a generally sideways trajectory. A decline toward the support zone is likely in the first few days, followed by a potential reversal and the beginning of an upward movement. The highest volatility is anticipated toward the end.Author: Isabel Clark

11:12 2025-07-14 UTC+2

733

- Bears are attacking, but this is a temporary phenomenon.

Author: Samir Klishi

11:25 2025-07-14 UTC+2

733