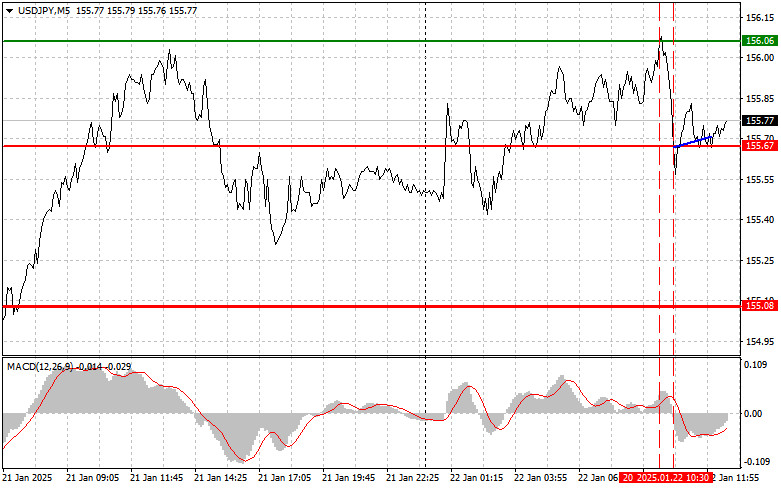

- The test of the 156.06 price level occurred when the MACD indicator had already moved significantly above the zero mark

Author: Jakub Novak

15:34 2025-01-22 UTC+2

1378

Technical analysisTrading Signals for GOLD (XAU/USD) for January 22-25, 2025: sell below $2,760 (21 SMA - 7/8 Murray)

The technical reversal zone is located around 7/8 Murray at about 2,773. This level could offer strong resistance and we could expect gold to fall.Author: Dimitrios Zappas

15:58 2025-01-22 UTC+2

1273

Futures on U.S. stock indices rose, signaling that the strong rally on Wall Street over the past two sessions is here to stayAuthor: Jakub Novak

15:47 2025-01-22 UTC+2

1183

- Crypto-currencies

Trading Recommendations for the Cryptocurrency Market on January 22nd (U.S. Session)

Bitcoin experienced a slight correction during the first half of the day, but no suitable entry points materializedAuthor: Miroslaw Bawulski

15:42 2025-01-22 UTC+2

1018

Technical analysisTrading Signals for EUR/USD for January 22-25, 2025: buy above 1.0376 or sell below 1.0460 (21 SMA - 5/8 Murray)

Below the 21SMA and below 5/8 Murray, the outlook could turn negative for the euro. So, EUR/USD could return below the bearish channel to reach 4/8 Murray at 1.0253. The price could even fall towards the low of 1.0131.Author: Dimitrios Zappas

15:56 2025-01-22 UTC+2

1018

The Pound Has Reached Its Bullish Target; Now It's Time for a Bearish OneAuthor: Laurie Bailey

05:45 2025-01-23 UTC+2

943

- AUD/USD Prepares for Prolonged Decline

Author: Laurie Bailey

05:45 2025-01-23 UTC+2

913

The Euro Still Lacks StrengthAuthor: Laurie Bailey

05:45 2025-01-23 UTC+2

883

Technical analysisTechnical Analysis of Intraday Price Movement of S&P 500, Thursday January 23, 2025.

Although the price movement of the S&P 500 index is above the SMA (200) which has aAuthor: Arief Makmur

07:15 2025-01-23 UTC+2

838

See also