How to find your Bitcoin wallet is a critical topic for anyone managing digital wealth. A Bitcoin wallet acts as a secure portal, holding the keys to your digital assets. Misplacing access credentials or losing track of this essential tool can lead to frustration and, in some cases, irreversible loss. Understanding how to locate your wallet is vital for ensuring access to your funds and maintaining control over your digital resources.

Why Wallets Are Important

Digital wallets serve as the cornerstone of managing virtual assets. They safeguard private keys, which grant ownership and enable transactions. Without access to these keys, users cannot manage or transfer their funds. Wallets come in various forms — hardware devices, software applications, paper backups, or hybrid solutions — but they all serve the same purpose: to protect the tools required for accessing and managing your holdings.

Losing access to a wallet doesn’t just mean losing funds — it also means losing control over your digital assets. Whether it’s for personal savings or professional transactions, keeping track of your wallet is an essential part of secure financial management.

Common Reasons for Losing Track

- Forgotten credentials. One of the most common issues is forgetting usernames, passwords, or recovery phrases. With the increasing number of online accounts and passwords people need to remember, it’s easy for essential information to slip through the cracks.

- Switching devices. Frequent device upgrades or replacements can also lead to misplaced tools. Old phones, laptops, or external drives might hold wallet data that wasn’t properly transferred during migration.

- Outdated wallets. For early adopters of digital assets, older wallets created years ago might be linked to services or devices that are no longer in use. These tools may rely on outdated security methods, making them harder to recover without specialized knowledge.

- Neglecting Backups. Failing to create or securely store backups is another significant factor. Users may realize too late that they never recorded their private keys or recovery phrases, leaving them without a way to regain access.

Why Understanding Recovery Methods Is Crucial

Learning how to recover misplaced wallets isn’t just about accessing your funds—it’s about reclaiming control over your digital financial resources. This knowledge allows users to address immediate challenges while also taking steps to prevent future issues.

Benefits of learning recovery strategies:

- Immediate resolution: regain access to funds by systematically exploring recovery options.

- Enhanced security practices: implement better management techniques to avoid losing access in the future.

- Peace of mind: know that your digital resources are within reach, even if misplaced temporarily.

Key Takeaways

Locating a lost wallet may seem daunting, but it’s achievable with the right approach. Whether the issue stems from forgotten credentials, outdated tools, or misplaced backups, understanding the causes and solutions is essential.

- Regularly update and securely store credentials to avoid future challenges.

- Back up your access keys or recovery phrases in multiple, secure locations.

- Develop a system for organizing wallet-related data, so it’s easy to retrieve when needed.

By exploring the methods and strategies of how to find your Bitcoin wallet, you’ll not only resolve the immediate issue of locating your wallet but also gain the skills necessary to secure your digital assets for the long term.

How to Find Your Bitcoin Wallet by Email

Email accounts are often the first place to look when trying to locate essential details related to your digital asset storage. Emails can contain critical setup confirmations, login credentials, or access instructions. Properly searching your inbox or resetting credentials through email can significantly improve the chances of regaining access to important information.

Email’s Role in Setup and Recovery

When creating a storage account, users typically register their email address with the provider. This email becomes a primary point of contact for important communications. Emails often include:

- Account setup confirmations: these confirm registration and may include access instructions or links.

- Private key notifications: some providers send encrypted private keys or instructions for generating them securely.

- Backup guidance: messages may offer details on securing backups or setting up additional recovery methods.

Providers also use email to notify users about updates or suspicious activity, making your inbox a valuable tool for locating lost information.

Using Search Filters

Efficiently navigating your inbox is crucial when looking for relevant messages. By using specific search techniques, you can quickly locate important emails.

Search Key Phrases

Typing specific keywords in the search bar helps refine results. Phrases like "Private key," "Access details," or provider names like "Coinbase" or "Trezor" often lead to relevant messages. These emails may contain: login credentials, recovery instructions, verification links.

Including variations or combinations of these phrases ensures a more thorough search. For example, searching "Setup instructions Ledger" might yield different results than "Ledger account."

Advanced Search Options

Most email platforms offer advanced tools to narrow searches:

- Filter by attachments: emails with files attached are more likely to contain keys or guides.

- Search by date: focus on emails from when you set up or accessed your account.

- Search specific folders: look in starred, important, or custom folders where such emails might be saved.

These methods allow users to dig deeper into their inbox and locate even old or overlooked messages.

Resetting Account Credentials via Email

If initial searches yield no results, recovery options via email may help. Many providers offer straightforward steps for resetting credentials:

- Visit the provider’s website or app and find the login page.

- Select “Forgot Password” or a similar option.

- Enter your registered email address.

- Check your inbox for a reset email with a link or recovery steps.

- Follow the instructions to regain access.

In some cases, these emails may include links to download missing files or tools necessary for recovery. It’s essential to act quickly, as some links may expire after a set period.

Check Spam and Archived Emails

Emails sometimes end up in unexpected folders, making it crucial to check areas like spam or archives. These folders may contain:

- Promotional emails: important updates flagged as promotions.

- Support communications: messages misclassified as spam.

- Older emails: automatically archived or manually moved emails.

Search using filters and keywords in these folders to uncover how to find your Bitcoin wallet. For example, a user might find a long-lost private key notification in the spam folder simply by searching "Key backup."

Real-Life Scenarios of Email-Based Retrieval

The power of email searches is evident in various success stories:

- Scenario 1: user found an old email with a private key attached by searching "PDF" along with the provider’s name. The email had been archived, making a filtered search vital.

- Scenario 2: account recovery email located in the spam folder provided the necessary credentials to access a locked account.

- Scenario 3: forgotten account was retrieved through the “Forgot Password” function, which directed the user to emails sent years earlier with complete recovery instructions.

Each case highlights the importance of thorough searches and leveraging all available tools within your email account.

Takeaways

Searching your email systematically and utilizing recovery options can reveal the solution to regaining access to your crypto wallet. Exploring folders, applying filters, and resetting credentials ensures nothing is missed. With a focused approach, you can unlock access to essential details and regain control over your digital assets.

What to Do If You Forget Your Wallet Provider

When access to your digital storage provider is forgotten, identifying the service you used becomes crucial. Pinpointing the provider often leads to the resources necessary for regaining access. Here are actionable strategies to help rediscover the platform you used.

Check Past Transaction Receipts

Email records or bank statements related to transactions can reveal the service you used. Most platforms send confirmation messages when you register, complete transactions, or set up accounts.

Search for Confirmation Emails

Providers often send messages with subject lines like:

- “Your account has been successfully created.”

- “Transaction Confirmation: [Amount Sent].”

- “[Provider Name] Account Registration Complete.”

Searching your email with these keywords or adding terms like “address” or “private key” can uncover correspondence with your service. Common senders include Coinbase, Trezor, or Ledger, which simplify identifying the platform.

Review Bank Statements

Look at payment histories, especially if you purchased digital assets through a linked card or bank account. Statements might show entries labeled with the provider’s name. For example:

- A purchase from “Binance” or “Kraken.”

- Fees charged by a storage provider.

Cross-referencing dates of these transactions with your email can narrow down the possibilities.

Search Device App Downloads

Your mobile devices or computer may hold clues to the service you used. Checking your download history can reveal apps associated with your storage.

Check App Stores

If you’ve used a smartphone, both iOS and Android keep records of downloaded apps. Search your app library or visit the app store to find installed or previously downloaded software. Look for names like: Electrum, Exodus, Mycelium. These apps are often linked to storage platforms, and revisiting them may refresh your memory.

Browser Bookmarks

If you accessed your storage through a web browser, bookmarks or saved logins could indicate the provider. Search your bookmarks folder or history for URLs like:

- [providername].com (e.g., blockchain.com or coinbase.com)

- Login pages or support portals.

Reviewing browser data often highlights forgotten platforms or resources linked to your account and helps to solve the question of how to find your Bitcoin wallet.

Popular Providers and Common Subject Lines

Familiarizing yourself with widely used services and their communication patterns makes identification easier. Many providers have distinct subject lines in their messages, helping you confirm their involvement.

Provider and Example Email Subjects

| Coinbase | Ledger | Exodus | Binance | Mycelium |

| “Welcome to Coinbase” | “Ledger Device Setup Complete” | “Welcome to Exodus: Start Your Journey” | “Your Binance Registration Is Complete” | “Backup Your Keys Now” |

| “Your Transaction Confirmation” | “Order Confirmation for Ledger Hardware” | “Exodus Wallet Recovery Instructions” | “Deposit Confirmation” | “Welcome to Mycelium” |

“Verify Your Email Address” |

Searching for these phrases in your email can quickly point to your provider, allowing you to initiate steps for regaining access.

Troubleshooting Tips

If you’re still unsure, combine methods for a more thorough search:

- Cross-reference email addresses linked to purchases with your inbox search results.

- Use keyword filters like “access,” “security,” or “confirmation” for broader searches.

- Check old devices, external drives, or cloud storage for setup files or private key backups.

How to Find Your Crypto Storage Provider

Combining email searches, app reviews, and bank statements increases the likelihood of success. These steps ensure no stone is left unturned when reconnecting with your provider. By thoroughly analyzing your digital and financial records, you’ll uncover clues that lead to recovering your stored assets.

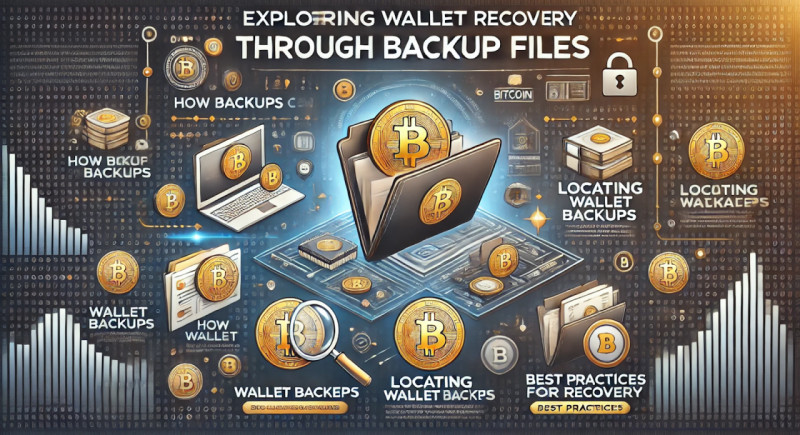

Exploring Wallet Recovery Through Backup Files

Backup files play a vital role in regaining access to your digital assets. These files store the essential data required to reconnect with your stored funds. If you’ve lost access or forgotten details, backups are often the quickest path to restoration.

How Backups Can Help

Backups are created to preserve key information. They may contain critical data such as private keys, transaction history, or encrypted access credentials. When stored securely, these files ensure access even after device loss or data corruption. Platforms often encourage users to generate backup files during the initial setup or at key points in usage.

Typical backup file formats include:

- wallet.dat: Commonly used by platforms like Bitcoin Core, this file contains private keys and transaction data.

- JSON: A file type used by some online and software-based solutions.

- Key File: Specific to certain providers, used for encrypted access to stored funds.

Identifying and locating these files can simplify access restoration.

Locating Wallet Backups

Backup files may exist on your desktop, mobile devices, or cloud storage services. Identifying where the backup resides is the first step in regaining access.

Search Your Desktop or Device

Backup files are often saved automatically to default folders or directories. To locate them, check:

- System folders: search directories such as "Documents," "Downloads," or "AppData" on Windows and "Library" or "Application Support" on macOS.

- Search by file name: use keywords like "wallet.dat," "key backup," or the name of the service you used.

- Specific app folders: applications like Bitcoin Core save backups in pre-defined locations. For example, Bitcoin Core backups are typically found in the AppData/Roaming/Bitcoin folder on Windows.

Using Cloud Storage

If you enabled cloud backups, services like Google Drive, Dropbox, or iCloud could contain copies of your files and help you solve the question of how to find your Bitcoin wallet. To locate these:

- Log into your cloud account and search using keywords such as "backup," "key file," or the name of the platform.

- Look in folders like "App Backups" or "Documents" for auto-saved files.

- Check recently deleted or archived files, as backups may have been moved unintentionally.

Tools for Deleted Files

If backup files were accidentally deleted, file recovery software can help. These tools scan your storage devices for traces of removed data. Popular recovery tools include:

- Recuva: free solution for Windows, ideal for retrieving recently deleted files.

- Disk Drill: compatible with both Windows and macOS, offering advanced recovery features.

- EaseUS Data Recovery Wizard: reliable option for locating missing or corrupted backup files.

Use these tools carefully, ensuring recovered files are verified for authenticity before use.

Best Practices for Backup Recovery

To maximize the chances of recovering your data:

- Use advanced search tools: filter searches by file type or modification date to narrow down results.

- Check external drives: backup files might have been saved on USB drives or external hard drives.

- Inspect archived folders: applications sometimes auto-archive backups to save space.

- Preserve recovered files: once located, make additional copies of the backup in secure locations.

Using Backups

Backup files are an essential part of ensuring your funds remain accessible. Searching devices, cloud storage, and even deleted file traces can uncover the information you need. Properly locating and utilizing backups removes the uncertainty of access loss, putting you back in control of your digital assets. Regularly reviewing and securing these files minimizes future risks and keeps your funds safe.

Provider-Specific Guides

Understanding the recovery process for different platforms is essential. Each service has unique procedures for regaining access, and following their specific instructions can significantly increase your chances of restoring access.

Coinbase: Account Recovery

Coinbase simplifies account management by integrating email-based recovery tools. If you’ve misplaced access details:

Search for initial emails

Log into your email and search for terms like "Coinbase setup," "account confirmation," or "security alert." These emails often include account setup information or login links.

Reset your credentials

- Go to the Coinbase website and click "Forgot Password."

- Enter the email linked to your account and follow the instructions.

- Confirm the reset link sent to your inbox, ensuring it’s not in spam or promotions folders.

Access support services

- If emails don’t provide enough information, contact Coinbase support.

- Provide details like the account-associated email, transaction records, or IDs used during verification.

Pro tip: use two-factor authentication (2FA) to enhance future account security, and ensure recovery keys are stored safely offline.

Trezor: Hardware Access Restoration

Trezor hardware ensures secure storage, but losing access requires precision to regain control. Here’s how to recover access:

Locate setup details

- Search for your Trezor setup instructions or purchase confirmation emails. These contain device configuration guides and customer support links.

Connect the device

- Plug in your Trezor to a computer and access the Trezor Suite software.

- If prompted for a PIN, enter it carefully. After too many incorrect attempts, the device may reset.

How to find your Bitcoin wallet and restore it with your recovery key

- If the device resets, you’ll need the recovery key (12–24 words) to restore. Enter this key into the Trezor Suite when prompted.

Contact support

- For issues beyond the recovery key, reach out to Trezor’s support team, providing proof of purchase or other ownership details.

Pro tip: store your recovery key in a fireproof safe or metal backup for added security.

Ledger: Reconnecting to Your Funds

Ledger wallets maintain security with robust features. If you lose access, follow these steps:

Find setup information

- Search your email for phrases like "Ledger Live setup" or "account activation."

- Review these emails for device setup instructions or links to download Ledger’s companion software.

Restore your access

- Connect the Ledger to your computer and open Ledger Live.

- If prompted, use your PIN to access the account.

- For resets, enter your recovery key to regain access.

Resolve errors

- If the device malfunctions or the recovery key is lost, contact Ledger support with proof of purchase.

Pro tip: regularly update Ledger Live and the device’s firmware for optimal functionality.

Blockchain.com: Recovering Online Access

Blockchain.com provides a straightforward recovery system using email and proof of ownership:

Search for account emails

- Look for subjects like "Welcome to Blockchain," "login attempt," or "account recovery" in your inbox.

- These emails contain critical setup details and recovery links.

Use recovery options

- Visit the Blockchain.com login page and select "Forgot Password."

- Follow the reset instructions sent to your registered email.

Contact support for assistance

- If email-based recovery isn’t enough, reach out to support. Provide documentation like transaction IDs, public keys, or identification.

Pro tip: ensure your email account used for registration is secure and protected with strong passwords and 2FA.

Maximizing Recovery Success

- Keep documentation handy: whether it’s purchase receipts or setup confirmations, maintain organized records for easier access.

- Explore all folders: search through spam, archived folders, or trash for missed emails.

- Use unique keywords: include specific wallet provider names in searches to narrow down results.

- Be persistent: recovery can take time. Stay patient and follow up with customer support as needed.

Each provider has its nuances, but by following these tailored steps, you’ll increase your chances of regaining access. Knowing how to get access to your crypto storage with the help of provider-specific processes ensures a clear path to resolving lost access efficiently.

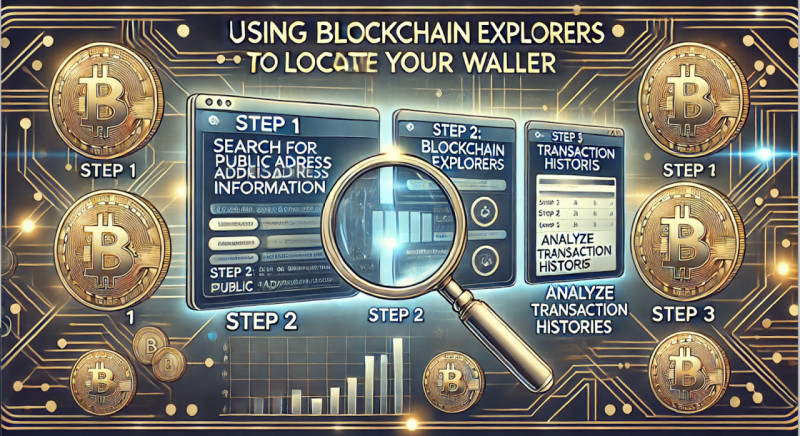

Using Blockchain Explorers to Locate Your Wallet

Blockchain explorers serve as powerful tools for accessing detailed transaction records and public address activity on the blockchain. These platforms allow users to trace specific addresses and analyze their histories, which can be instrumental in identifying lost or forgotten assets.

What Are Blockchain Explorers?

A blockchain explorer is an online platform that provides a transparent view of transactions recorded on the blockchain. These tools allow users to search for public addresses, transaction hashes, or blocks to obtain detailed activity histories. By examining data, users can verify asset ownership, track incoming or outgoing transfers, and assess address balances.

These platforms do not expose private credentials when you need to solve the question of how to find your Bitcoin wallet but rely on the public nature of blockchain data. This makes them essential for tracing past activities and confirming the existence of assets linked to specific addresses.

Steps to Locate Your Wallet Using Blockchain Explorers

Step 1: Search for Public Address Information

Begin by checking old records for public address details. These could be stored in:

- Emails: search inboxes using terms like "address," "transaction ID," or wallet provider names. Emails from exchanges or service providers often include public addresses or confirmation links.

- Files on devices: look for saved text documents, screenshots, or spreadsheets containing address strings. Common file names include "wallet address" or "keys."

- Old notes or printouts: check any physical backups or notes you may have taken during setup. Public addresses might be written alongside login details or other account information.

Step 2: Use Blockchain Explorers

After retrieving a public address, use a blockchain explorer to analyze its activity. Popular options include: Blockchain.com Explorer, Blockchair, BTCScan. These platforms support simple searches by pasting the address into the search bar.

Step 3: Analyze Transaction Histories

Once the address is located on the explorer:

- Check activity: review the transaction list associated with the address. Look for familiar amounts, recipient addresses, or timestamps that align with your activities.

- Verify ownership: ownership can be confirmed if the address matches details from your records or previous communications with exchanges.

- Confirm balances: check if the address still holds assets. If the balance is zero, this might indicate prior withdrawals or transfers to another address.

Advanced Techniques for Identifying Wallet Information

Link transactions to known exchanges. If past transactions involve exchanges, look for corresponding email confirmations or bank statements. Cross-referencing these records with transaction IDs found on the explorer can provide additional clues.

Explore related addresses. Blockchain explorers often reveal connected addresses, such as those used in multi-signature setups or linked through transaction chains. Examining these related addresses might uncover additional details about your account.

Pro Tips for Successful Search

- Refine search terms: use specific keywords in your email or file searches to minimize irrelevant results.

- Check all folders: don’t forget spam, archived emails, or forgotten drives that might contain address information.

- Combine tools: pair blockchain explorers with other recovery methods like emails or device searches to compile comprehensive data.

Using Blockchain Explorers

Using blockchain explorers provides a detailed roadmap for reconnecting with forgotten assets. By leveraging public address data and transaction histories, you can efficiently trace activity and confirm ownership. Whether retracing steps through old emails or analyzing blockchain entries, this method ensures no stone is left unturned in locating your Bitcoin holdings.

Security Tips While Searching for Your Wallet

Ensuring the safety of your digital assets while searching for your wallet is paramount. The process can expose users to potential threats like phishing scams or fraud, so it’s essential to follow robust security practices. Safeguarding sensitive details ensures you maintain control over your funds when you need to know how to find your Bitcoin wallet.

Avoiding Scams

Recognizing Phishing Attempts

Phishing is a common method used by attackers to trick users into divulging sensitive information. Scammers often create fake websites, emails, or tools mimicking legitimate services. These fraudulent platforms can compromise your data if you’re not cautious.

- Emails posing as providers: be wary of emails claiming to assist with recovery. Scammers often replicate official emails, complete with logos and branding, to appear legitimate. Always check the sender's email address and compare it to official contact information.

- Fake recovery tools: fraudulent tools promising to help restore access may actually steal your credentials. Only use software recommended by the official provider, downloaded from their verified website.

Tip: avoid clicking on links or downloading files from unverified sources. Navigate directly to the provider’s official website to confirm communications or access resources.

Verifying Communication

- Direct contact: when in doubt, reach out to the support team of your provider through their official contact page. Avoid relying on information from forums or unsolicited emails.

- Secure websites: ensure the site you visit has a valid SSL certificate (look for "https://" in the URL). Double-check the domain name to ensure it’s accurate, as scammers often use similar but slightly altered addresses.

- Support scams: avoid third-party services claiming to represent wallet providers. Genuine support teams will never request your private keys or sensitive information.

Warning: never share sensitive details like private keys, passphrases, or passwords with anyone claiming to offer assistance. Legitimate services will not ask for these.

Maintaining Privacy

Protecting Sensitive Information

Keeping private information secure is critical during recovery efforts. Mishandling sensitive details can lead to permanent loss of access or theft.

- Avoid public networks: perform all searches on a secure, private internet connection. Public Wi-Fi networks are vulnerable to attacks that could intercept data.

- Handle keys safely: if you come across private keys or similar data during your search, do not store them in easily accessible locations like online notes or unsecured documents.

- Minimize exposure: keep recovery-related activities discreet. Avoid discussing specific details online or in forums, as bad actors may exploit the information.

Best Practices for Managing Data

- Use encrypted storage: store sensitive information in encrypted drives or password-protected files. This prevents unauthorized access in case of device theft or loss.

- Avoid reusing credentials: if you reset any account credentials, ensure they are unique and not reused across other services.

- Document handling: if you print sensitive information, keep it in a secure, fireproof location. Destroy unnecessary copies properly to prevent leaks.

Staying Vigilant While Searching

- Recognize suspicious behavior: scammers may use urgency or emotional manipulation to gain your trust. Be skeptical of offers that seem too good to be true.

- Research before acting: cross-check information provided by any third party. User reviews, forums, and official documentation are valuable tools for verifying claims.

Safety First

Searching for your wallet requires a combination of persistence and caution. By implementing strong security measures, avoiding phishing traps, and safeguarding sensitive details, you minimize risks during recovery efforts. Adhering to these guidelines not only protects your digital assets but also ensures a smooth and secure resolution of the question of how to find your Bitcoin wallet.

What to Do If You Can’t Find Your Wallet

Losing access to your digital assets can be frustrating and overwhelming, but there are actionable steps to take if traditional recovery methods fail. Whether you’ve exhausted your search for backups, forgotten account details, or encountered other roadblocks, persistence and caution are essential.

Contacting Provider Support

Reaching out to the customer support team of your wallet provider can offer solutions tailored to your situation. Providers often have recovery protocols that can assist users who’ve lost access.

- Locate support channels: visit the official website of the service you used. Look for support pages, help centers, or live chat options. Many providers offer step-by-step guides to address common issues.

- Prepare information: when contacting support, provide any information you can recall:

- Email addresses associated with your account.

- Transaction IDs or receipts for purchases made with the account.

- Details about the device or operating system used during account setup.

- Verify authenticity: be sure you’re communicating with the official provider. Scammers often pose as support agents to gain access to sensitive information. Avoid sharing private keys, recovery phrases, or passwords.

Pro tip: patience is key when dealing with support teams, as response times may vary depending on the provider.

Exploring Professional Recovery Services

When traditional methods fail, professional recovery services can sometimes help regain access. These services specialize in unlocking accounts or retrieving data from corrupted or lost files. However, caution is vital when considering this option.

How Recovery Services Work

- Advanced tools: professionals use proprietary software and hardware tools to analyze encrypted files, broken devices, or other inaccessible data.

- Expertise: trained technicians may attempt to reconstruct damaged files or access backup information stored on old devices.

Choosing a Reliable Service

- Reputation: research companies extensively. Check reviews, testimonials, and online discussions to ensure credibility.

- Credentials: ensure the service specializes in digital asset recovery and can provide verifiable references.

- Transparency: legitimate services will explain their methods without guaranteeing success. Be cautious of firms offering "100% guaranteed recovery."

Costs and Risks

- Professional recovery can be expensive, with costs varying based on the complexity of the issue.

- Sharing sensitive details with unverified services poses risks. Only provide information necessary for the recovery process and avoid granting full access to your accounts.

Accepting Loss and Planning for the Future

In some cases, assets may be irretrievable. Accepting the loss is challenging, but it provides an opportunity to reflect and improve your practices for managing future accounts.

Secure Future Accounts

- Organized record-keeping: maintain detailed records of all account credentials, including passwords, email addresses, and recovery phrases. Store these records securely in multiple locations.

- Offline security measures: use physical backups, like metal engravings or fireproof safes, for recovery phrases and access keys. Avoid storing this information digitally to prevent unauthorized access.

- Routine checks: regularly verify access to your accounts and backups to ensure everything remains intact.

Learn From Mistakes

- Evaluate what led to the loss and identify areas for improvement.

- Avoid relying solely on memory or a single recovery method. Redundancy is essential for protecting valuable assets.

Moving Forward

Although losing access to an account and not knowing how to find your Bitcoin wallet can be discouraging, taking proactive steps can help minimize the impact and prevent similar situations in the future. By leveraging support teams, cautiously exploring professional services, and adopting better security habits, you ensure a more secure approach to managing your digital assets. For those wondering about gaining access to their crypto storage, persistence and a methodical approach often yield the best results.

How to Prevent Losing Your Wallet Again

Losing access to your digital asset account can be a stressful experience, but implementing proactive strategies can prevent it from happening again. By adopting effective habits and securing sensitive information, you can ensure long-term protection and easy access to your holdings.

Safeguard Private Keys and Recovery Information

Ensuring your keys and recovery details are securely stored is crucial. These elements act as the gateway to your funds, and their loss could mean permanent inaccessibility.

Use secure physical storage

- Write your recovery phrases or private keys on durable materials like metal sheets or stone tablets to protect against fire, water, and physical wear.

- Store these items in secure locations such as a home safe, safety deposit box, or other tamper-proof environments.

Distribute backup locations

- Create multiple copies and store them in geographically separate places to mitigate the risk of simultaneous loss or damage (e.g., one copy at home, another with a trusted family member).

Avoid digital storage

- Refrain from saving sensitive information on devices, emails, or cloud services vulnerable to cyberattacks. Physical copies are far more secure.

Regularly Organize and Update Backup Systems

A systematic approach to maintaining your account information ensures that you can locate important details quickly if needed.

Routine backups

- Create a recurring schedule to back up important details. If using a hardware device, ensure the latest version of the firmware is saved as part of your routine.

Label and organize

- Keep backups clearly labeled with non-identifiable codes that only you understand. For example, avoid labeling something “Private Key” and instead use a generic name like “File A.”

Centralized recordkeeping

- Use a dedicated notebook or physical ledger solely for recording account credentials, passcodes, and other relevant information.

Maintain Contact with Providers

Maintaining active communication with your account service providers and updating your records regularly can streamline future recovery efforts.

Keep email accounts active

- Ensure the email address linked to your account remains active and accessible. Update your information with providers if you change emails.

Record provider contact details

- Save the official support contact information for your service provider in a secure place. This ensures you won’t have to search for it during an emergency.

Set alerts

- Enable notifications related to account activity or backups. This helps monitor and respond to any unusual events promptly.

Adopt Preventative Best Practices

Implementing smart strategies now can save headaches later.

Create redundancy

- Use multiple storage methods to reduce the risk of losing access. For instance, split your holdings between hardware devices and paper copies.

Test your recovery system

- Periodically test your recovery process in a controlled environment to ensure all backups function correctly.

Leverage trusted tools

- Use reputable tools designed for secure storage and backup management. Research well before trusting third-party solutions.

Building Peace of Mind

By following these best practices, you create a robust safety net, ensuring your assets remain protected and accessible. If you are wondering how to find your Bitcoin wallet after losing access, the process often highlights the importance of good organization and secure storage. With the right measures, you can confidently manage your account without fear of misplacement or loss.

Conclusion: Reclaim Your Bitcoin Safely

Persistence and caution are critical when trying to regain access to your digital assets. The process of locating your account credentials or stored files might take time, but staying focused and avoiding hasty decisions can protect your funds from permanent loss or security breaches. Reclaiming your funds is possible with the right approach and tools, ensuring your efforts are rewarded and your investments safeguarded.

Patience Pays Off

Regaining access requires methodical effort. Start by examining all potential clues, including email accounts, physical records, and old devices. Review details systematically, keeping a checklist of potential storage methods or services you may have used. This structured approach minimizes the chance of overlooking critical information.

Avoid shortcuts or unverified tools that promise quick access. These often target vulnerable users and can lead to further complications, such as stolen funds or leaked credentials. The effort invested in safely navigating this process is always worth it compared to the risks of acting recklessly.

If emails or documentation fail to provide results, extend your search to other avenues, such as files stored on devices, cloud services, or old transaction histories. Every detail could hold a clue, so leave no stone unturned.

Email’s Role in Recovery

Email is an essential asset in your search. Most accounts are tied to an email during setup, making it a gateway to recovery tools, account credentials, or forgotten details.

Search thoroughly

Use advanced filters to uncover hidden or archived messages. Include specific terms like “account setup,” “private key,” or the name of the service provider. Use logical combinations of keywords to maximize your search. For instance, a query like “Ledger account setup” could help you locate device-specific emails.

Check spam and promotional folders, as automated messages can sometimes end up in unexpected locations. Your recovery email might have been marked as unimportant and filed away automatically.

Leverage account recovery links

Wallet service providers often include recovery links or instructions within emails. Locate and follow these instructions carefully to regain access. These emails often contain essential details about resetting your credentials or confirming ownership. Be sure to act swiftly, as some recovery links might expire.

Utilize email providers’ tools

If you’ve lost access to an old email, use the email provider’s account recovery options. Once regained, search it thoroughly for any relevant details. Tools such as Gmail’s search operators or Outlook’s advanced filtering can help you locate hidden messages efficiently.

Safety First During the Process

Ensuring security during the search is as important as recovering access. Phishing schemes, fake tools, and other malicious activities frequently target individuals attempting to regain their digital holdings.

Stick to official sources

Use recovery tools provided only by verified service providers when you need to manage how to find your Bitcoin wallet. Double-check URLs and avoid clicking on suspicious links. Scammers often create fake websites that mimic trusted services.

Keep your details private

Never share private keys, access codes, or login credentials. No legitimate service will ask for this information to assist with recovery. If anyone claims to need these details, treat it as a red flag.

Double-check requests

Verify every communication claiming to help. Contact service providers directly through their official websites to confirm the authenticity of recovery offers or support.

Enable two-factor authentication (2FA)

Once access is regained, enable 2FA on all accounts. This adds a vital layer of security, reducing the likelihood of unauthorized access in the future.

Proactive Protection Moving Forward

Once access is restored, implement preventative measures to avoid future challenges. Securely store credentials and account details in tamper-proof locations. For maximum protection:

- Create multiple backups

Store recovery information in multiple secure places, such as safes or encrypted digital storage. Avoid relying on a single backup to reduce the risk of total loss.

- Use durable materials

Consider engraving recovery phrases or other important details onto metal plates. Metal backups resist damage from fire, water, or physical wear, ensuring long-term safety.

- Audit regularly

Periodically review your security setup to confirm all information remains accessible. Test your backup methods to ensure they are functioning as expected.

- Update information

Keep associated accounts and contact details up to date. A current email or phone number ensures you can receive notifications or recovery links without delays.

Final Thoughts

Recovering access requires diligence and careful effort. For those wondering about how to find your Bitcoin wallet, persistence combined with a methodical approach often leads to success. By leveraging email recovery tools, maintaining a high level of caution, and adopting best practices for future security, you can regain access and protect your holdings effectively. With proper safeguards, you not only recover what’s lost but also build a robust foundation for managing digital assets in the future.

Recommended

“How to create a bitcoin wallet”