#AMZN (Amazon.com, Inc.). Exchange rate and online charts.

Currency converter

28 Apr 2025 20:22

(-0.02%)

Closing price, the previous day.

Opening price.

The highest price over the last trading day.

The lowest price over the last trading day

Price range high in the last week

Price range low in the last week

AMZN is the shares of the American company Amazon.com Inc. Amazon.com has become one of the largest companies by turnover among those that sell commodities and services online. Besides, it is the first internet service oriented towards sales of mass-market actuals. The Amazon headquarters is located in Seattle, Washington.

The company was founded in 1994; in a year, its main site was launched. Originally, Amazon.com was focused only on selling books, however, at present time, the service takes in 34 types of goods including e-books, household appliances and electronics, toys, food, housewares, etc. The company works in two segments – the United States and international level. Amazon branches are situated not only in USA but also beyond them, for example, in Brazil, Canada, UK, Germany, Japan, France, Italy, India and China.

The company managed to use successfully two main advantages of internet trading - opportunity to address to the largest number of potential customers and availability of vast number of goods irrespectively of their physical presence in a storehouse.

According to the results of the fourth quarter of 2013, the company's earnings were $0.51 per share, which is much more than $0.21 logged in the previous year. However, analysts say that profits are going to grow further, though, at a slower pace. The total earnings for the same period made up $25.59 billion which is more than the figures of 2012 by more than 20%.

See Also

- Wave analysis

Weekly Forecast Based on Simplified Wave Analysis for EUR/USD, USD/JPY, GBP/JPY, USD/CAD, NZD/USD, and GOLD — April 28th

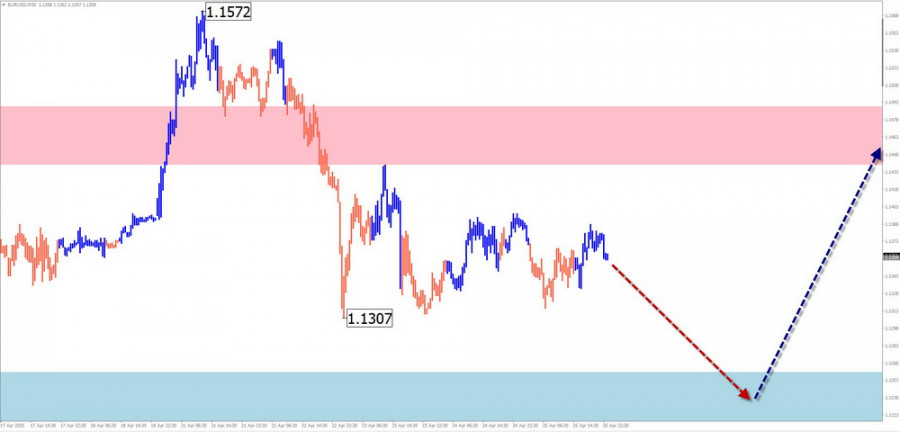

At the beginning of the upcoming week, the European currency is expected to continue moving sideways along the calculated counter-trend zones. A downward movement is more likely at the start of the week. Toward the weekend, we can expect increased volatility, a change in direction, and a resumption.Author: Isabel Clark

09:28 2025-04-28 UTC+2

1183

Wave analysisWeekly Forecast Based on Simplified Wave Analysis for GBP/USD, AUD/USD, USD/CHF, EUR/JPY, AUD/JPY, and US Dollar Index — April 28th

In the upcoming week, the British pound is highly likely to follow a general sideways trajectory. A brief price decline is expected early in the week. Toward the weekend, volatility is likely to increase, and the price may return to an upward trend, potentially coinciding with the release of.Author: Isabel Clark

09:32 2025-04-28 UTC+2

1033

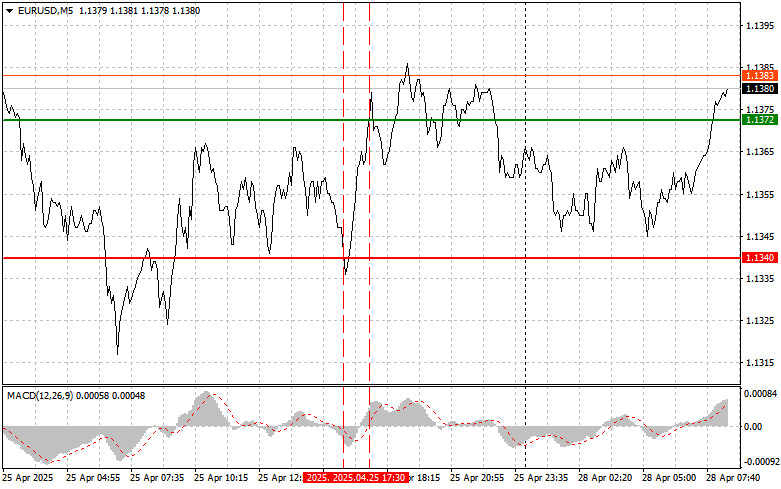

Type of analysisEUR/USD: Simple Trading Tips for Beginner Traders on April 28. Review of Yesterday's Forex Trades

EUR/USD: Simple Trading Tips for Beginner Traders on April 28. Review of Yesterday's Forex TradesAuthor: Jakub Novak

08:19 2025-04-28 UTC+2

1033

- Type of analysis

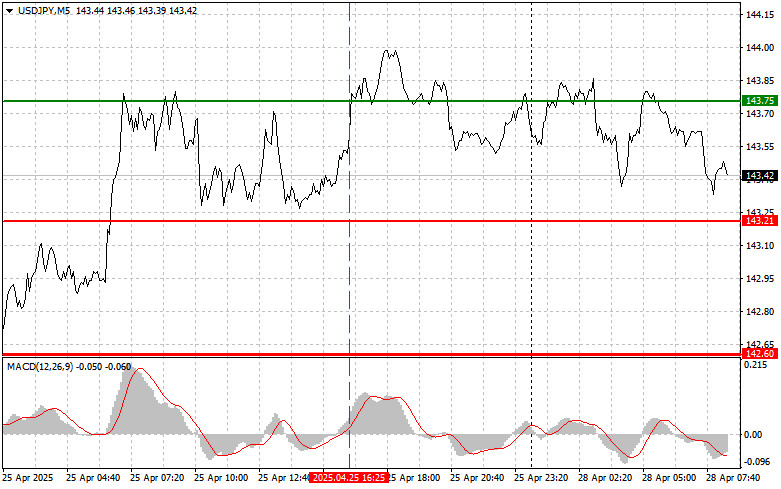

USD/JPY: Simple Trading Tips for Beginner Traders on April 28. Review of Yesterday's Forex Trades

USD/JPY: Simple Trading Tips for Beginner Traders on April 28. Review of Yesterday's Forex TradesAuthor: Jakub Novak

08:19 2025-04-28 UTC+2

1018

ECB Ready to Cut Rates FurtherAuthor: Jakub Novak

09:24 2025-04-28 UTC+2

853

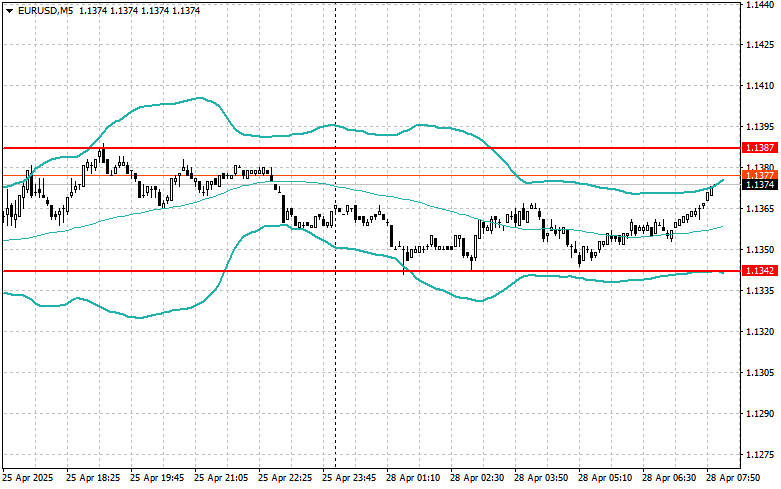

Intraday Strategies for Beginner Traders on April 28Author: Miroslaw Bawulski

08:19 2025-04-28 UTC+2

823

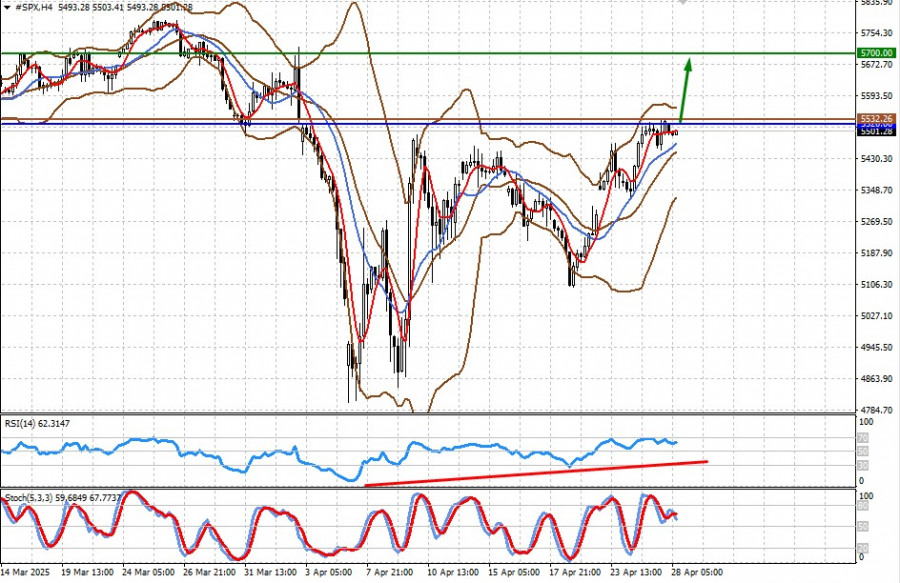

- Stock Market Update for April 28th: S&P 500 and NASDAQ Pause Their Advance

Author: Jakub Novak

09:06 2025-04-28 UTC+2

793

Fundamental analysisThe Upcoming Week May Be Positive for Markets but Negative for the Dollar and Gold (we expect further growth in CFD contracts for S&P 500 futures and Bitcoin)

The upcoming week will be rich in important economic data releases, which could have a noticeable impact on market dynamics — but will they be able to?Author: Pati Gani

09:12 2025-04-28 UTC+2

748

The S&P 500 and Nasdaq ended the previous trading session higher, defying choppy performance across Asian and European exchanges. Investors are now focused on the upcoming economic data and earnings reports from tech giants such as Microsoft and AppleAuthor: Ekaterina Kiseleva

11:31 2025-04-28 UTC+2

733

- Wave analysis

Weekly Forecast Based on Simplified Wave Analysis for EUR/USD, USD/JPY, GBP/JPY, USD/CAD, NZD/USD, and GOLD — April 28th

At the beginning of the upcoming week, the European currency is expected to continue moving sideways along the calculated counter-trend zones. A downward movement is more likely at the start of the week. Toward the weekend, we can expect increased volatility, a change in direction, and a resumption.Author: Isabel Clark

09:28 2025-04-28 UTC+2

1183

- Wave analysis

Weekly Forecast Based on Simplified Wave Analysis for GBP/USD, AUD/USD, USD/CHF, EUR/JPY, AUD/JPY, and US Dollar Index — April 28th

In the upcoming week, the British pound is highly likely to follow a general sideways trajectory. A brief price decline is expected early in the week. Toward the weekend, volatility is likely to increase, and the price may return to an upward trend, potentially coinciding with the release of.Author: Isabel Clark

09:32 2025-04-28 UTC+2

1033

- Type of analysis

EUR/USD: Simple Trading Tips for Beginner Traders on April 28. Review of Yesterday's Forex Trades

EUR/USD: Simple Trading Tips for Beginner Traders on April 28. Review of Yesterday's Forex TradesAuthor: Jakub Novak

08:19 2025-04-28 UTC+2

1033

- Type of analysis

USD/JPY: Simple Trading Tips for Beginner Traders on April 28. Review of Yesterday's Forex Trades

USD/JPY: Simple Trading Tips for Beginner Traders on April 28. Review of Yesterday's Forex TradesAuthor: Jakub Novak

08:19 2025-04-28 UTC+2

1018

- ECB Ready to Cut Rates Further

Author: Jakub Novak

09:24 2025-04-28 UTC+2

853

- Intraday Strategies for Beginner Traders on April 28

Author: Miroslaw Bawulski

08:19 2025-04-28 UTC+2

823

- Stock Market Update for April 28th: S&P 500 and NASDAQ Pause Their Advance

Author: Jakub Novak

09:06 2025-04-28 UTC+2

793

- Fundamental analysis

The Upcoming Week May Be Positive for Markets but Negative for the Dollar and Gold (we expect further growth in CFD contracts for S&P 500 futures and Bitcoin)

The upcoming week will be rich in important economic data releases, which could have a noticeable impact on market dynamics — but will they be able to?Author: Pati Gani

09:12 2025-04-28 UTC+2

748

- The S&P 500 and Nasdaq ended the previous trading session higher, defying choppy performance across Asian and European exchanges. Investors are now focused on the upcoming economic data and earnings reports from tech giants such as Microsoft and Apple

Author: Ekaterina Kiseleva

11:31 2025-04-28 UTC+2

733