#BA (Boeing Company). Exchange rate and online charts.

Currency converter

14 Jul 2025 21:03

(0.01%)

Closing price, the previous day.

Opening price.

The highest price over the last trading day.

The lowest price over the last trading day

Price range high in the last week

Price range low in the last week

The Boeing Company (Boeing), incorporated in 1916, is an aerospace company. The Company operates in five segments: Commercial Airplanes, Boeing Military Aircraft (BMA), Network & Space Systems (N&SS), Global Services & Support (GS&S) and Boeing Capital Corporation (BCC). Boeing Defence, Space & Security (BDS) consists of three capabilities-driven businesses: BMA, N&SS and GS&S. Its Other segment includes the unallocated activities of engineering, operations and technology (EO&T) and Shared Services Group (SSG), as well as intercompany guarantees provided to BCC. EO&T provides Boeing with technical and functional capabilities, including information technology, research and development, test and evaluation, technology strategy development, environmental remediation management and intellectual property management. During the year ended December 31, 2011, the 747-8 Freighter was certified and delivery occurred in October 2011. In May 2012, the Company acquired Inmedius, a provider of software applications and services for managing and sharing information and learning content.

First flight of the 747-8 Intercontinental passenger derivative occurred in March 2011 and type certification was achieved during 2011. The Company completed initial type certification flight testing activities and received design and production certifications for the 787-8 during 2011. The Company delivered the first 787-8 airplane in September 2011 and delivered another two additional aircraft in 2011. The Company also completed the critical design review for the 787-9 derivative in 2011. BDS operations principally involve research, development, production, modification and support of the products and related systems, such as global strike systems, including fighters, bombers, combat rotorcraft systems, weapons and unmanned systems; global mobility systems, including transport and tanker aircraft, rotorcraft transport and tilt-rotor systems; airborne surveillance and reconnaissance aircraft, including command and control, battle management and airborne anti-submarine aircraft; network and tactical systems, including electronics and mission systems; information solutions, including cyber security, secure mobile applications, analytics and secure infrastructure; strategic missile and defense systems; space and intelligence systems, including satellites and commercial satellite launching vehicles, and space exploration.

Commercial Airplanes Segment

The Commercial Airplanes segment develops, produces and markets commercial jet aircraft and provides related support services, principally to the commercial airline industry worldwide. The Company is a producer of commercial aircraft and offer a family of commercial jetliners designed to meet a spectrum of passenger and cargo requirements of domestic and non-United States airlines. The family of commercial jet aircraft in production includes the 737 narrow-body model and the 747, 767, 777 and 787 wide-body models. Development continues on the 787-9 derivative. During 2011, the Company launched a variant of the 737 that will feature more fuel efficient engines-the 737 MAX. The Commercial Airplanes segment also offers aviation services support, aircraft modifications, spares, training, maintenance documents and technical advice to commercial and government customers worldwide.

Boeing Military Aircraft Segment

The segment is engaged in the research, development, production and modification of manned and unmanned military weapons systems for the global strike, mobility and surveillance and engagement markets as well as related services. Included in this segment are the A160 Hummingbird, AH-64 Apache, Airborne Early Warning and Control (AEW&C), CH-47 Chinook, C-17 Globemaster, EA-18G Growler Airborne Attack Electronic Aircraft, F/A-18E/F Super Hornet, F-15 Strike Eagle, F-22 Raptor, Harpoon, USAF KC-46A Tanker, KC-767 International Tanker, Joint Direct Attack Munition, P-8A Poseidon, India P-8I, ScanEagle, Small Diameter Bomb, T-45TS Goshawk and V-22 Osprey.

Network & Space Systems Segment

The segment is engaged in the research, development, production and modification of products and services to assist its customers in transforming their operations through the capabilities, such as network integration, information and cyber applications, command, control, communications, computers, intelligence, surveillance and reconnaissance (C4ISR) space exploration and satellites. Included in the segment are the Airborne Laser, Brigade Combat Team Modernization (BCTM), Combat Survivor Evader Locator (CSEL), Crew Space Transportation-100, cyber and security programs, directed energy, Enhanced Medium Altitude Reconnaissance and Surveillance System (EMARSS), Family of Advanced Beyond Line-of-Sight Terminals (FAB-T), Future Rapid Effects System, Global Positioning System, Ground-based Midcourse Defense (GMD), High Energy Laser Technology Demonstrator, International Space Station, Joint Tactical Radio System (JTRS), satellite systems, SBInet, Space Launch System, space payloads, Space Shuttle and Wideband Global SATCOM.

Global Services & Support Segment

The segment is engaged in the operations, maintenance, training, upgrades and logistics support functions for military platforms and operations. Included in this segment are the activities, such as integrated logistics on platforms, including AEW&C, AH-64, AV-8B, C-17, CH-47, F-15, F/A-18, F-22, GMD Operations and Support (O&S), KC-767 International Tanker, P-8A, T-45 and V-22; Maintenance, Modifications and Upgrades on platforms, including A-10, B-1, B-2, B-52, C-32, C-40, C-130, E-4B, E-6, KC-10, KC-135, QF-16, T-38 and VC-25; Training Systems and Services on platforms, including AH-64, C-17, F-15, F-16, F/A-18, P-8A and T-45; and Defense and Government Services, including the Infrastructure and Range Services, Log C2 and LogNEC programs.

Boeing Capital Corporation Segment

BCC facilitates, arranges, structures and provides selective financing solutions for its Commercial Airplanes customers. In the space and defense markets, BCC primarily arranges and structures financing solutions for its BDS government customers. BCC’s portfolio consists of equipment under operating leases, finance leases, notes and other receivables, assets held for sale or re-lease and investments.

The Company competes with Lockheed Martin Corporation, Northrop Grumman Corporation, Raytheon Company and General Dynamics Corporation, Embraer, Bombardier, BAE Systems and European Aeronautic Defence and Space Company (EADS).

See Also

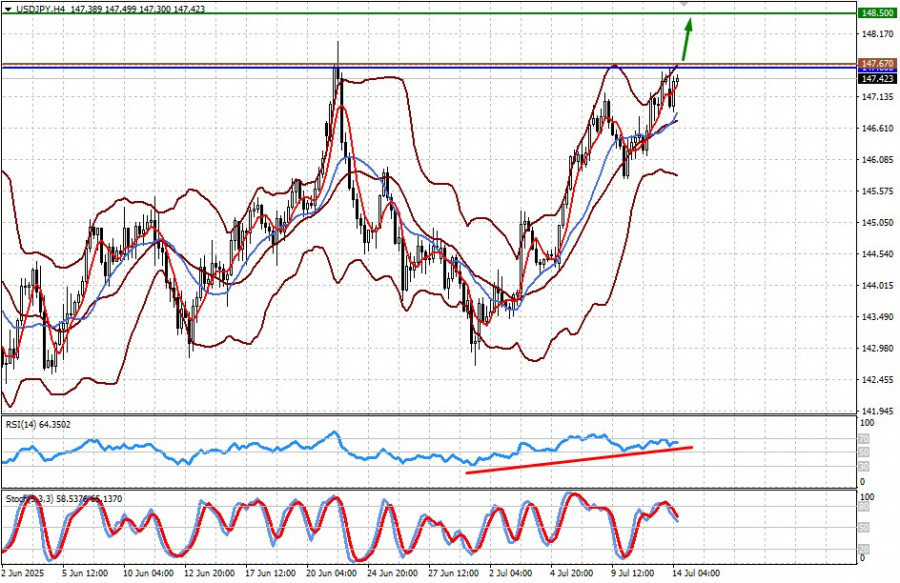

- The USD/JPY pair continues to consolidate near a three-week high amid U.S. dollar strength and mixed market signals

Author: Irina Yanina

12:17 2025-07-14 UTC+2

1018

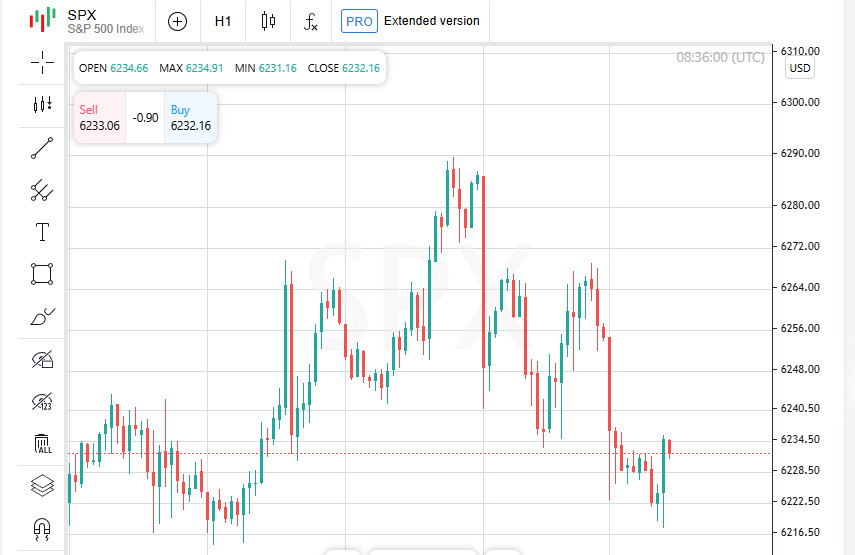

S&P 500 and EU futures fall, Nikkei steady Euro falls after Trump threatens 30% EU tariff US inflation and China growth data loom this weekAuthor: Thomas Frank

10:40 2025-07-14 UTC+2

928

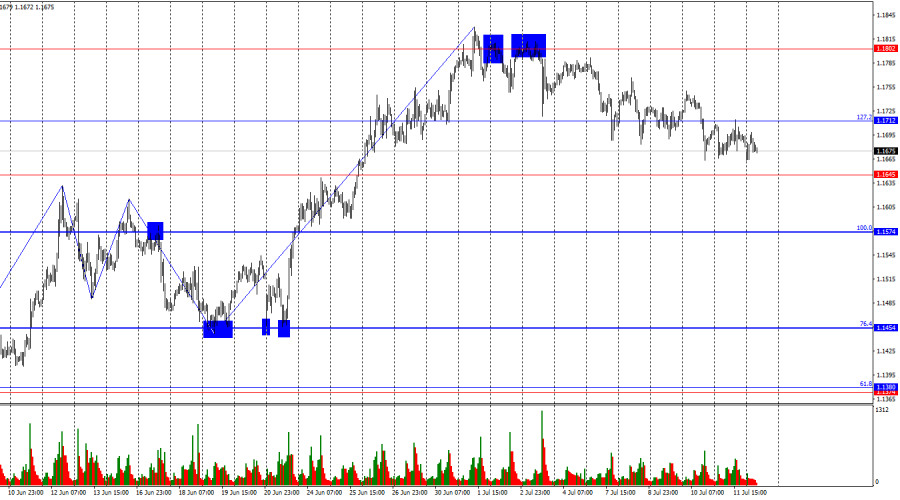

Last week, the pair moved downward and nearly tested the 23.6% retracement level at 1.1647 (blue dashed line), after which the price turned upward and closed the weekly candle at 1.1689. In the upcoming week, the price may continue its downward movement.Author: Stefan Doll

11:34 2025-07-14 UTC+2

883

- Wave analysis

Weekly Forecast Using Simplified Wave Analysis for EUR/USD, USD/JPY, GBP/JPY, USD/CAD, NZD/USD, and Gold as of July 14th

A sideways price movement is expected to continue in the upcoming week. A downward move toward the support zone is more likely in the first days, followed by a potential reversal and resumption of the upward trend. A change in direction may trigger a sharp increase in volatility.Author: Isabel Clark

10:57 2025-07-14 UTC+2

838

Bears still lack optimismAuthor: Samir Klishi

11:31 2025-07-14 UTC+2

733

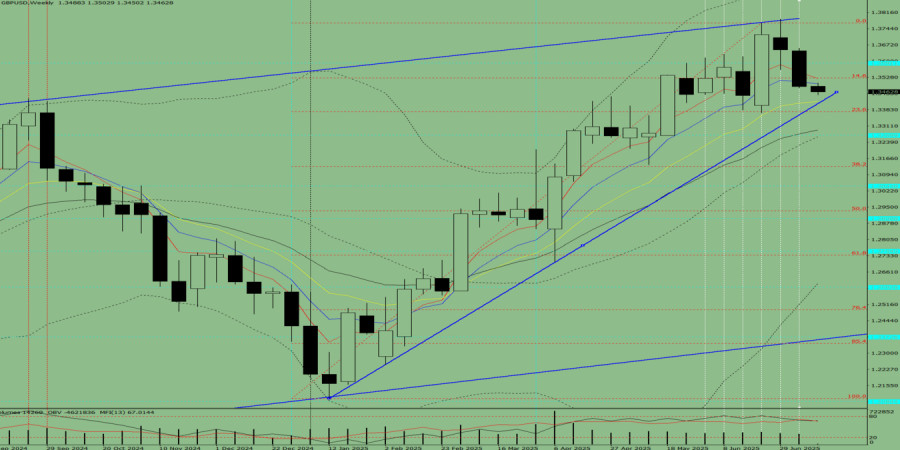

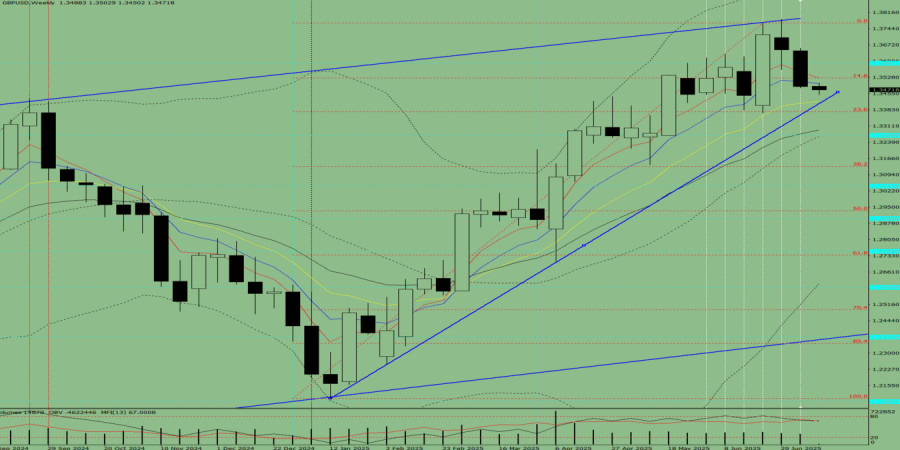

Last week, the pair moved downward and broke below the 8-period EMA at 1.3509 (thin blue line), closing the weekly candle at 1.3487. In the upcoming week, the price may continue to move lower.Author: Stefan Doll

11:40 2025-07-14 UTC+2

733

- Wave analysis

Weekly Forecast Using Simplified Wave Analysis for GBP/USD, AUD/USD, USD/CHF, EUR/JPY, AUD/JPY, and the US Dollar Index as of July 14th

Throughout the upcoming week, the British pound is expected to move in a generally sideways trajectory. A decline toward the support zone is likely in the first few days, followed by a potential reversal and the beginning of an upward movement. The highest volatility is anticipated toward the end.Author: Isabel Clark

11:12 2025-07-14 UTC+2

718

Fundamental analysisTrump Continues to Pressure U.S. Trade Partners (Potential Resumption of USD/JPY and Ethereum Growth)

The United States, through its president, continues to exert economic—and arguably geopolitical—pressure on its trade partners, which is having a ricochet effect on global trade and financial markets. But, oddly enough, we're now seeing clear changes in how market participants are assessing the sit.Author: Pati Gani

10:00 2025-07-14 UTC+2

688

Donald Trump announced 30% tariffs on goods from the EU and Mexico. The initial market reaction was negative, but the S&P 500 partially rebounded thanks to gains in large-cap stocksAuthor: Ekaterina Kiseleva

14:36 2025-07-14 UTC+2

688

- The USD/JPY pair continues to consolidate near a three-week high amid U.S. dollar strength and mixed market signals

Author: Irina Yanina

12:17 2025-07-14 UTC+2

1018

- S&P 500 and EU futures fall, Nikkei steady Euro falls after Trump threatens 30% EU tariff US inflation and China growth data loom this week

Author: Thomas Frank

10:40 2025-07-14 UTC+2

928

- Last week, the pair moved downward and nearly tested the 23.6% retracement level at 1.1647 (blue dashed line), after which the price turned upward and closed the weekly candle at 1.1689. In the upcoming week, the price may continue its downward movement.

Author: Stefan Doll

11:34 2025-07-14 UTC+2

883

- Wave analysis

Weekly Forecast Using Simplified Wave Analysis for EUR/USD, USD/JPY, GBP/JPY, USD/CAD, NZD/USD, and Gold as of July 14th

A sideways price movement is expected to continue in the upcoming week. A downward move toward the support zone is more likely in the first days, followed by a potential reversal and resumption of the upward trend. A change in direction may trigger a sharp increase in volatility.Author: Isabel Clark

10:57 2025-07-14 UTC+2

838

- Bears still lack optimism

Author: Samir Klishi

11:31 2025-07-14 UTC+2

733

- Last week, the pair moved downward and broke below the 8-period EMA at 1.3509 (thin blue line), closing the weekly candle at 1.3487. In the upcoming week, the price may continue to move lower.

Author: Stefan Doll

11:40 2025-07-14 UTC+2

733

- Wave analysis

Weekly Forecast Using Simplified Wave Analysis for GBP/USD, AUD/USD, USD/CHF, EUR/JPY, AUD/JPY, and the US Dollar Index as of July 14th

Throughout the upcoming week, the British pound is expected to move in a generally sideways trajectory. A decline toward the support zone is likely in the first few days, followed by a potential reversal and the beginning of an upward movement. The highest volatility is anticipated toward the end.Author: Isabel Clark

11:12 2025-07-14 UTC+2

718

- Fundamental analysis

Trump Continues to Pressure U.S. Trade Partners (Potential Resumption of USD/JPY and Ethereum Growth)

The United States, through its president, continues to exert economic—and arguably geopolitical—pressure on its trade partners, which is having a ricochet effect on global trade and financial markets. But, oddly enough, we're now seeing clear changes in how market participants are assessing the sit.Author: Pati Gani

10:00 2025-07-14 UTC+2

688

- Donald Trump announced 30% tariffs on goods from the EU and Mexico. The initial market reaction was negative, but the S&P 500 partially rebounded thanks to gains in large-cap stocks

Author: Ekaterina Kiseleva

14:36 2025-07-14 UTC+2

688