EURHUF (Euro vs Hungarian Forint). Exchange rate and online charts.

Currency converter

29 Apr 2025 00:14

(0%)

Closing price, the previous day.

Opening price.

The highest price over the last trading day.

The lowest price over the last trading day

Price range high in the last week

Price range low in the last week

EUR/HUF is a common currency pair in the forex market. The instrument proves to be vastly popular among savvy traders owing to its great stability and the predictability of the eurozone and the Hungarian economies.

At the same time, EUR/HUF is a cross currency pair against the US dollar. The pair does not contain USD, but its exchange rate is significantly affected by it. This tendency could be traced if we compare the EUR/USD and USD/HUF charts.

Main features

EUR/HUF is suitable for both novice and professional traders. It involves low risks. The pair’s exchange rate is influenced by the correlation between the eurozone economy and the Hungarian one. Although Hungary is part of the European Union, it has preserved its national currency – the forint. That is why the Hungarian currency often repeats the euro’s dynamics.

Hungary is heavily dependent on the organizations and countries that operate in its territory. Hungary enjoys a high share of foreign investments in its economy.

A large portion of Hungary's income comes from tourism. The country’s other well-developed economic sectors are mechanical engineering, metallurgy, chemical, and agriculture (products are mainly exported abroad). Hungary’s main trade partners are the EU countries and Russia. Therefore, when evaluating the forint’s exchange rate, the economic indicators of these regions should be taken into consideration.

Aspects of trading EUR/HUF

When trading cross currency pairs, traders should bear in mind that brokers set a higher spread for them than for major currency pairs. For that reason, before working with cross currency pairs, it is important to explore the broker’s trading conditions for a specific instrument.

EUR/HUF is usually heavily traded in the European session and is coolly traded the rest of the time.

Above all else, the US dollar has a significant impact on both the euro and the Hungarian forint. That is why traders should focus on the main US economic indicators when making forecasts for EUR/HUF (interest rates, GDP, unemployment, Nonfarm Payrolls, etc.).

See Also

- Wave analysis

Weekly Forecast Based on Simplified Wave Analysis for EUR/USD, USD/JPY, GBP/JPY, USD/CAD, NZD/USD, and GOLD — April 28th

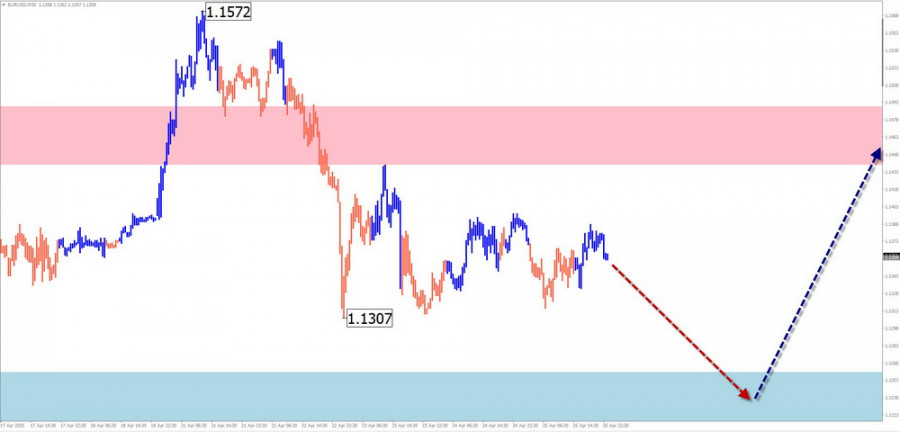

At the beginning of the upcoming week, the European currency is expected to continue moving sideways along the calculated counter-trend zones. A downward movement is more likely at the start of the week. Toward the weekend, we can expect increased volatility, a change in direction, and a resumption.Author: Isabel Clark

09:28 2025-04-28 UTC+2

1303

Wave analysisWeekly Forecast Based on Simplified Wave Analysis for GBP/USD, AUD/USD, USD/CHF, EUR/JPY, AUD/JPY, and US Dollar Index — April 28th

In the upcoming week, the British pound is highly likely to follow a general sideways trajectory. A brief price decline is expected early in the week. Toward the weekend, volatility is likely to increase, and the price may return to an upward trend, potentially coinciding with the release of.Author: Isabel Clark

09:32 2025-04-28 UTC+2

1213

ECB Ready to Cut Rates FurtherAuthor: Jakub Novak

09:24 2025-04-28 UTC+2

973

- Technical analysis

Trading Signals for GOLD (XAU/USD) for April 28-30, 2025: buy above $3,270 (21 SMA - 7/8 Murray)

The Eagle indicator is showing oversold signals, so we believe that gold could resume its bullish cycle in the short term after a technical correction and reach the psychological level of $3,500.Author: Dimitrios Zappas

16:25 2025-04-28 UTC+2

913

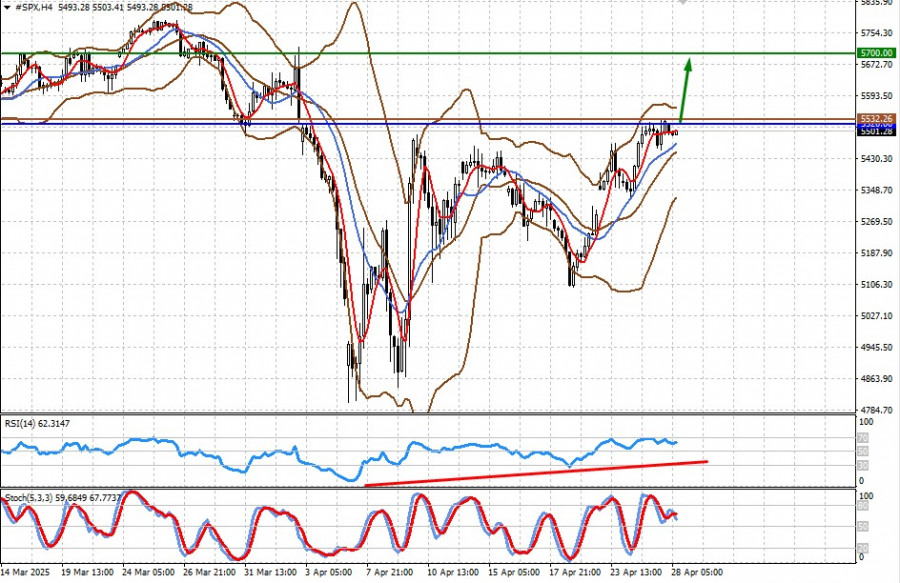

Stock Market Update for April 28th: S&P 500 and NASDAQ Pause Their AdvanceAuthor: Jakub Novak

09:06 2025-04-28 UTC+2

853

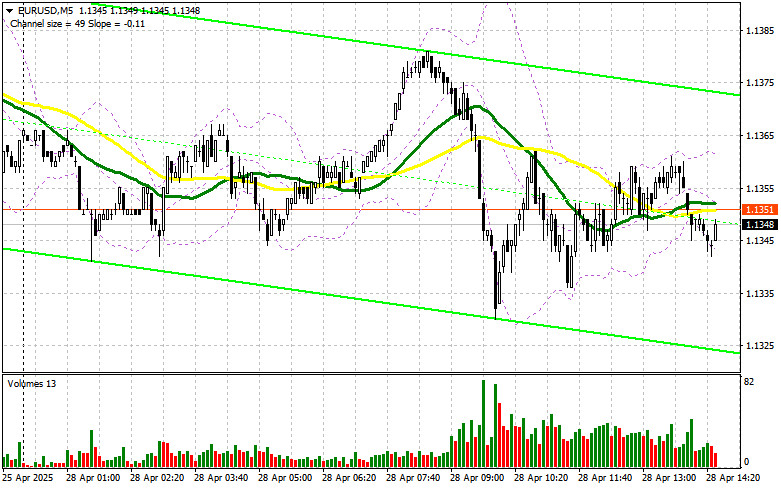

EUR/USD: Simple Trading Tips for Beginner Traders on April 28th (U.S. Session)Author: Jakub Novak

19:23 2025-04-28 UTC+2

823

- Fundamental analysis

The Upcoming Week May Be Positive for Markets but Negative for the Dollar and Gold (we expect further growth in CFD contracts for S&P 500 futures and Bitcoin)

The upcoming week will be rich in important economic data releases, which could have a noticeable impact on market dynamics — but will they be able to?Author: Pati Gani

09:12 2025-04-28 UTC+2

793

The S&P 500 and Nasdaq ended the previous trading session higher, defying choppy performance across Asian and European exchanges. Investors are now focused on the upcoming economic data and earnings reports from tech giants such as Microsoft and AppleAuthor: Ekaterina Kiseleva

11:31 2025-04-28 UTC+2

778

EUR/USD: Trading Plan for the U.S. Session on April 28th (Review of Morning Trades)Author: Miroslaw Bawulski

19:07 2025-04-28 UTC+2

778

- Wave analysis

Weekly Forecast Based on Simplified Wave Analysis for EUR/USD, USD/JPY, GBP/JPY, USD/CAD, NZD/USD, and GOLD — April 28th

At the beginning of the upcoming week, the European currency is expected to continue moving sideways along the calculated counter-trend zones. A downward movement is more likely at the start of the week. Toward the weekend, we can expect increased volatility, a change in direction, and a resumption.Author: Isabel Clark

09:28 2025-04-28 UTC+2

1303

- Wave analysis

Weekly Forecast Based on Simplified Wave Analysis for GBP/USD, AUD/USD, USD/CHF, EUR/JPY, AUD/JPY, and US Dollar Index — April 28th

In the upcoming week, the British pound is highly likely to follow a general sideways trajectory. A brief price decline is expected early in the week. Toward the weekend, volatility is likely to increase, and the price may return to an upward trend, potentially coinciding with the release of.Author: Isabel Clark

09:32 2025-04-28 UTC+2

1213

- ECB Ready to Cut Rates Further

Author: Jakub Novak

09:24 2025-04-28 UTC+2

973

- Technical analysis

Trading Signals for GOLD (XAU/USD) for April 28-30, 2025: buy above $3,270 (21 SMA - 7/8 Murray)

The Eagle indicator is showing oversold signals, so we believe that gold could resume its bullish cycle in the short term after a technical correction and reach the psychological level of $3,500.Author: Dimitrios Zappas

16:25 2025-04-28 UTC+2

913

- Stock Market Update for April 28th: S&P 500 and NASDAQ Pause Their Advance

Author: Jakub Novak

09:06 2025-04-28 UTC+2

853

- EUR/USD: Simple Trading Tips for Beginner Traders on April 28th (U.S. Session)

Author: Jakub Novak

19:23 2025-04-28 UTC+2

823

- Fundamental analysis

The Upcoming Week May Be Positive for Markets but Negative for the Dollar and Gold (we expect further growth in CFD contracts for S&P 500 futures and Bitcoin)

The upcoming week will be rich in important economic data releases, which could have a noticeable impact on market dynamics — but will they be able to?Author: Pati Gani

09:12 2025-04-28 UTC+2

793

- The S&P 500 and Nasdaq ended the previous trading session higher, defying choppy performance across Asian and European exchanges. Investors are now focused on the upcoming economic data and earnings reports from tech giants such as Microsoft and Apple

Author: Ekaterina Kiseleva

11:31 2025-04-28 UTC+2

778

- EUR/USD: Trading Plan for the U.S. Session on April 28th (Review of Morning Trades)

Author: Miroslaw Bawulski

19:07 2025-04-28 UTC+2

778