11.10.2023 03:00 PM

11.10.2023 03:00 PMAfter a 5-day strengthening streak, the EUR/USD pair has slowed its ascent today, trading near the 1.0600 level as of writing.

Market participants prefer not to engage in significant trading activities and exercise caution in the lead-up to important publications. Additionally, on Thursday (at 11:30 GMT), the ECB will release a report containing information about the September meeting of the Bank's Governing Council.

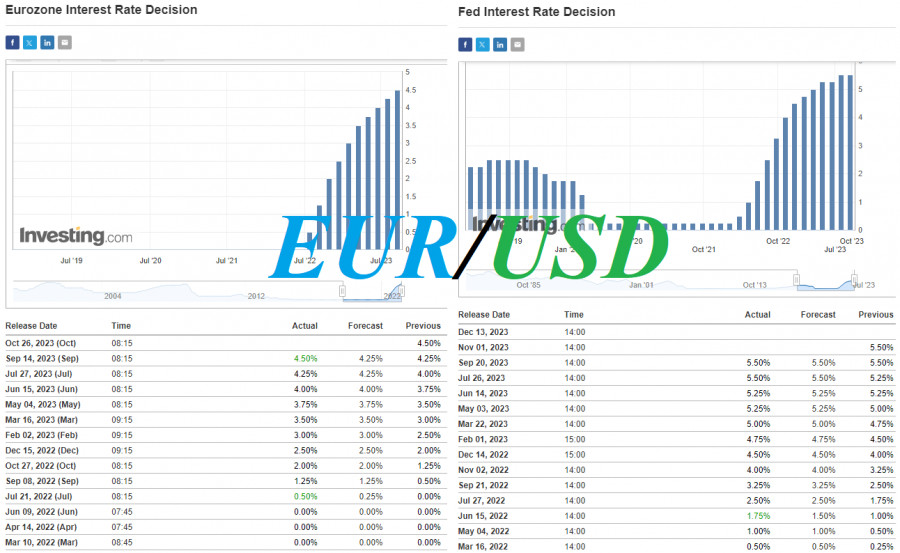

This document also provides an overview of the current ECB policy with planned changes in the financial and monetary spheres. As known, following the September meeting, the European Central Bank announced a 25-basis-point increase in key rates, bringing them to 4.50% for main refinancing operations and 4.75% for the marginal lending facility. The accompanying statement from the meeting mentioned that the "Governing Council considers that the key ECB interest rates have reached levels that, maintained for a sufficiently long duration, will make a substantial contribution to the timely return of inflation to the target."

Investors will closely examine the minutes from this ECB meeting to catch additional signals regarding future monetary policy.

Moreover, yesterday, the International Monetary Fund downgraded its economic growth forecasts for the Eurozone. This year, it could be 0.7% (down from the previous expectation of 0.9%), and next year, 1.2% (versus the previous forecast of 1.5%), with the possibility of a recession.

However, from the perspective of ECB officials, there have been quite hawkish statements regarding the prospects of further tightening monetary policy. For instance, the head of the Bank of France, Francois Villeroy de Galhau, recently noted that inflation in the Eurozone needs to decrease to the target level of 2.0%. Also, a member of the ECB's Governing Council, Klaas Knot, stated on Wednesday that "inflation is still too high," and the bank is "prepared for further rate adjustments if disinflation persists."

Therefore, the dynamics of the EUR/USD pair at the moment are influenced by both the dollar and the euro. It is also important not to overlook the role of the dollar as a safe-haven asset. Given the complex geopolitical situation in the world and the new hotspot of tension in the Middle East, investor attention to the role of the safe-haven dollar may again shift after the publication of all the aforementioned documents and macroeconomic indicators.

From a technical perspective, EUR/USD continues to trade within the medium-term and long-term bearish markets, below the key resistance levels of 1.0760 and 1.1040, respectively. In our previous review, we noted that after breaking the resistance level of 1.0542, if the upward correction continues, targets at the levels of 1.0633 and 1.0676 may be reasonable when planning your trading strategy. As we can see, the first target is almost reached, with only 5 points remaining to reach it. A break of today's low at 1.0593 could be the first signal to resume short positions.

投資者對於唐納德·特朗普緊跟股市走勢充滿信心,因此標普500指數不再需要特別的理由上漲。這個廣泛的股權指數原本在等待來自中國的好消息,但阿里巴巴的財報令投資者失望。

週四發布的 GDP 報告顯示,日本經濟在第一季度同比萎縮 0.7%,這是過去一年中的首次年度下降,且情況遠壞於預期。 經濟萎縮主要歸因於美國執行的貿易關稅和出口減少。

市場已經完全反映了美國與中國會談的結果,該會談導致達成了為期 90 天的貿易休戰。比預期疲軟的美國經濟數據抵消了週初的樂觀情緒。

週四,英鎊/美元貨幣對橫盤整理,波動性低,這是過去一個月英鎊的典型行為模式。首先出現了典型的水平區間,現在我們看到了帶有輕微下行趨勢的「波動」。

週四,歐元/美元貨幣對雙向波動,但最終仍保持在移動平均線下方。它位於移動平均線下方的位置使我們預期美元將進一步增強。

上週,唐納·川普宣布在他的「美國解放運動」下,與英國簽署了第一份協議。後來揭示該協議尚未簽署,談判可能還需要幾週時間。

中國商品正在大量湧入歐洲市場,但歐元/美元的多頭並未因此感到恐慌。儘管美國已經減少了從中國進口的關稅,但加權平均關稅仍然高達39%——這是一個顯著的高比率。

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.