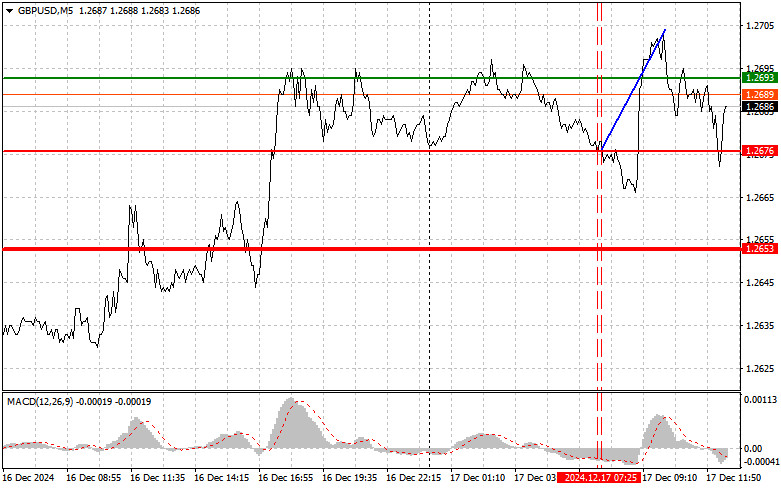

The 1.2676 price test coincided with the MACD indicator moving far below the zero mark, which, in my opinion, limited the pair's downward potential. For this reason, I did not sell the pound. The second test of 1.2676, when the MACD was in the oversold area, provided an entry point for implementing Scenario #2 for buying, resulting in a 30+ point rise in the pair.

Data showing almost no unemployment claims in the UK for November, along with a sharp increase in average earnings, supported the British pound. However, despite the initial optimism, the economic context remains challenging.

In the second half of the day, focus will shift to US economic data, specifically:

Economists expect retail sales to rise by 0.6% compared to the previous month.

For intraday strategy, I will focus on implementing Scenario #1 and Scenario #2.

Scenario #1:

I plan to buy the pound when the price reaches 1.2698 (green line on the chart). Target: Growth to 1.2739 (thicker green line). At 1.2739, I will exit purchases and open short positions in the opposite direction, expecting a 30-35 point reversal. Important! Before buying, ensure the MACD indicator is above the zero mark and just starting to rise.

Scenario #2:

I will also plan to buy the pound if there are two consecutive tests of the 1.2671 price level when the MACD indicator is in the oversold area. This will limit the pair's downward potential and trigger a reversal upward. Expect growth toward the opposite levels of 1.2698 and 1.2739.

Scenario #1:

I plan to sell the pound after breaking below the 1.2671 level (red line on the chart). Target: 1.2635, where I will exit short positions and open long positions in the opposite direction, expecting a 20-25 point reversal. Sellers will show strength only if US statistics come out strong. Important! Before selling, ensure the MACD indicator is below the zero mark and just starting to decline.

Scenario #2:

I will also plan to sell the pound if there are two consecutive tests of the 1.2698 price level while the MACD indicator is in the overbought area. This will limit the pair's upward potential and trigger a reversal downward. Expect a decline toward the opposite levels of 1.2671 and 1.2635.

Beginner traders on the Forex market must make cautious decisions when entering trades. Before major fundamental reports are released, it is safer to stay out of the market to avoid sharp price movements.

Remember: Successful trading requires a clear trading plan. Spontaneous trading decisions based on current market movements are inherently losing strategies for intraday traders.

You have already liked this post today

*这里的市场分析是为了增加您对市场的了解,而不是给出交易的指示。

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.