#FRANCE40 (CAC40). Exchange rate and online charts.

Currency converter

14 Jul 2025 13:50

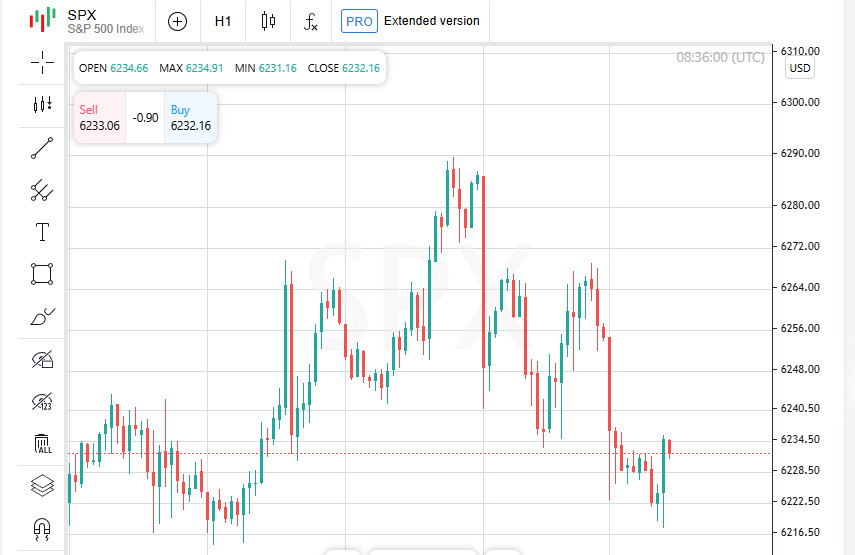

(0%)

Closing price, the previous day.

Opening price.

The highest price over the last trading day.

The lowest price over the last trading day

Price range high in the last week

Price range low in the last week

See Also

- Type of analysis

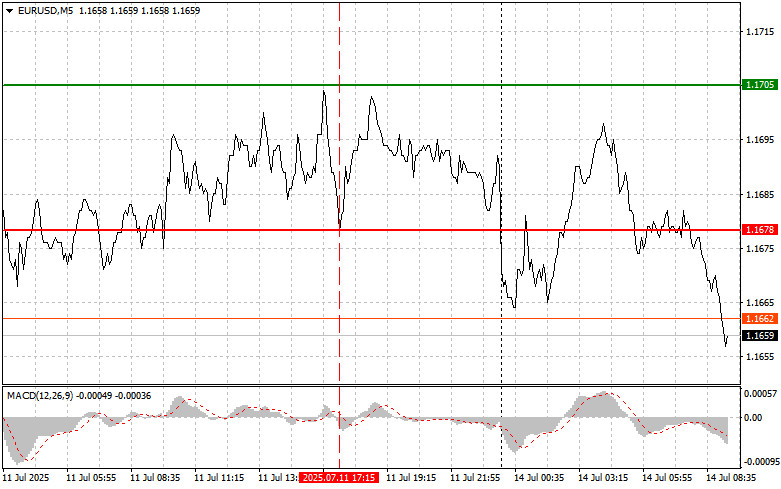

EUR/USD: Simple Trading Tips for Beginner Traders on July 14. Analysis of Yesterday's Forex Trades

EUR/USD: Simple Trading Tips for Beginner Traders on July 14. Analysis of Yesterday's Forex TradesAuthor: Jakub Novak

09:15 2025-07-14 UTC+2

778

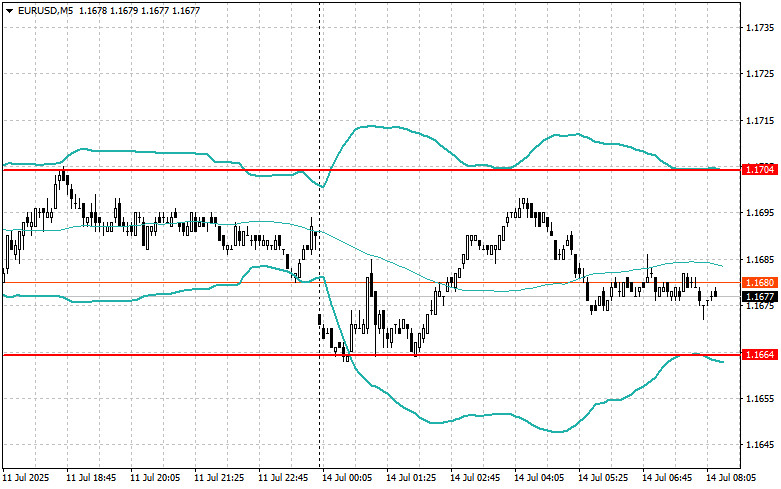

Intraday Strategies for Beginner Traders on July 14Author: Miroslaw Bawulski

08:26 2025-07-14 UTC+2

733

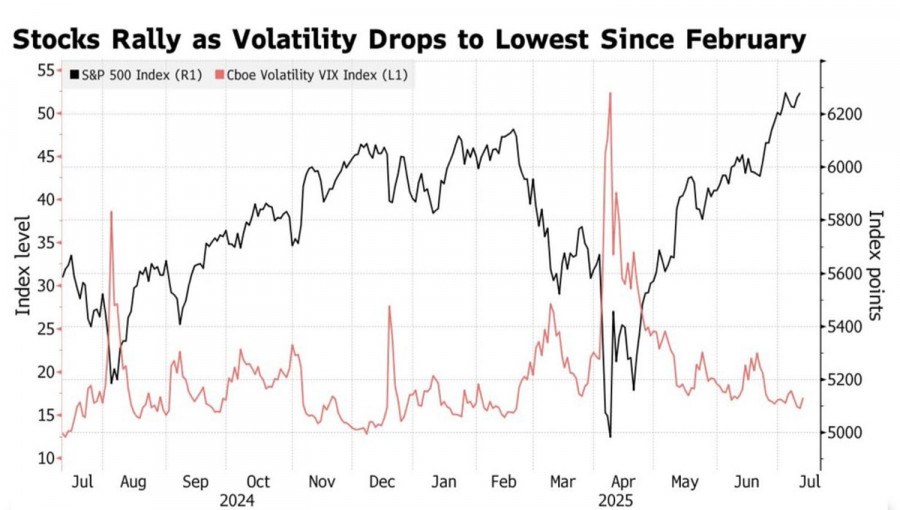

The White House is convinced that S&P 500 records are the result of its protectionist policiesAuthor: Marek Petkovich

09:06 2025-07-14 UTC+2

718

- Technical analysis

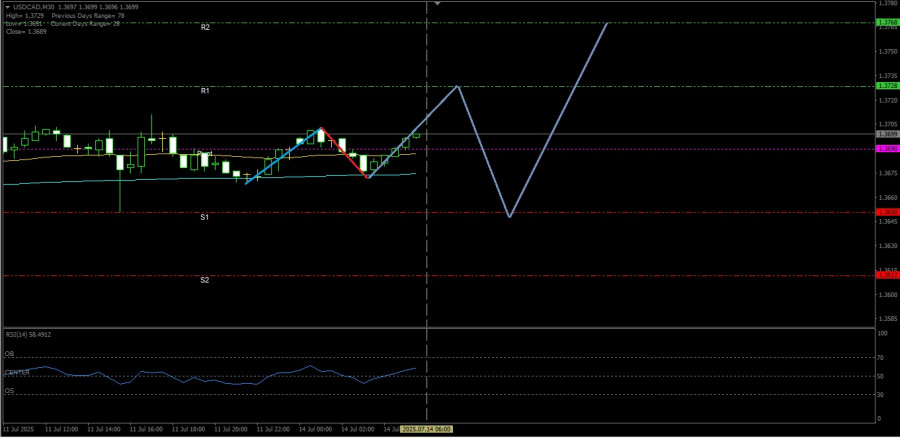

The USD/CAD commodity currency pair has the potential to correct towards its pivot point today, Monday, July 14, 2025.

Although the Lonnie is moving in a neutral-bullish position,Author: Arief Makmur

07:21 2025-07-14 UTC+2

688

Wave analysisWeekly Forecast Using Simplified Wave Analysis for EUR/USD, USD/JPY, GBP/JPY, USD/CAD, NZD/USD, and Gold as of July 14th

A sideways price movement is expected to continue in the upcoming week. A downward move toward the support zone is more likely in the first days, followed by a potential reversal and resumption of the upward trend. A change in direction may trigger a sharp increase in volatility.Author: Isabel Clark

10:57 2025-07-14 UTC+2

688

Fundamental analysisTrump Continues to Pressure U.S. Trade Partners (Potential Resumption of USD/JPY and Ethereum Growth)

The United States, through its president, continues to exert economic—and arguably geopolitical—pressure on its trade partners, which is having a ricochet effect on global trade and financial markets. But, oddly enough, we're now seeing clear changes in how market participants are assessing the sit.Author: Pati Gani

10:00 2025-07-14 UTC+2

673

- Wave analysis

Weekly Forecast Using Simplified Wave Analysis for GBP/USD, AUD/USD, USD/CHF, EUR/JPY, AUD/JPY, and the US Dollar Index as of July 14th

Throughout the upcoming week, the British pound is expected to move in a generally sideways trajectory. A decline toward the support zone is likely in the first few days, followed by a potential reversal and the beginning of an upward movement. The highest volatility is anticipated toward the end.Author: Isabel Clark

11:12 2025-07-14 UTC+2

658

S&P 500 and EU futures fall, Nikkei steady Euro falls after Trump threatens 30% EU tariff US inflation and China growth data loom this weekAuthor: Thomas Frank

10:40 2025-07-14 UTC+2

658

Trading Recommendations for the Cryptocurrency Market on July 14Author: Miroslaw Bawulski

09:53 2025-07-14 UTC+2

643

- Type of analysis

EUR/USD: Simple Trading Tips for Beginner Traders on July 14. Analysis of Yesterday's Forex Trades

EUR/USD: Simple Trading Tips for Beginner Traders on July 14. Analysis of Yesterday's Forex TradesAuthor: Jakub Novak

09:15 2025-07-14 UTC+2

778

- Intraday Strategies for Beginner Traders on July 14

Author: Miroslaw Bawulski

08:26 2025-07-14 UTC+2

733

- The White House is convinced that S&P 500 records are the result of its protectionist policies

Author: Marek Petkovich

09:06 2025-07-14 UTC+2

718

- Technical analysis

The USD/CAD commodity currency pair has the potential to correct towards its pivot point today, Monday, July 14, 2025.

Although the Lonnie is moving in a neutral-bullish position,Author: Arief Makmur

07:21 2025-07-14 UTC+2

688

- Wave analysis

Weekly Forecast Using Simplified Wave Analysis for EUR/USD, USD/JPY, GBP/JPY, USD/CAD, NZD/USD, and Gold as of July 14th

A sideways price movement is expected to continue in the upcoming week. A downward move toward the support zone is more likely in the first days, followed by a potential reversal and resumption of the upward trend. A change in direction may trigger a sharp increase in volatility.Author: Isabel Clark

10:57 2025-07-14 UTC+2

688

- Fundamental analysis

Trump Continues to Pressure U.S. Trade Partners (Potential Resumption of USD/JPY and Ethereum Growth)

The United States, through its president, continues to exert economic—and arguably geopolitical—pressure on its trade partners, which is having a ricochet effect on global trade and financial markets. But, oddly enough, we're now seeing clear changes in how market participants are assessing the sit.Author: Pati Gani

10:00 2025-07-14 UTC+2

673

- Wave analysis

Weekly Forecast Using Simplified Wave Analysis for GBP/USD, AUD/USD, USD/CHF, EUR/JPY, AUD/JPY, and the US Dollar Index as of July 14th

Throughout the upcoming week, the British pound is expected to move in a generally sideways trajectory. A decline toward the support zone is likely in the first few days, followed by a potential reversal and the beginning of an upward movement. The highest volatility is anticipated toward the end.Author: Isabel Clark

11:12 2025-07-14 UTC+2

658

- S&P 500 and EU futures fall, Nikkei steady Euro falls after Trump threatens 30% EU tariff US inflation and China growth data loom this week

Author: Thomas Frank

10:40 2025-07-14 UTC+2

658

- Trading Recommendations for the Cryptocurrency Market on July 14

Author: Miroslaw Bawulski

09:53 2025-07-14 UTC+2

643