GBPZAR (British Pound vs South African Rand). Exchange rate and online charts.

Currency converter

04 Aug 2025 19:32

(-0.01%)

Closing price, the previous day.

Opening price.

The highest price over the last trading day.

The lowest price over the last trading day

Price range high in the last week

Price range low in the last week

The GBP/ZAR currency pair is a popular one on Forex market. As South Africa does an active trade with the United Kingdom, the experienced traders choose this trading instrument for the high stability and predictability of the Great Britain and South Africa's economies. The most intense GBP/ZAR bidding is observed during the European sessions.

This pair is the cross rate against the U.S. dollar. There is no the U.S. dollar in this currency pair, nevertheless, it wields an enormous influence over the pound and the rand. To see it graphically, just combine the GBP/USD and USD/ZAR charts in the same price chart, and you will get the approximate GBP/ZAR chart.

The U.S. dollar affects both currencies profoundly. Hence, for a better prognosis on the future rate movement of this currency pair, you should take into account the main indicators of the U.S. economy. There are such indicators as the interest rate, GDP, unemployment, new workplaces indicator and many others. Keep in mind that the aforementioned currencies may respond in a different manner to the changes in the economic situation of the U.S.A.

The South African rand is one of the most widespread currencies, which is used in many trading operations. The huge reserves of the mineral resources allow South Africa to be the richest country of its continent. Its economy is concentrated on mining with a further export of minerals. Moreover, one of the major stock exchanges that is in the top 10 world's largest stock exchanges, is situated in South Africa. South Africa specializes in extraction of precious stones and metals, including gold and diamonds. Since the country is the leading car manufacturer in Africa, the majority of its products goes on export. As you can see, South Africa does not suffer from the shortage in raw materials. Among the factors, which can affect the rand rate, are prices for precious gems and metals, as well as level of engineering production.

Remember that the spread for the cross rates can be higher than for more popular currency pairs. Thus, before you start dealing with the cross currency pair, learn thoroughly the broker's conditions for this specified trading instrument.

See Also

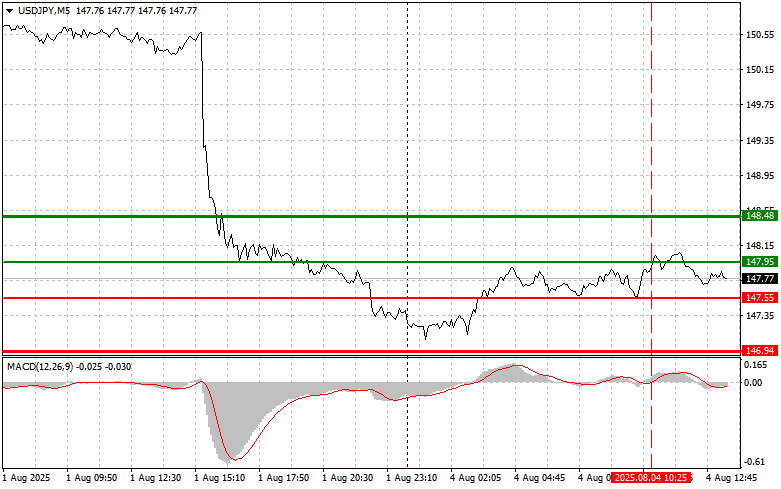

- USD/JPY: Simple Trading Tips for Beginner Traders – August 4th (U.S. Session)

Author: Jakub Novak

12:59 2025-08-04 UTC+2

988

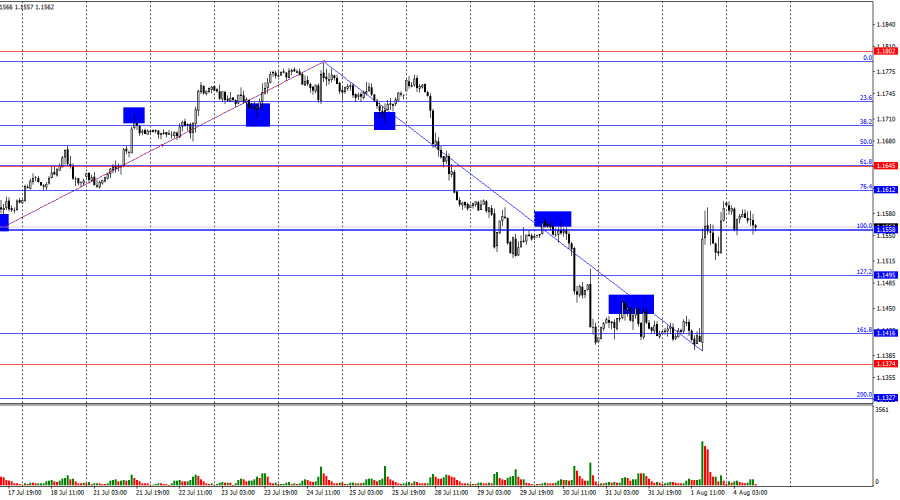

Forecast for EUR/USD on August 4, 2025Author: Samir Klishi

11:49 2025-08-04 UTC+2

988

Gold Resumes Its RallyAuthor: Jakub Novak

11:10 2025-08-04 UTC+2

973

- On Friday, the pair moved downward, tested the historical support level of 1.3148 (blue dotted line), and then rebounded upward (following news releases), closing the daily candlestick at 1.3278. Today, the price may attempt to continue its upward movement. No significant economic events are.

Author: Stefan Doll

10:21 2025-08-04 UTC+2

958

USD/JPY – Analysis and ForecastAuthor: Irina Yanina

12:44 2025-08-04 UTC+2

958

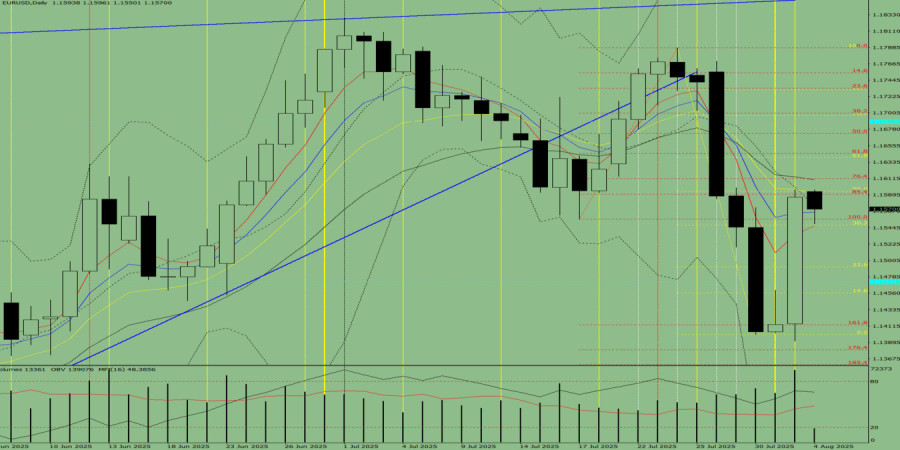

Last week, the pair moved downward and nearly tested the 61.8% retracement level at 1.1378 (red dotted line), before reversing upward and closing the weekly candle at 1.1586. In the upcoming week, the price may begin an upward movement.Author: Stefan Doll

10:38 2025-08-04 UTC+2

958

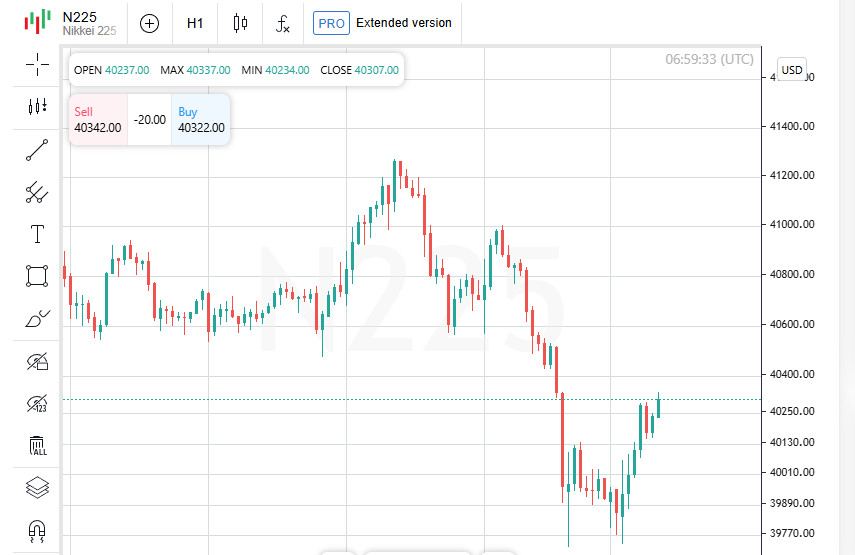

- S&P 500 futures and European indices surged, while the Nikkei dropped. A surprise result of the US employment report prompted markets to price in further rate cuts. Investors await earnings reports from Disney, McDonald's, and Caterpillar. The dollar held steady. Oil dipped

Author: Gleb Frank

11:12 2025-08-04 UTC+2

943

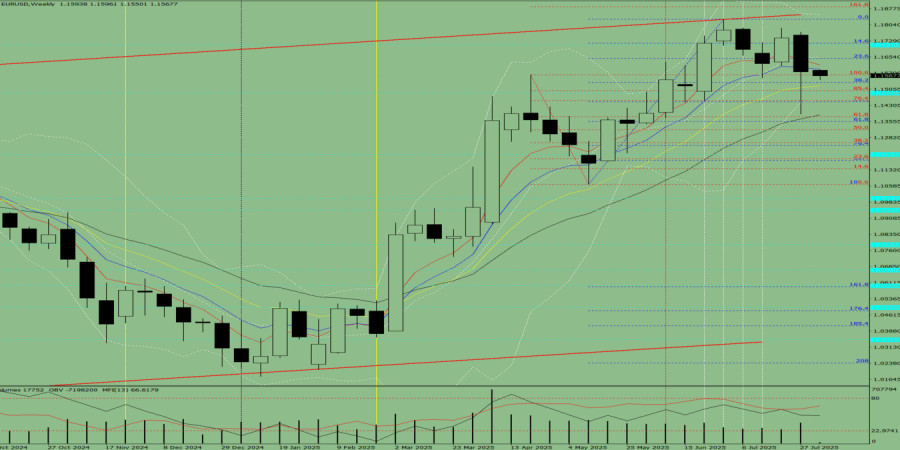

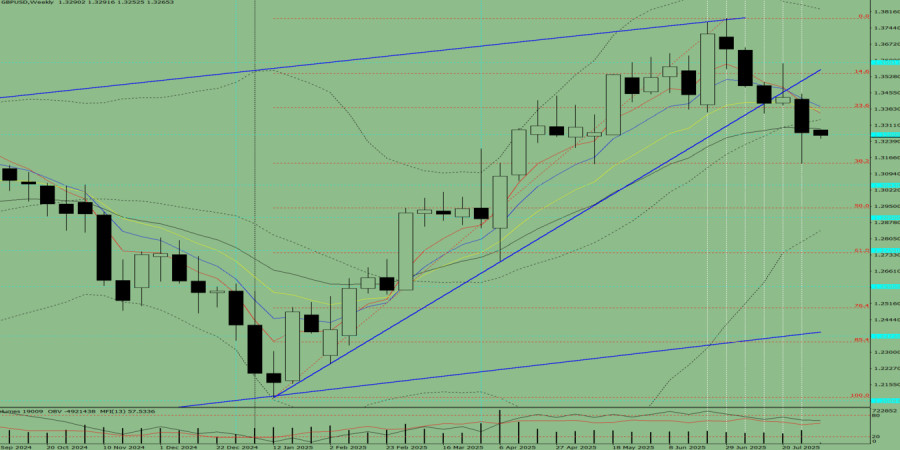

Last week, the pair moved downward and tested the 38.2% retracement level at 1.3141 (red dashed line), after which the price moved upward and closed the weekly candle at 1.3278. In the upcoming week, the price may start moving upward.Author: Stefan Doll

11:38 2025-08-04 UTC+2

928

Bad Economic News Leads to Negative ConsequencesAuthor: Jakub Novak

10:42 2025-08-04 UTC+2

928

- USD/JPY: Simple Trading Tips for Beginner Traders – August 4th (U.S. Session)

Author: Jakub Novak

12:59 2025-08-04 UTC+2

988

- Forecast for EUR/USD on August 4, 2025

Author: Samir Klishi

11:49 2025-08-04 UTC+2

988

- Gold Resumes Its Rally

Author: Jakub Novak

11:10 2025-08-04 UTC+2

973

- On Friday, the pair moved downward, tested the historical support level of 1.3148 (blue dotted line), and then rebounded upward (following news releases), closing the daily candlestick at 1.3278. Today, the price may attempt to continue its upward movement. No significant economic events are.

Author: Stefan Doll

10:21 2025-08-04 UTC+2

958

- USD/JPY – Analysis and Forecast

Author: Irina Yanina

12:44 2025-08-04 UTC+2

958

- Last week, the pair moved downward and nearly tested the 61.8% retracement level at 1.1378 (red dotted line), before reversing upward and closing the weekly candle at 1.1586. In the upcoming week, the price may begin an upward movement.

Author: Stefan Doll

10:38 2025-08-04 UTC+2

958

- S&P 500 futures and European indices surged, while the Nikkei dropped. A surprise result of the US employment report prompted markets to price in further rate cuts. Investors await earnings reports from Disney, McDonald's, and Caterpillar. The dollar held steady. Oil dipped

Author: Gleb Frank

11:12 2025-08-04 UTC+2

943

- Last week, the pair moved downward and tested the 38.2% retracement level at 1.3141 (red dashed line), after which the price moved upward and closed the weekly candle at 1.3278. In the upcoming week, the price may start moving upward.

Author: Stefan Doll

11:38 2025-08-04 UTC+2

928

- Bad Economic News Leads to Negative Consequences

Author: Jakub Novak

10:42 2025-08-04 UTC+2

928