USDPLN (US Dollar vs Polish Zloty). Exchange rate and online charts.

Currency converter

14 Jul 2025 14:02

(-0.01%)

Closing price, the previous day.

Opening price.

The highest price over the last trading day.

The lowest price over the last trading day

Price range high in the last week

Price range low in the last week

USD/PLN (US Dollar vs Polish Zloty)

The USD/PLN is not popular currency pair on Forex. Poland intends to continue introducing the euro. At the same time, a lot of internal problems such as the budget deficit, high external debt, etc. as well as global economic downturn prevented this country from adopting the single currency in time. The European Central Bank requires the government to introduce some reforms so Poland will enter the European Union in 2014 after fulfilling all the requirements.

Poland is an industrial country with the developed economy and high quality of life. The main economic sectors are engineering, metallurgy, and chemical and coal industries. Poland has well-developed automobile production and shipbuilding at the shipyards of the Baltic Sea. Poland is rich in mineral resources: coal, copper, lead, natural gas, etc. Due to the large reserves of hydrocarbons, the Polish economy is able to satisfy almost all its energy needs. The factors that can significantly impact Poland's economy are the international rating of the country and the leading industries of Poland and the European Union.

If you trade USD/PLN, you have to pay attention to the behavior of other most important trading instruments such as: EUR/USD, GBP/USD, and USD/JPY. They are indicators of the USD/PLN price movement as they greatly influence the national currency of Poland.

If you trade USD/PLN, you should focus on economic indicators of Poland as well as the world oil prices.

See Also

- Type of analysis

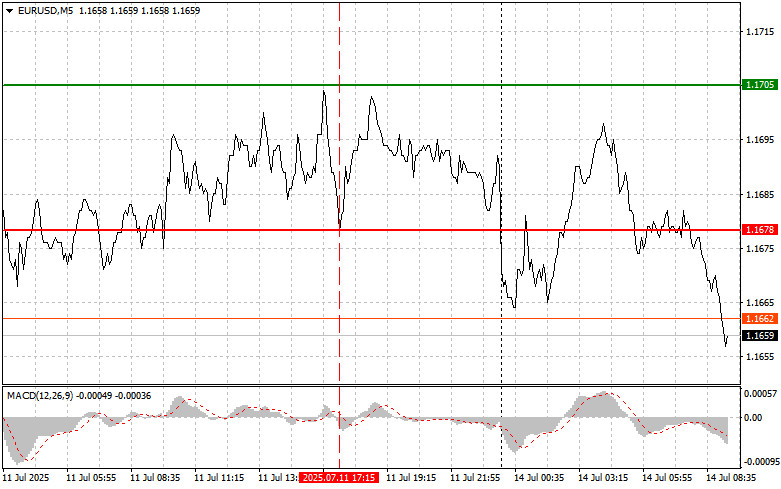

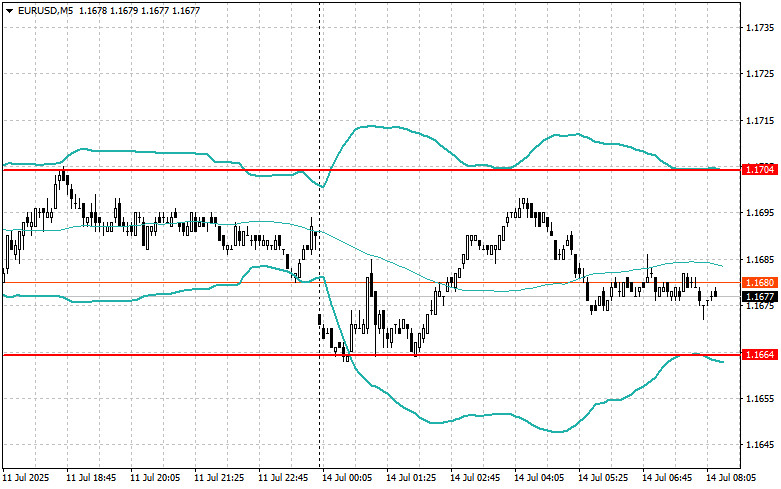

EUR/USD: Simple Trading Tips for Beginner Traders on July 14. Analysis of Yesterday's Forex Trades

EUR/USD: Simple Trading Tips for Beginner Traders on July 14. Analysis of Yesterday's Forex TradesAuthor: Jakub Novak

09:15 2025-07-14 UTC+2

808

Intraday Strategies for Beginner Traders on July 14Author: Miroslaw Bawulski

08:26 2025-07-14 UTC+2

748

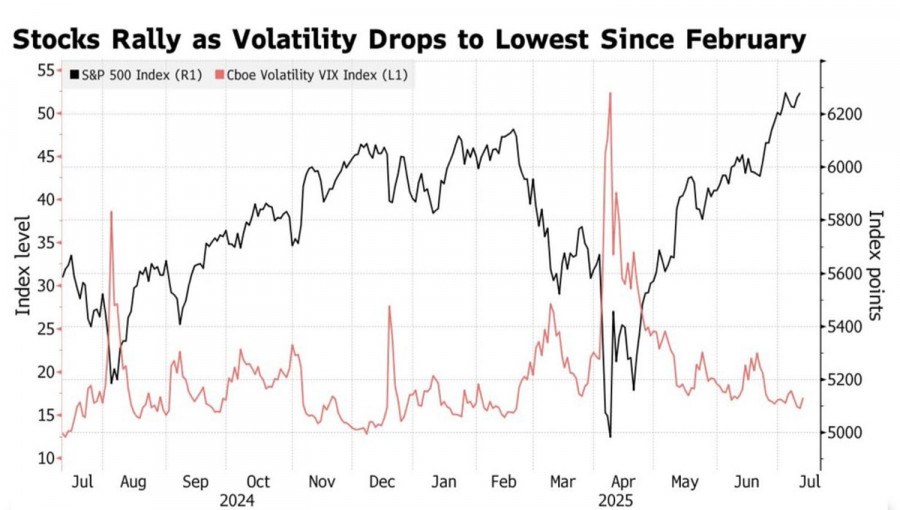

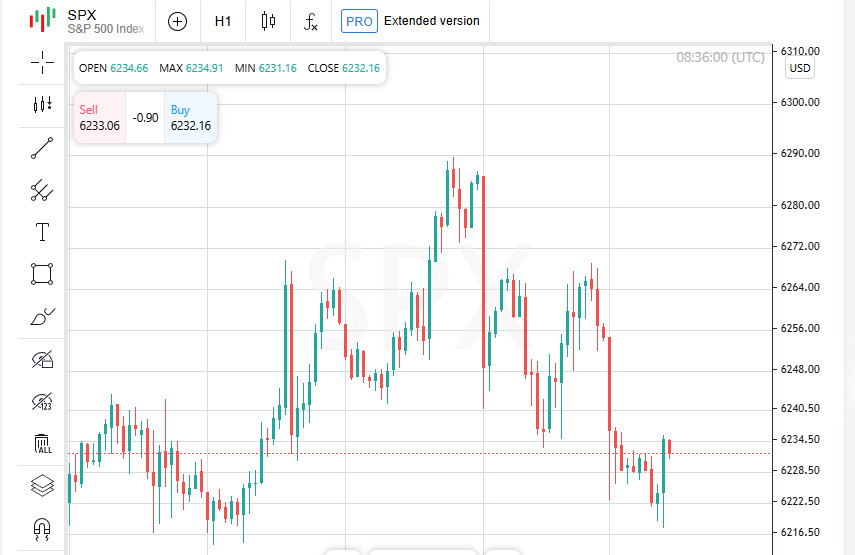

The White House is convinced that S&P 500 records are the result of its protectionist policiesAuthor: Marek Petkovich

09:06 2025-07-14 UTC+2

718

- Technical analysis

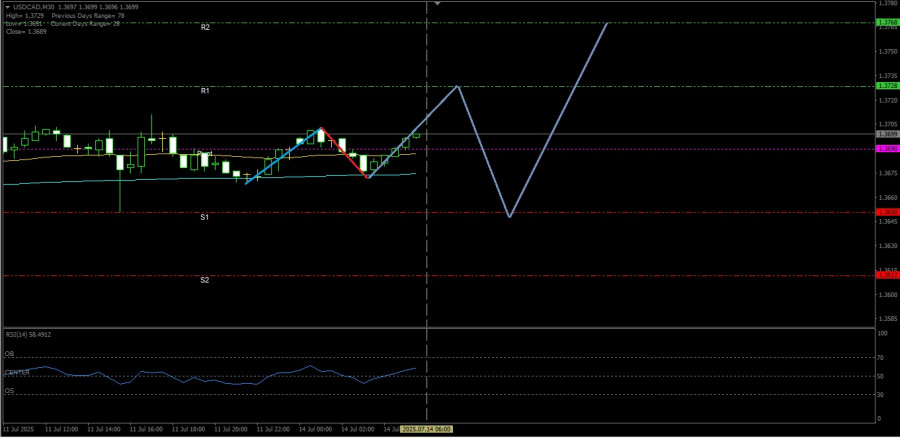

The USD/CAD commodity currency pair has the potential to correct towards its pivot point today, Monday, July 14, 2025.

Although the Lonnie is moving in a neutral-bullish position,Author: Arief Makmur

07:21 2025-07-14 UTC+2

703

Wave analysisWeekly Forecast Using Simplified Wave Analysis for EUR/USD, USD/JPY, GBP/JPY, USD/CAD, NZD/USD, and Gold as of July 14th

A sideways price movement is expected to continue in the upcoming week. A downward move toward the support zone is more likely in the first days, followed by a potential reversal and resumption of the upward trend. A change in direction may trigger a sharp increase in volatility.Author: Isabel Clark

10:57 2025-07-14 UTC+2

688

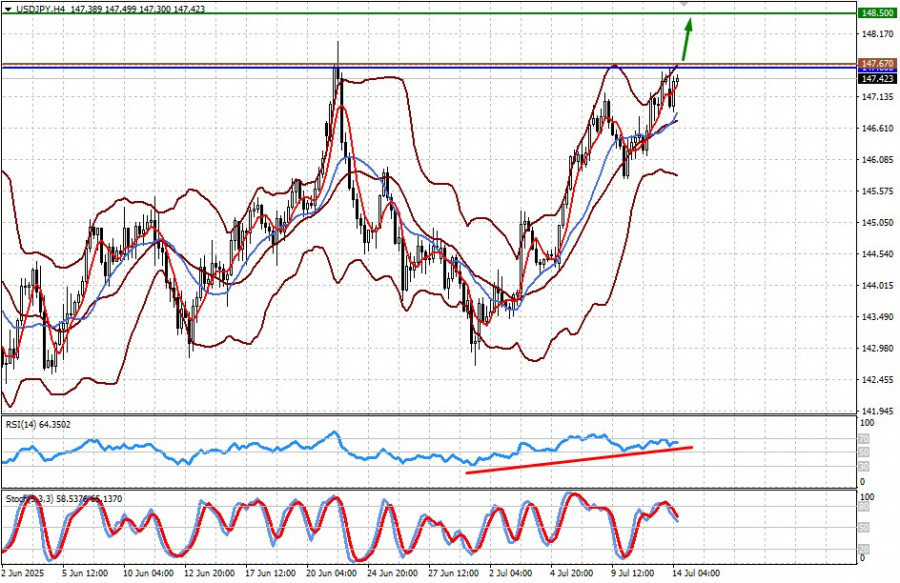

Fundamental analysisTrump Continues to Pressure U.S. Trade Partners (Potential Resumption of USD/JPY and Ethereum Growth)

The United States, through its president, continues to exert economic—and arguably geopolitical—pressure on its trade partners, which is having a ricochet effect on global trade and financial markets. But, oddly enough, we're now seeing clear changes in how market participants are assessing the sit.Author: Pati Gani

10:00 2025-07-14 UTC+2

673

- Wave analysis

Weekly Forecast Using Simplified Wave Analysis for GBP/USD, AUD/USD, USD/CHF, EUR/JPY, AUD/JPY, and the US Dollar Index as of July 14th

Throughout the upcoming week, the British pound is expected to move in a generally sideways trajectory. A decline toward the support zone is likely in the first few days, followed by a potential reversal and the beginning of an upward movement. The highest volatility is anticipated toward the end.Author: Isabel Clark

11:12 2025-07-14 UTC+2

658

S&P 500 and EU futures fall, Nikkei steady Euro falls after Trump threatens 30% EU tariff US inflation and China growth data loom this weekAuthor: Thomas Frank

10:40 2025-07-14 UTC+2

658

Trading Recommendations for the Cryptocurrency Market on July 14Author: Miroslaw Bawulski

09:53 2025-07-14 UTC+2

643

- Type of analysis

EUR/USD: Simple Trading Tips for Beginner Traders on July 14. Analysis of Yesterday's Forex Trades

EUR/USD: Simple Trading Tips for Beginner Traders on July 14. Analysis of Yesterday's Forex TradesAuthor: Jakub Novak

09:15 2025-07-14 UTC+2

808

- Intraday Strategies for Beginner Traders on July 14

Author: Miroslaw Bawulski

08:26 2025-07-14 UTC+2

748

- The White House is convinced that S&P 500 records are the result of its protectionist policies

Author: Marek Petkovich

09:06 2025-07-14 UTC+2

718

- Technical analysis

The USD/CAD commodity currency pair has the potential to correct towards its pivot point today, Monday, July 14, 2025.

Although the Lonnie is moving in a neutral-bullish position,Author: Arief Makmur

07:21 2025-07-14 UTC+2

703

- Wave analysis

Weekly Forecast Using Simplified Wave Analysis for EUR/USD, USD/JPY, GBP/JPY, USD/CAD, NZD/USD, and Gold as of July 14th

A sideways price movement is expected to continue in the upcoming week. A downward move toward the support zone is more likely in the first days, followed by a potential reversal and resumption of the upward trend. A change in direction may trigger a sharp increase in volatility.Author: Isabel Clark

10:57 2025-07-14 UTC+2

688

- Fundamental analysis

Trump Continues to Pressure U.S. Trade Partners (Potential Resumption of USD/JPY and Ethereum Growth)

The United States, through its president, continues to exert economic—and arguably geopolitical—pressure on its trade partners, which is having a ricochet effect on global trade and financial markets. But, oddly enough, we're now seeing clear changes in how market participants are assessing the sit.Author: Pati Gani

10:00 2025-07-14 UTC+2

673

- Wave analysis

Weekly Forecast Using Simplified Wave Analysis for GBP/USD, AUD/USD, USD/CHF, EUR/JPY, AUD/JPY, and the US Dollar Index as of July 14th

Throughout the upcoming week, the British pound is expected to move in a generally sideways trajectory. A decline toward the support zone is likely in the first few days, followed by a potential reversal and the beginning of an upward movement. The highest volatility is anticipated toward the end.Author: Isabel Clark

11:12 2025-07-14 UTC+2

658

- S&P 500 and EU futures fall, Nikkei steady Euro falls after Trump threatens 30% EU tariff US inflation and China growth data loom this week

Author: Thomas Frank

10:40 2025-07-14 UTC+2

658

- Trading Recommendations for the Cryptocurrency Market on July 14

Author: Miroslaw Bawulski

09:53 2025-07-14 UTC+2

643