CHFZAR (Swiss Franc vs South African Rand). Exchange rate and online charts.

Currency converter

14 Jul 2025 07:44

(-0%)

Closing price, the previous day.

Opening price.

The highest price over the last trading day.

The lowest price over the last trading day

Price range high in the last week

Price range low in the last week

CHF/ZAR is not popular currency pair on Forex market. CHF/ZAR can be considered as the cross rate against the U.S. dollar. The greenback greatly affects the CHF/ZAR currency pair, although it is not obviously represented in this trading instrument. If combine the USD/CHF and USD/ZAR charts, we can get an approximate CHF/ZAR price chart.

Both currencies are influenced by the greenback. That is why it is necessary to take into account the discount rate, GDP, unemployment, new created workplaces indicator and many other U.S. major economic indicators for the correct analysis of this financial instrument. However, it should be noted that the mentioned above currencies could respond with different speed to the changes in the U.S. economy, therefore, the CHF/ZAR currency pair may act as a specific indicator of changes within these currencies.

Switzerland economy remains strong for several centuries. As a consequence, the Swiss franc demonstrates its strength all over the world , being one of the most reliable and stable world currencies. The Swiss franc serves as a safe haven currency for capital investment during the crises. Therefore, during financial meltdown, when global capital is urgently forwarded to Switzerland, the Swiss franc rises sharply against other currencies. This feature of Swiss economy should be taken into account when you trade this instrument.

This trading instrument is relatively illiquid compared to such major currency pairs as EUR/USD, USD/CHF, GBP/USD, and USD/JPY. Therefore, when you make a prognosis for the financial instrument, you should primarily focus on those currency pairs that include the U.S. dollar.

It is necessary to remember that brokers, as a rule, set a higher spread for cross rates rather than for more popular currency pairs. Thus, before you start working with the cross rates, read carefully the conditions offered by the broker to trade with specified instrument.

See Also

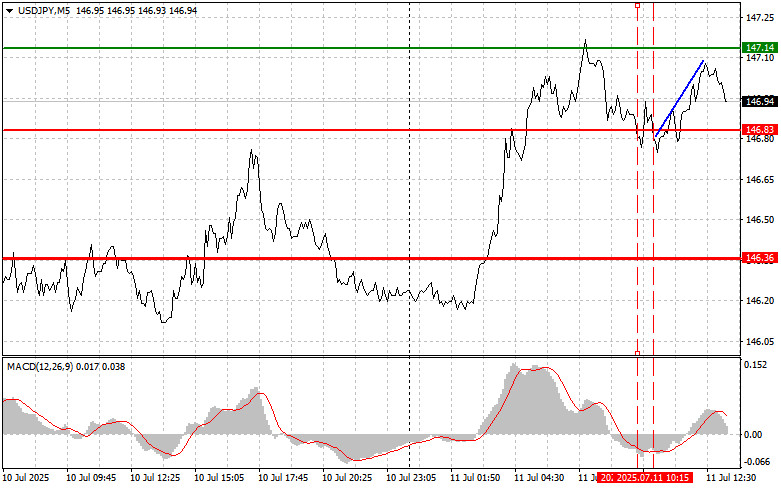

- USD/JPY: Simple Trading Tips for Beginner Traders – July 11th (U.S. Session)

Author: Jakub Novak

13:49 2025-07-11 UTC+2

2188

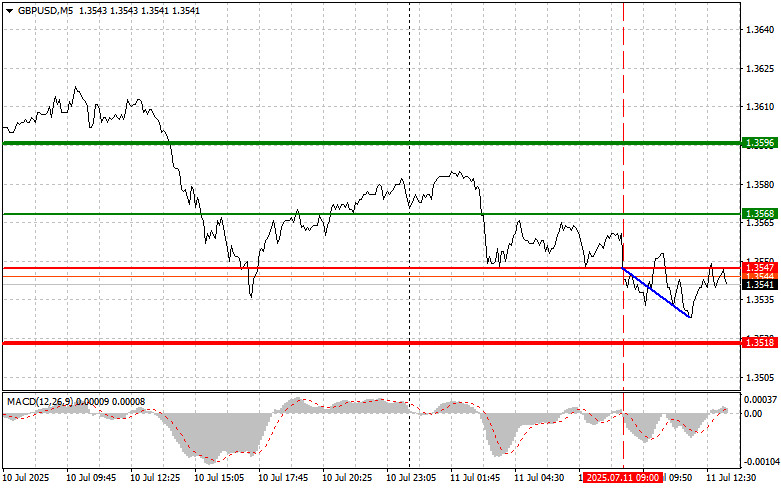

GBP/USD: Simple Trading Tips for Beginner Traders – July 11th (U.S. Session)Author: Jakub Novak

13:06 2025-07-11 UTC+2

2128

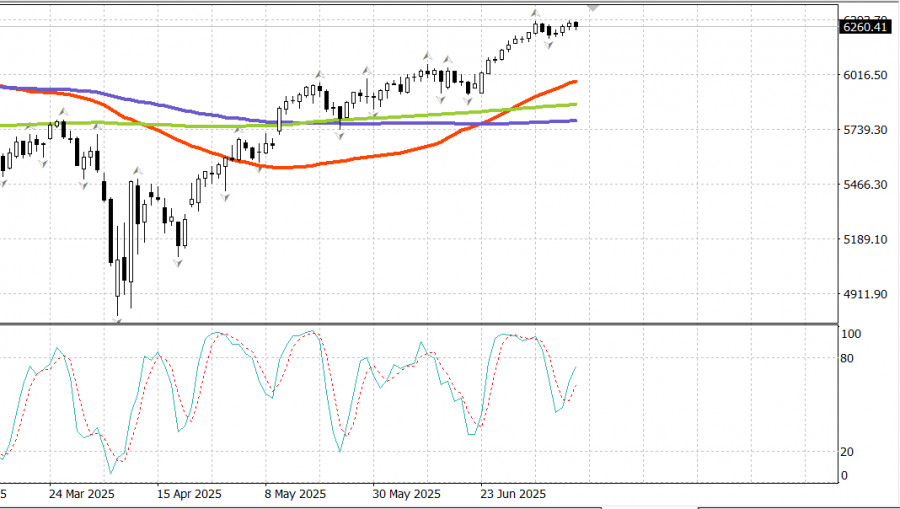

Stock indices extending modest growthAuthor: Jozef Kovach

12:57 2025-07-11 UTC+2

2038

- The Japanese yen is under pressure today.

Author: Irina Yanina

14:21 2025-07-11 UTC+2

1858

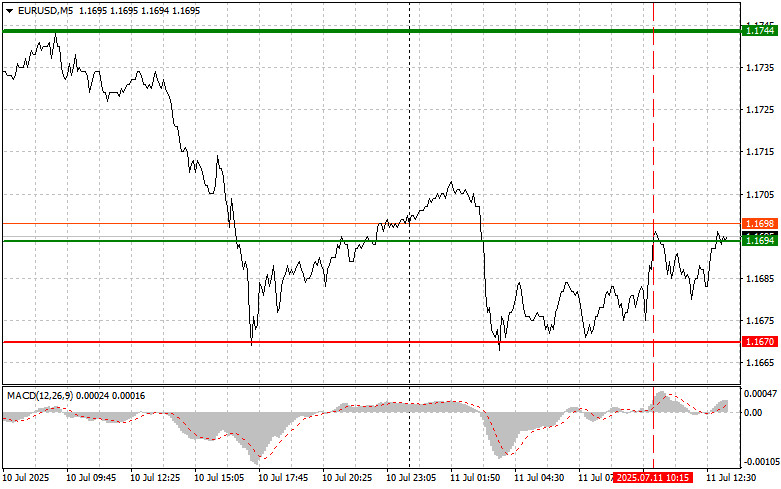

EUR/USD: Simple Trading Tips for Beginner Traders – July 11th (U.S. Session)Author: Jakub Novak

13:01 2025-07-11 UTC+2

1858

Bears still lack positive momentumAuthor: Samir Klishi

12:44 2025-07-11 UTC+2

1603

- Fundamental analysis

EUR/USD. Weekly Preview: U.S. Inflation, Retail Sales, ZEW Indices, and China's GDP

The upcoming trading week will be marked by U.S. inflation data. Reports on CPI and PPI growth will be released, along with the University of Michigan Consumer Sentiment Index. However, the economic calendar also includes several other events that may stir movement in the EUR/USD pair.Author: Irina Manzenko

00:41 2025-07-14 UTC+2

763

Trading planTrading Recommendations and Trade Breakdown for EUR/USD on July 14. The Dollar Is Tired

The EUR/USD currency pair showed virtually no decline throughout FridayAuthor: Paolo Greco

04:33 2025-07-14 UTC+2

673

In the upcoming week in the U.S., reports on inflation and industrial production will be released, along with a few other moderately interesting indicatorsAuthor: Chin Zhao

00:41 2025-07-14 UTC+2

658

- USD/JPY: Simple Trading Tips for Beginner Traders – July 11th (U.S. Session)

Author: Jakub Novak

13:49 2025-07-11 UTC+2

2188

- GBP/USD: Simple Trading Tips for Beginner Traders – July 11th (U.S. Session)

Author: Jakub Novak

13:06 2025-07-11 UTC+2

2128

- Stock indices extending modest growth

Author: Jozef Kovach

12:57 2025-07-11 UTC+2

2038

- The Japanese yen is under pressure today.

Author: Irina Yanina

14:21 2025-07-11 UTC+2

1858

- EUR/USD: Simple Trading Tips for Beginner Traders – July 11th (U.S. Session)

Author: Jakub Novak

13:01 2025-07-11 UTC+2

1858

- Bears still lack positive momentum

Author: Samir Klishi

12:44 2025-07-11 UTC+2

1603

- Fundamental analysis

EUR/USD. Weekly Preview: U.S. Inflation, Retail Sales, ZEW Indices, and China's GDP

The upcoming trading week will be marked by U.S. inflation data. Reports on CPI and PPI growth will be released, along with the University of Michigan Consumer Sentiment Index. However, the economic calendar also includes several other events that may stir movement in the EUR/USD pair.Author: Irina Manzenko

00:41 2025-07-14 UTC+2

763

- Trading plan

Trading Recommendations and Trade Breakdown for EUR/USD on July 14. The Dollar Is Tired

The EUR/USD currency pair showed virtually no decline throughout FridayAuthor: Paolo Greco

04:33 2025-07-14 UTC+2

673

- In the upcoming week in the U.S., reports on inflation and industrial production will be released, along with a few other moderately interesting indicators

Author: Chin Zhao

00:41 2025-07-14 UTC+2

658