MXNJPY (Mexican Peso vs Japanese Yen). Exchange rate and online charts.

Currency converter

16 Jun 2025 23:21

(0%)

Closing price, the previous day.

Opening price.

The highest price over the last trading day.

The lowest price over the last trading day

Price range high in the last week

Price range low in the last week

MXN/JPY is not a popular currency pair on the Forex market. As the MXN/JPY currency pair represents the cross rate against the U.S. dollar, it has a significant influence on it. Thus, by merging USD/JPY and USD/MXN price charts, it is possible to get an approximate MXN/JPY chart.

Both currencies of the MXN/JPY currency pair are influenced by the U.S. dollar, that is why it is necessary to consider the U.S. major indicators such as the discount rate, GDP growth, unemployment rate, new vacancies and others to correctly predict the future course rate.

Today, Mexico is one of the most developed countries in Latin America. It ranks first among Latin American countries in terms of income per capita. The Mexican economy is based mostly on the private sector due to the mass privatization of state enterprises launched in the 1980s to overcome the economic crisis. Most of the former state enterprises now belong to foreign companies.

Mexico is a member of NAFTA - the North American Free Trade Agreement. For this reason, the country trades actively with the United States and Canada, which brings good revenue for the Mexican government.

Mexico is the largest exporter of oil in its region. Its oil sector yields significant profits for the country. However, the main source of income for Mexico is the service sector.

Although Mexico has huge oil and gas reserves, its natural hydrocarbons are strongly depleted. The government has to reduce the amount of extracted oil and natural gas in order to avoid new problems in the economy. According to forecasts, Mexico will soon be forced to import oil from abroad to meet the needs of its economy. Such news has a significant impact on the Mexican currency which is highly dependent on world oil prices. In addition, the Mexican peso exchange rate is affected by the international ranking of the country which is based on complex economic formulas.

Currency pair MXNJPY is very susceptible to a variety of major political and economic developments taking place in the world. For this reason, the price chart for this currency pair is poorly predictable, and often goes in the opposite direction relative to any analysis.

It is not recommended for beginers to start trading on MXN/JPY as there are many nuances а the price chart behavior that can greatly affect the pair's future course rate.

It should be noted that brokers set a higher spread for cross rates than for basic currency pairs. So before you start working with the crosses, get familiarized with the terms and conditions offered by the broker.

See Also

- Today, gold is holding on to its intraday losses

Author: Irina Yanina

12:18 2025-06-16 UTC+2

5713

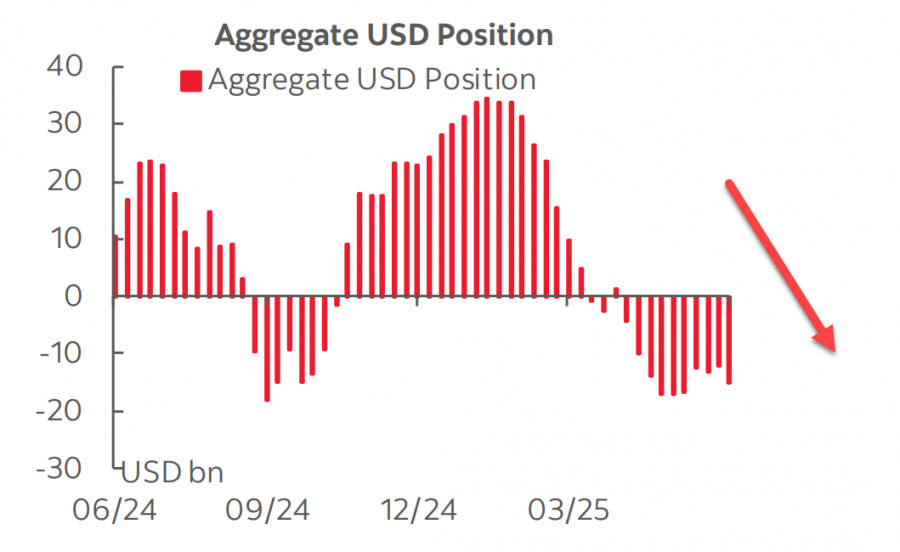

Fundamental analysisCFTC Report: The Dollar Is Being Sold Off Again. Awaiting New Revelations from Trump

CFTC Report: The Dollar Is Being Sold Off Again. Awaiting New Revelations from TrumpAuthor: Kuvat Raharjo

12:14 2025-06-16 UTC+2

1693

Fundamental analysisThe Israel-Iran Confrontation. Fed Meeting. What's Next? (I expect further decline in USD/CAD and a local pullback in gold before a new wave of growth)

Israel and Iran are exchanging missile strikes, but it seems markets are trying to play their own game, assuming that this conflict will not cross the nuclear threshold. In the meantime, investors are shifting their focus to key events this weekAuthor: Pati Gani

10:51 2025-06-16 UTC+2

1603

- Bears still struggling to find support

Author: Samir Klishi

12:02 2025-06-16 UTC+2

1603

GBP/USD. Analysis and ForecastAuthor: Irina Yanina

12:10 2025-06-16 UTC+2

1573

Stock Market on May 16th: S&P 500 and NASDAQ Closed LowerAuthor: Jakub Novak

10:43 2025-06-16 UTC+2

1483

- US equity indices ended Friday's session in the red as escalating tensions between Israel and Iran drove oil prices higher and fueled market uncertainty. The S&P 500 fell by 1.13%, the Nasdaq 100 dropped by 1.30%, and the Dow Jones lost 1.79%

Author: Ekaterina Kiseleva

13:50 2025-06-16 UTC+2

1453

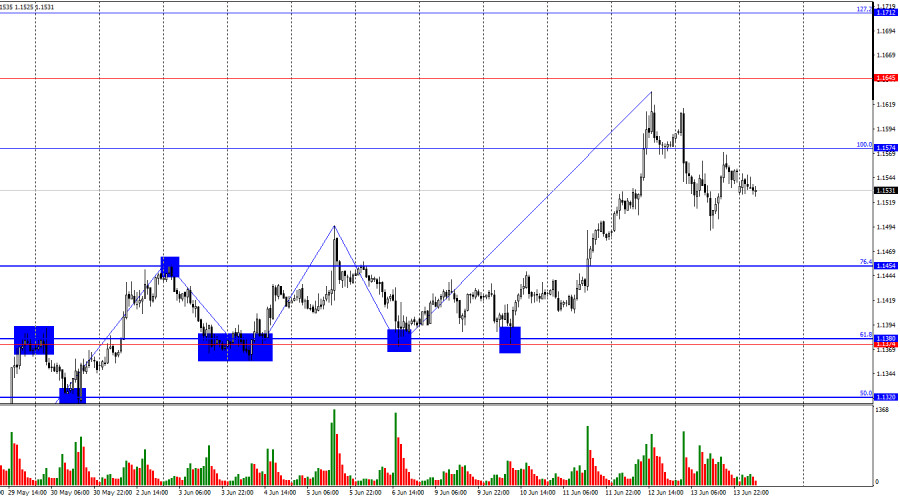

EUR/USD. Analysis and ForecastAuthor: Irina Yanina

12:08 2025-06-16 UTC+2

1363

Bitcoin pauses above $105,000, but breakout occursAuthor: Ekaterina Kiseleva

17:22 2025-06-16 UTC+2

1168

- Today, gold is holding on to its intraday losses

Author: Irina Yanina

12:18 2025-06-16 UTC+2

5713

- Fundamental analysis

CFTC Report: The Dollar Is Being Sold Off Again. Awaiting New Revelations from Trump

CFTC Report: The Dollar Is Being Sold Off Again. Awaiting New Revelations from TrumpAuthor: Kuvat Raharjo

12:14 2025-06-16 UTC+2

1693

- Fundamental analysis

The Israel-Iran Confrontation. Fed Meeting. What's Next? (I expect further decline in USD/CAD and a local pullback in gold before a new wave of growth)

Israel and Iran are exchanging missile strikes, but it seems markets are trying to play their own game, assuming that this conflict will not cross the nuclear threshold. In the meantime, investors are shifting their focus to key events this weekAuthor: Pati Gani

10:51 2025-06-16 UTC+2

1603

- Bears still struggling to find support

Author: Samir Klishi

12:02 2025-06-16 UTC+2

1603

- GBP/USD. Analysis and Forecast

Author: Irina Yanina

12:10 2025-06-16 UTC+2

1573

- Stock Market on May 16th: S&P 500 and NASDAQ Closed Lower

Author: Jakub Novak

10:43 2025-06-16 UTC+2

1483

- US equity indices ended Friday's session in the red as escalating tensions between Israel and Iran drove oil prices higher and fueled market uncertainty. The S&P 500 fell by 1.13%, the Nasdaq 100 dropped by 1.30%, and the Dow Jones lost 1.79%

Author: Ekaterina Kiseleva

13:50 2025-06-16 UTC+2

1453

- EUR/USD. Analysis and Forecast

Author: Irina Yanina

12:08 2025-06-16 UTC+2

1363

- Bitcoin pauses above $105,000, but breakout occurs

Author: Ekaterina Kiseleva

17:22 2025-06-16 UTC+2

1168