See also

07.12.2021 11:30 AM

07.12.2021 11:30 AMThe gold market continues to struggle because investors are reacting to the hawkish rhetoric of Fed Chairman Jerome Powell.

Until three weeks ago, investors were all about keeping gold in their portfolio, trying to protect themselves from rising inflationary pressures. But now the Fed appears to be taking the threat more seriously, which, in turn, raises expectations for tighter monetary policy in the near future. Many anticipate an announcement of a much faster reduction of bond purchases in December.

But even if expectations begin to change, the broader investment landscape remains the same. Despite Powell's new aggressive stance, most economists and market analysts believe the Fed will lag behind the inflation curve. This means that real interest rates will remain negative, which will be good for gold.

Leigh Goehring, managing partner of Goehring & Rozencwajg Associates, said the long-term target for gold is $ 20,000 per ounce.

"We're getting closer to the explosion of gold prices to the upside. I'm a big believer that inflation is not going away. It's going to continue to be a problem," he said.

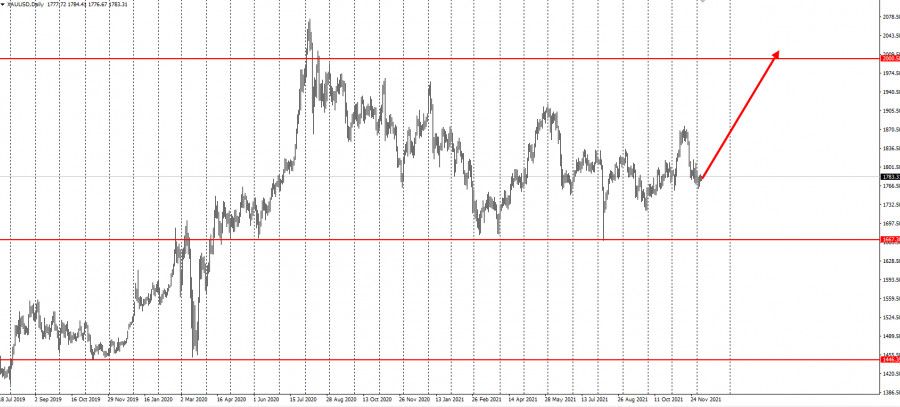

Meanwhile, Gerald Moser, chief market strategist at Barclays Bank, said gold prices will rise 20% over the next 12 months.

Although investors are ignoring gold as a hedge against inflation, other central banks are paying much more attention to it. The central bank of Singapore and the central bank of Ireland bought gold for the first time in decades.

Singapore reportedly bought 26.35 metric tons of gold between May and June, which was the first gold purchase by an Asian central bank since 2000. Ireland, on the other hand, bought two tons of gold, its first purchase since 2009.

Ireland's central bank governor, Gabriel Makhlouf, also said inflation was a growing concern for him.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

On Monday, the United States announced "significant progress" in trade talks with China following a two-day meeting in Switzerland over the weekend. Markets reacted to this news with a gap-up

There are no macroeconomic events scheduled for Monday. Fundamental developments will also be limited, but at this point, it is entirely unclear which factors are influencing price formation. The pound

InstaTrade

video analytics

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.