See also

14.09.2023 03:00 PM

14.09.2023 03:00 PMIt is widely expected that by the end of its meeting, the European Central Bank's key interest rate and deposit rate for commercial banks will remain at their current levels of 4.25% and 3.75%, respectively, given the growing risks of a recession in the European economy.

However, if ECB President Christine Lagarde sends "hawkish" signals during the press conference following today's meeting, the euro may strengthen sharply. A soft tone in her statements and hints at a pause or a reversal in the direction of the ECB's monetary policy will negatively impact the euro. In this case, we must prepare for further, deeper weakening of the euro, including in major cross-currency pairs, particularly in the EUR/JPY pair.

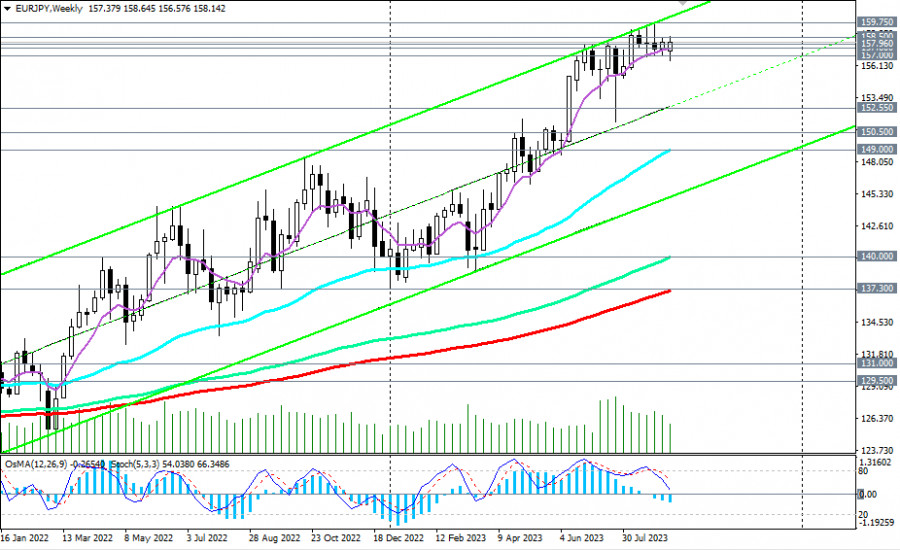

Looking at the EUR/JPY chart, it is evident that the pair is experiencing an upward trend, partly due to the divergence in monetary policies between the ECB and the Bank of Japan. In favor of buying the yen and the EUR/JPY pair is also the so-called "carry-trade," where a more expensive currency is bought at the expense of a cheaper one.

Nevertheless, starting from August, the pair has mainly traded within a wide range between 157.00 (50 EMA on the daily chart) and 159.75 and within a narrower range between 157.60 (200 EMA on the 4-hour chart) and 158.50.

Therefore, a break above the upper level of the short-term range (between 158.50 and 157.60) may be the first signal to increase long positions.

A break of the recent local high at 159.75 (near this level, the upper boundary of the upward channel on the weekly chart also passes) may trigger further growth of the pair, which continues to trade within the long-term bullish trend.

In an alternative scenario, the first signal to open short positions could be a break below the 157.60 mark, with confirmation coming from a break of the important support level at 157.00, targeting a decline near the key support levels 152.55 (144 EMA on the daily chart), 150.50 (200 EMA on the daily chart). Breaking through these levels would break the medium-term bullish trend of the pair, while it would remain within the framework of the long-term bullish trend, above the support levels of 140.00 (144 EMA on the weekly chart) and 137.30 (200 EMA on the weekly chart).

As long as a stable bullish trend and a strong upward momentum prevail, long positions remain preferable.

Support levels: 157.96, 157.60, 157.00, 152.55, 150.50, 149.00

Resistance levels: 158.50, 159.00, 159.75

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

There are no macroeconomic events scheduled for Friday. Fundamental developments will also be limited, but it's entirely unclear which factors influence price formation. The pound and the euro had reasons

Analysis of Thursday's Trades 1H Chart of GBP/USD On Thursday, the GBP/USD pair continued its choppy decline within the sideways channel and failed to break out, unlike the EUR/USD pair

Analysis of Thursday's Trades 1H Chart of EUR/USD On Thursday, the EUR/USD currency pair unexpectedly exited the sideways channel where it had been trading for three weeks. This occurred during

On Thursday, the GBP/USD currency pair continued trading within the sideways channel, visible in the hourly timeframe. Two central bank meetings — each of which could be considered favorable

The EUR/USD currency pair exhibited a particularly interesting trend on Thursday. As a reminder, the FOMC meeting results were announced Wednesday evening, and we once again considered them hawkish. It's

Analysis of Wednesday's Trades 1H Chart of GBP/USD The GBP/USD pair showed no notable movements on Wednesday. After Jerome Powell stated the need for more time to assess the full

InstaFutures

Make money with a new promising instrument!

InstaFutures

Make money with a new promising instrument!

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.