See also

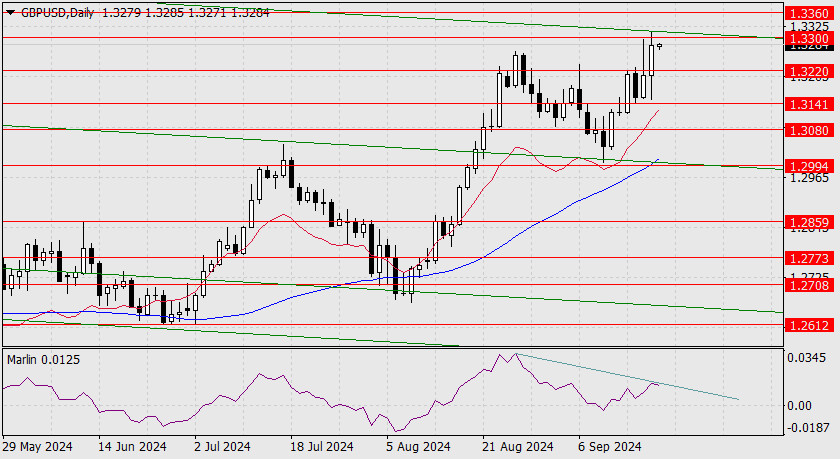

Following yesterday's Bank of England meeting, only one member of the Committee voted for a rate cut, contrary to the expectation of two. Eight members voted to keep the rate unchanged (the forecast was seven). The pound again tested the resistance level of 1.3300 (with a slight overreach). The total range exceeded 160 pips.

However, the technical outlook remains unchanged, and the bears have not lost their potential for a reversal. The divergence and the pressure from linear resistances are still in place. Even if the price rises to 1.3360, this pressure will remain. Only a firm hold above 1.3360 will open the path to 1.3525 or slightly lower, toward the peaks of December 2019 (1.3514) or August 2020.

The divergence has changed but is still present on the four-hour chart. It could strengthen if the price falls below the support at 1.3220, allowing the Marlin oscillator to enter negative territory. After that, a battle with the 1.3141 level awaits. So far, this is the main scenario.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.