See also

Bitcoin has faced renewed pressure, momentarily dropping below $67,000. The primary pressure on the crypto market stems from the U.S. presidential election and the candidates' chances of winning. Additionally, yesterday's news that Mt. Gox transferred over 32,000 BTC (worth $2.2 billion) to new wallet addresses in preparation for future sales also impacted the crypto market.

The current repayment plan, extended to October 31, 2025, involves substantial transfers of crypto assets, which, as we can see, influence market volatility. On Tuesday morning, Bitcoin's price dipped below $67,000 but then partially recovered. It is currently trading around $68,500, down 2% in the past 24 hours.

Regarding the Mt. Gox payout, transactions of this nature significantly increase market pressure, as initial investors will receive assets at much higher values than their initial entries before 2013, which might prompt them to sell and lock in profits. Also, remember that today is the U.S. presidential election, with Trump's odds now at 50/50, though a few days ago, he was expected to win easily.

As for intraday crypto market strategy, I will continue to rely on any significant dips in Bitcoin and Ethereum, counting on a medium-term bull market trend that remains intact.

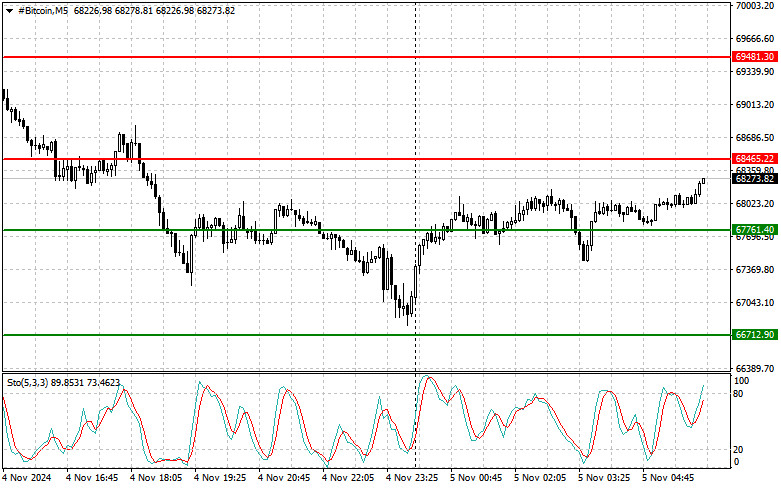

For short-term trading, the strategy and conditions are outlined below.

Buy Scenario

Today, I will buy Bitcoin upon reaching an entry point of around $68,460, with a target to rise to $69,480. Around $69,480, I will exit from buying and sell immediately on the rebound. Before buying on the breakout, ensure that the Stochastic indicator is near the lower boundary, around level 20.

Sell Scenario

Today, I will sell Bitcoin upon reaching an entry point of around $67,760, aiming for a decline to $66,700. Around $66,700, I will exit from selling and buy immediately on the rebound. Before selling on the breakout, ensure that the Stochastic indicator is near the upper boundary, around level 80.

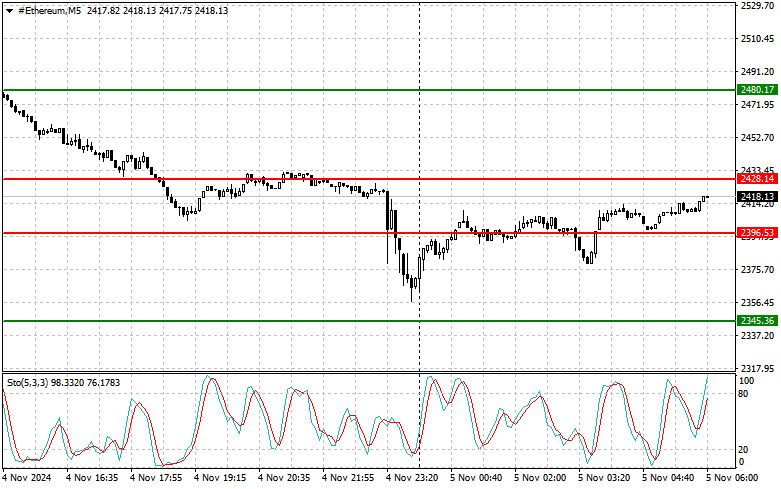

Buy Scenario

Today, I will buy Ethereum upon reaching an entry point of around $2,428, targeting a rise to $2,480. Around $2,480, I will exit from buying and sell immediately on the rebound. Before buying on the breakout, ensure that the Stochastic indicator is near the lower boundary, around level 20.

Sell Scenario

Today, I will sell Ethereum upon reaching an entry point of around $2,396, aiming for a decline to $2,345. Around $2,345, I will exit from selling and buy immediately on the rebound. Before selling on the breakout, ensure that the Stochastic indicator is near the upper boundary, around level 80.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.