See also

17.01.2025 09:14 AM

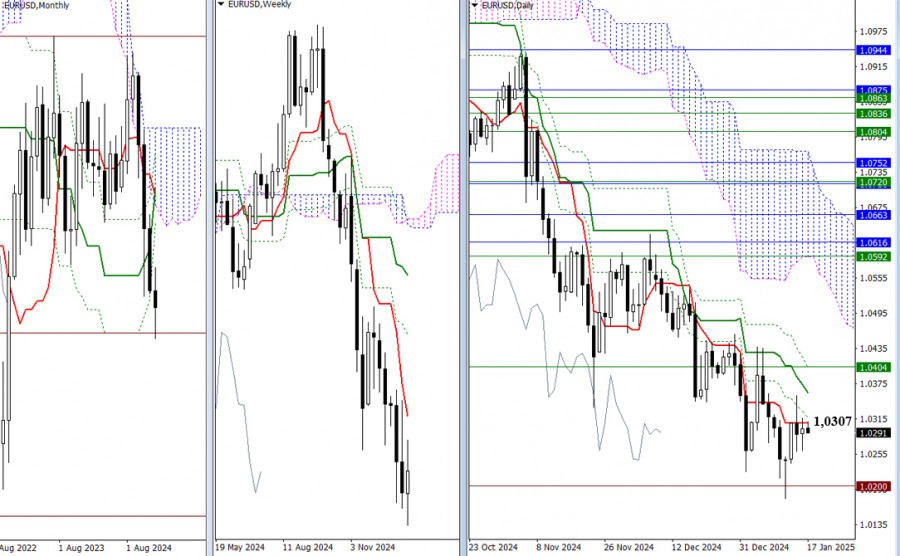

17.01.2025 09:14 AMThe past day has been marked by uncertainty and stagnation in the market. The currency pair is currently drawn to the daily short-term trend zone at 1.0308. As we approach the end of the week, it is crucial for bullish traders to ensure that the weekly candle only has a small upper wick. For the bulls to gain momentum, they need to break through the Ichimoku daily dead cross (which ranges from 1.0307 to 1.0402) and reclaim the weekly short-term trend at 1.0404. On the other hand, bearish traders are focused on breaking through the historical support level at 1.0200, which could reestablish the downtrend at 1.0179.

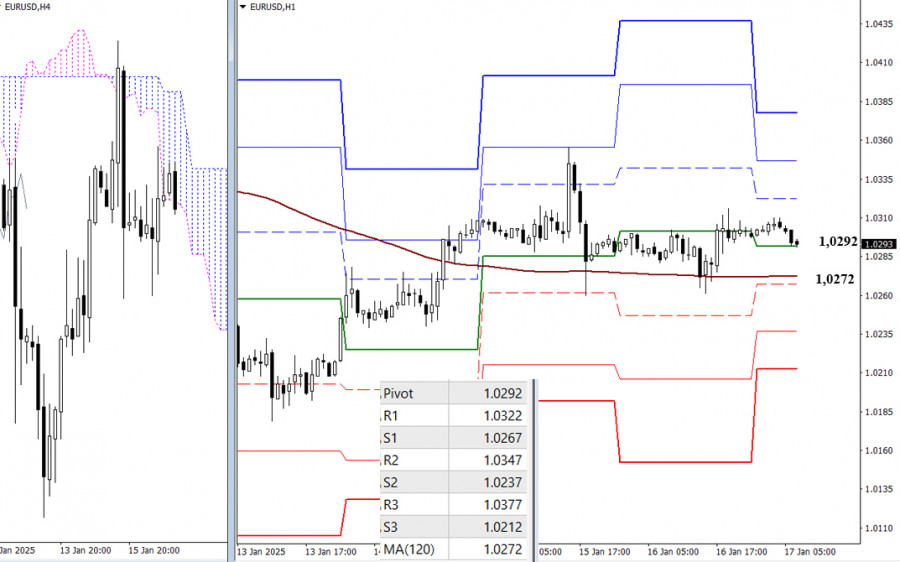

On lower timeframes, key support levels are currently being tested. Today, these levels are identified at 1.0292 (the Central Pivot Point for the day) and 1.0272 (the weekly long-term trend). As long as the price remains above these levels, it will favor the bulls and maintain their advantage. However, if the price breaks below these levels and reverses the trend, it could give the bears the upper hand and open the door to further bearish momentum. In terms of intraday movements, additional targets include resistances at 1.0322, 1.0347, and 1.0377, as well as supports at 1.0267, 1.0237, and 1.0212, based on classic Pivot Points.

***

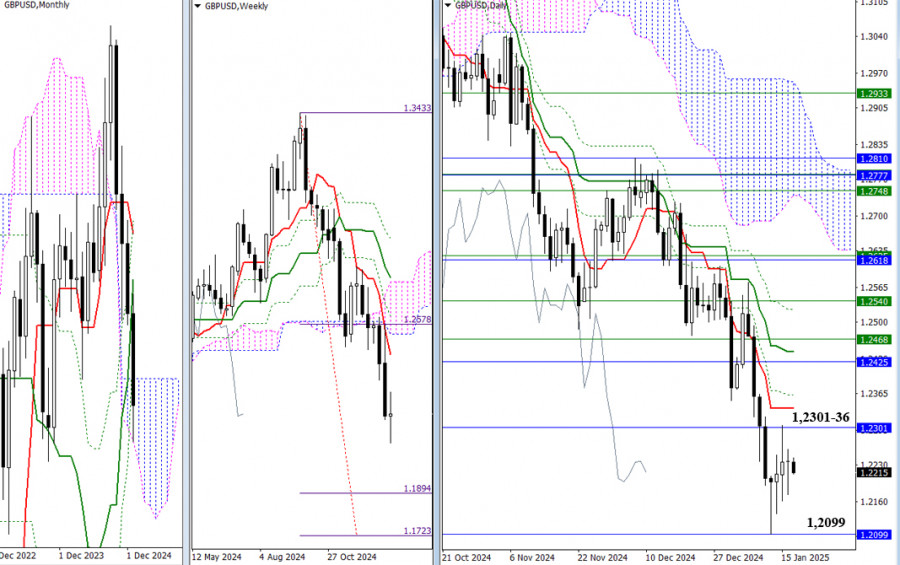

The British pound continues to show daily uncertainty. If this trend persists today, the weekly candle will also reflect indecision. The nearest targets remain unchanged under these circumstances. For bulls, the goal is to break above the monthly Ichimoku cloud at 1.2301 to enter bullish territory and to establish control over the daily short-term trend at 1.2336. For bears, the priority is to break below the lower boundary of the monthly cloud at 1.2099, securing a bearish stance relative to the cloud.

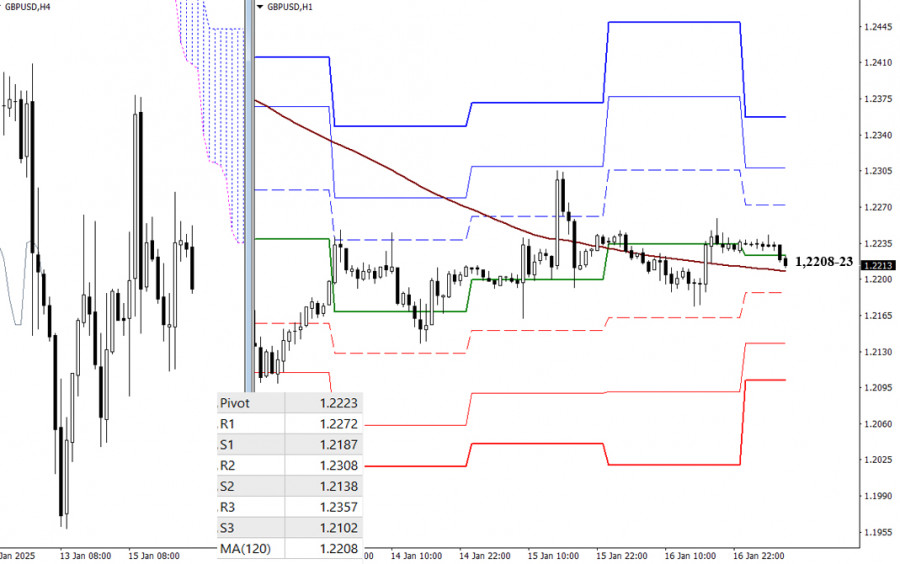

On the H4 and H1 timeframes, the pair is consolidating around the weekly long-term trend level at 1.2208 due to the uncertainty on higher timeframes. Gaining control of this trend and reversing it will provide a further directional advantage. If bulls succeed, the intraday resistance targets are 1.2272, 1.2308, and 1.2357, based on classic Pivot Points. Conversely, if bears initiate a directional movement first, their intraday support targets will be 1.2187, 1.2138, and 1.2102.

***

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

During the European session, the euro reached a new high around +2/8 Murray, located at 1.1473. This movement in EUR/USD occurred after the announcement by China's Ministry of Finance that

Early in the American session, gold is undergoing a strong technical correction after reaching a new high around 3,237.69 for now. Economic data from the United States will be released

Useful links: My other articles are available in this section InstaForex course for beginners Popular Analytics Open trading account Important: The begginers in forex trading need to be very careful

The Eagle indicator is reaching oversold levels and is giving a negative signal, so we will look for opportunities to sell below 3,145 or below 3,131 with a target

InstaTrade

video analytics

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.