See also

21.01.2025 09:25 AM

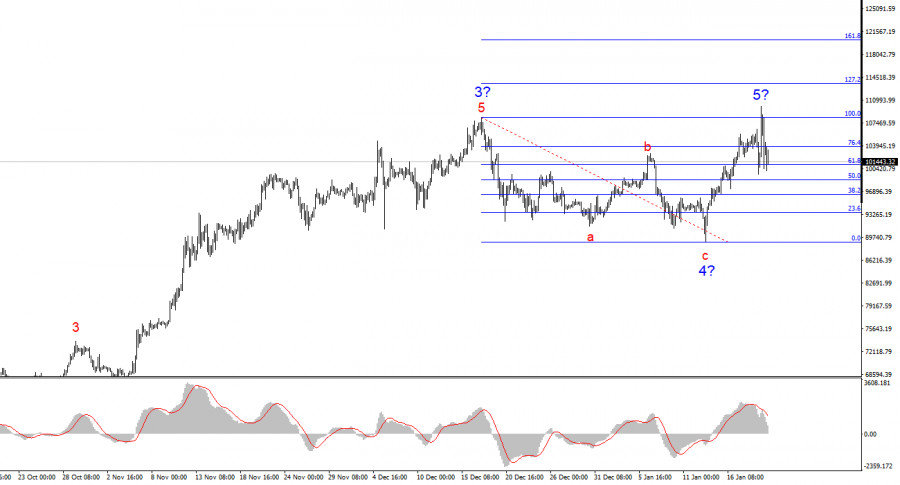

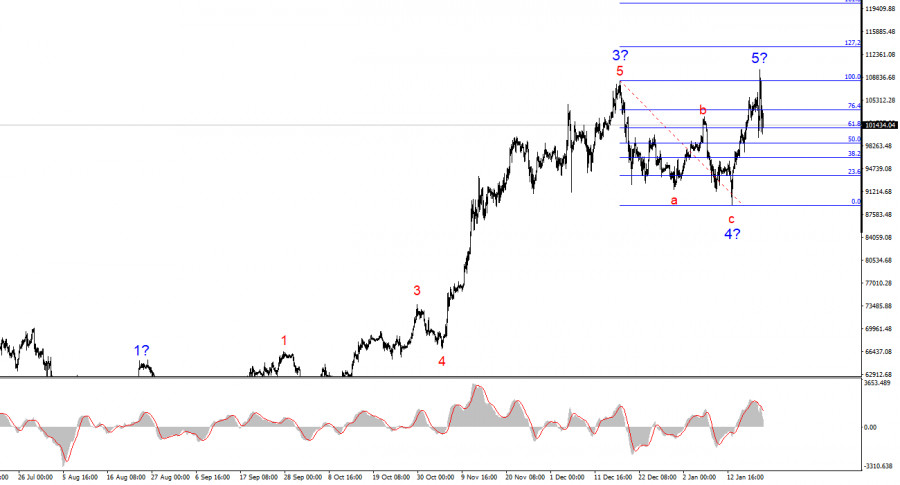

21.01.2025 09:25 AMThe 4-hour wave structure for BTC/USD is clear. Following a long and complex corrective structure a-b-c-d-e, which developed between March 14 and August 5, a new impulsive wave began to form, already showing a five-wave structure. Judging by the size of the first wave, the fifth wave could be shortened. Therefore, I do not anticipate Bitcoin to rise above $110,000–$115,000 in the coming months.

Wave 4 has formed a three-wave pattern, confirming the current wave count's validity. Since wave 5 has likely begun, buying opportunities should be sought. However, as noted earlier, this wave could end soon—or already be over. The news backdrop continues to support Bitcoin's growth due to constant reports of new investments from institutional traders, governments of certain countries, and pension funds. While some of these reports may not be accurate, demand is growing. The question is: how long will it continue?

The BTC/USD exchange rate initially dropped by $4,000 on Monday, then increased by $9,000, and subsequently decreased by $9,000. For Bitcoin, such volatility is not unusual. The inauguration of Donald Trump undoubtedly triggered yesterday's market storm. In his speech, the new U.S. president announced plans to declare a state of emergency on the Mexican border, rename the Gulf of Mexico to the "American Gulf," eliminate all non-traditional genders, reclaim control of the Panama Canal, declare an energy emergency, and end all wars worldwide. "The Golden Age of America begins today," Trump declared.

While Trump may attempt to deliver on some of these promises, his first term casts doubt on the likelihood of fulfilling them all. Many of his declarations from four years ago remained unfulfilled. Trump's ambitious plans are tempered by the reality that he is neither a unilateral leader of the U.S. nor the "ruler of the world." For markets, the key will be the specific programs Trump implements and their impact on the economy. Bitcoin and the dollar are influenced by actual economic changes or market expectations of such changes. From my perspective, there are no substantial reasons for Bitcoin to continue its ascent post-inauguration. Wave 5 appears to be shortened and complete.

Based on this analysis, I conclude that Bitcoin's growth is nearing its end. While this may not be a popular opinion, wave 5 could be shortened. Afterward, a collapse or a new complex correction is likely. Therefore, I do not recommend buying cryptocurrency at this time.

If wave 5 begins to take on an extended five-wave form, it must include a corrective wave 2. This wave could provide insights into Bitcoin's potential growth in the first half of the year, allowing for adjustments to the forecast.

On a higher wave scale, a five-wave upward structure is evident. A corrective downward structure or a bearish trend segment may soon develop.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Bitcoin and Ethereum continued their corrections, falling significantly throughout yesterday. The decline extended into today's Asian session, with Bitcoin updating its price to $104,500 and Ethereum testing $2,560. Thus

Bitcoin has shown a fairly solid rebound, climbing back above the $108,000 mark and breaking through $109,000. The chart below highlights a morning breakout through the $108,100 level. Statistics confirm

Bitcoin is starting a correction, and Ethereum is showing signs of strength. Yesterday, Bitcoin dipped to around $107,000 before rebounding sharply — a sign that many traders are cautious about

Graphical patterns

indicator.

Notices things

you never will!

InstaTrade in figures

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.