See also

06.02.2025 12:04 PM

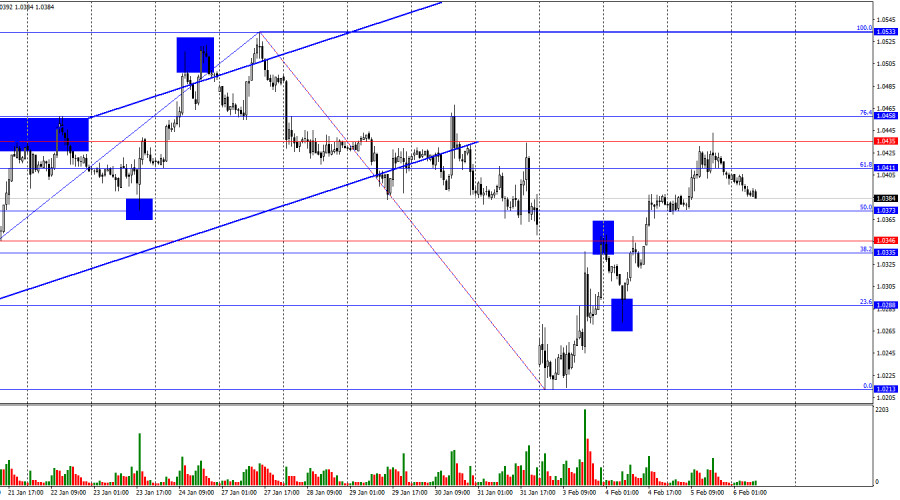

06.02.2025 12:04 PMOn Wednesday, the EUR/USD pair rose to the 1.0435 level before bouncing off and reversing in favor of the U.S. dollar. A downward move has begun towards the 50.0% and 38.2% Fibonacci retracement levels. With multiple key levels within the current range, traders should closely monitor potential rebounds and breakouts. On the 4-hour chart, the movement has been mostly sideways for the past month and a half.

Wave analysis on the hourly chart has become increasingly uncertain. The last completed upward wave broke the previous peak, while the most recent downward wave broke the lows of the two preceding waves. This suggests that the trend may be shifting to a bearish one, or we are witnessing complex horizontal movement. The inconsistent size of recent waves adds to the uncertainty.

On Wednesday, economic data had little impact on traders' sentiment despite the presence of several significant reports. Initially, the bulls maintained control, but later in the day, bears took over—possibly in anticipation of a dovish decision from the Bank of England.

Despite the large number of critical reports, they did not provide a clear direction for EUR/USD trading. Following a strong upward move, a bearish correction seems likely. However, today's Bank of England meeting is the only major scheduled event, which could influence sentiment among euro traders. Currently, neither bulls nor bears have a decisive advantage.

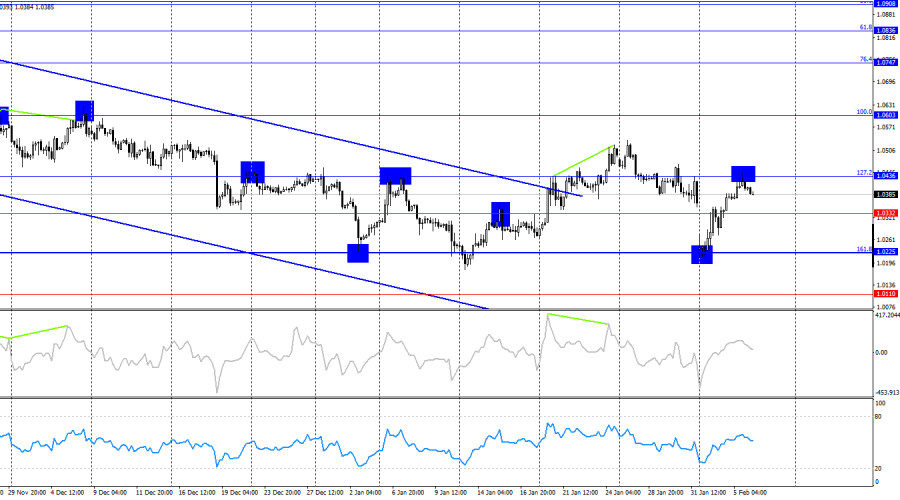

On the 4-hour chart, the pair reached the 127.2% Fibonacci retracement level at 1.0436 before pulling back. This suggests a potential reversal in favor of the U.S. dollar, with a real chance of a return to the 161.8% level at 1.0225. Bulls would need strong fundamental catalysts to break above 1.0436. No divergence signals are currently visible on any indicator.

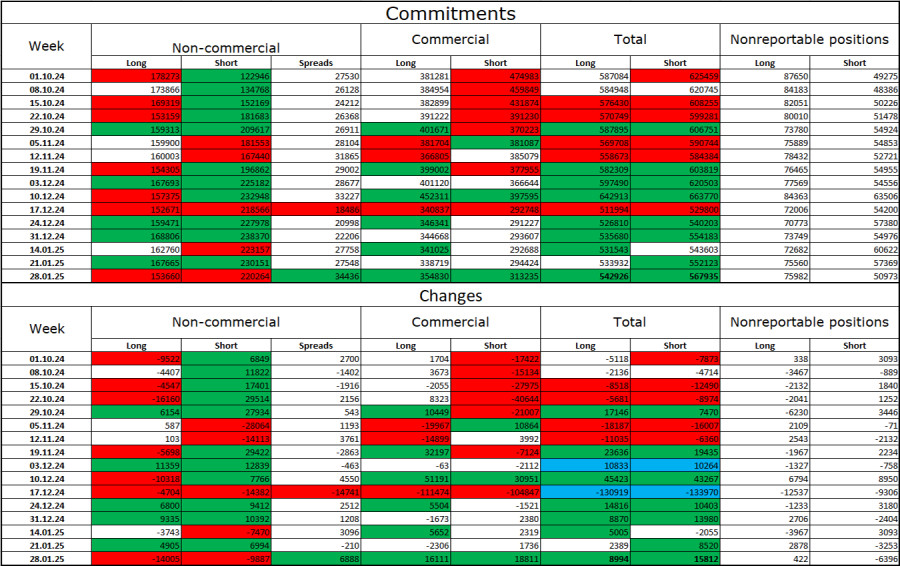

During the last reporting week, institutional traders closed 14,005 long positions and 9,887 short positions. The sentiment in the "Non-commercial" category remains bearish, indicating a continued decline in the pair. The total number of long positions held by speculators now stands at 153K, while short positions amount to 220K.

For 19 consecutive weeks, large traders have been selling the euro, confirming a sustained bearish trend. Although bulls occasionally dominate on a weekly basis, these instances are exceptions rather than a shift in overall sentiment. The primary driver of the dollar's decline—expectations of FOMC monetary policy easing—has already been priced in. The market currently lacks strong reasons to sell the U.S. dollar. If new bearish catalysts emerge, they may change this trend over time. However, for now, a continued decline in EUR/USD remains the most likely scenario.

The economic calendar for February 6 contains only two relatively minor reports. Their impact on market sentiment may be limited, but the Bank of England meeting should not be overlooked, as it could indirectly affect euro trading.

Selling opportunities: Sell on rebounds from 1.0435 and 1.0436 (on hourly and 4-hour charts), targeting the 1.0335–1.0346 zone.

Buying opportunities: Long positions were valid yesterday with targets at 1.0411 and 1.0435, which have already been met.

Fibonacci retracement levels are drawn between 1.0533–1.0213 on the hourly chart and 1.0603–1.1214 on the 4-hour chart.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Useful links: My other articles are available in this section InstaForex course for beginners Popular Analytics Open trading account Important: The begginers in forex trading need to be very careful

Early in the American session, gold is trading around 3,314 with a strong technical rebound originating after reaching the 50% Fibonacci retracement. Gold rose sharply after testing

Early in the American session, the euro is trading around 1.1331 and is experiencing a strong technical rebound after reaching the 4/8 Murray level at 1.1230. The euro could rise

Training video

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.