See also

11.03.2025 10:03 AM

11.03.2025 10:03 AMThe stock sell-off continued yesterday but slowed during Asian trading hours today, contributing to a recovery in U.S. stock index futures, Treasury yields, and cryptocurrencies.

However, market sentiment remains tense as Wall Street investors have tempered their optimism due to concerns that tariffs and government spending cuts could hinder the growth of the world's largest economy. S&P 500 futures rose by 0.3% after losing more than 1% at the start of Asian trading. Futures contracts on the Nasdaq 100 and European stocks also experienced slight recoveries.

Asian stocks fell to a five-week low on Tuesday after the Nasdaq 100 experienced its worst day since 2022. Stock indices in Hong Kong and China also trimmed their losses. The yield on 2-year U.S. Treasury bonds rebounded after hitting its lowest level since October.

Two months into Donald Trump's presidency, global market sentiment has turned pessimistic as investors increasingly worry about U.S. economic growth due to the trade war, spending cuts, and shifts in long-standing geopolitical relationships. Some investors see this shift in sentiment as a buying opportunity, particularly in Hong Kong and China, where expectations are rising that the government will introduce economic stimulus measures.

Despite the risk-off sentiment, investors from mainland China made unprecedented stock purchases yesterday, continuing to increase their holdings amid a rally driven by developments in China's AI sector, sparked by the startup DeepSeek.

Meanwhile, strategists at Citigroup Inc. downgraded U.S. stocks to "neutral" from "overweight" while upgrading China to "overweight," stating that the U.S.'s market dominance is currently on pause. Citi raised China's rating to "overweight" because the country remains attractive after the recent rally.

Earlier, HSBC strategists upgraded European stocks (excluding the UK) from "underweight" to "overweight," as they expect fiscal stimulus in the Eurozone to be a potential game-changer.

As mentioned earlier, the S&P 500 fell 2.7% at the close of regular trading, and the Nasdaq 100 lost 3.8%. At one point, indices were down more than 5%. In the mega-cap sector, Tesla Inc. plunged 15%, while Nvidia Corp. lost around 7%.

Most G10 currencies strengthened against the dollar on Tuesday, with only the Australian and New Zealand dollars declining during the Asian session. Traditional safe-haven currencies, such as the Swiss franc and Japanese yen, performed particularly well. The euro continues to attract buyers due to an improving growth outlook.

In commodities, oil prices are declining for the second consecutive day. This follows a drop in stock markets and other risk assets, fueled by fears that tariffs and other measures will slow the growth of the world's largest economy. Gold experienced a slight increase, while cryptocurrencies reached new yearly lows in the wake of the U.S. stock sell-off.

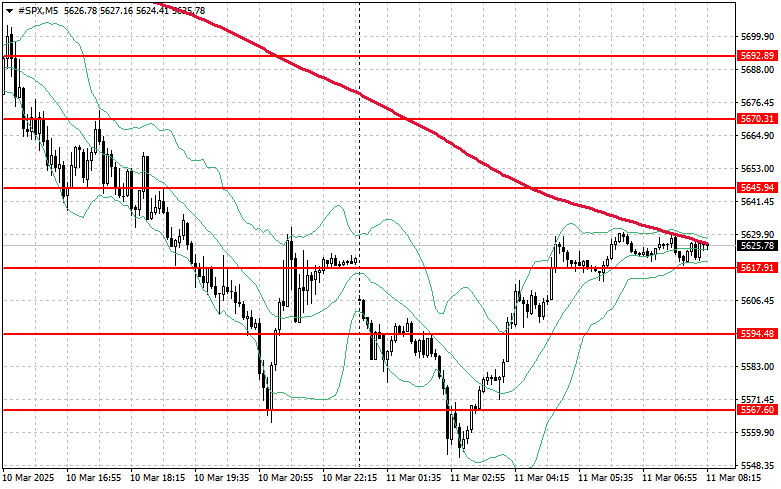

Regarding the technical outlook for the S&P 500, the decline is ongoing. Buyers' primary goal today is to break through the nearest resistance level at $5,645. Successfully doing so would help sustain growth and pave the way for a rise to the next level of $5,670. Equally important for buyers is maintaining control at the $5,692 level, which would strengthen their position. If the market declines amid reduced risk appetite, buyers must hold the $5,617 level. A breakdown below this level could quickly push the index down to $5,594 and potentially open the path to $5,567.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Global markets are once again in turmoil: the escalation of the trade war between the US and China has slammed stock markets, gold is breaking records, Meta is mired

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.