See also

11.03.2025 10:00 AM

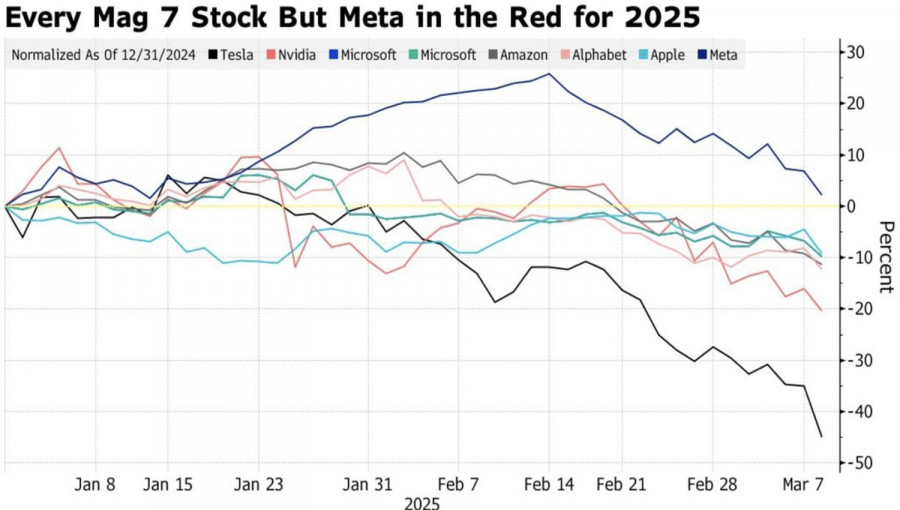

11.03.2025 10:00 AMThe S&P 500 sell-off accelerated amid the White House's indifference to a potential economic downturn. The broad stock index tumbled as Donald Trump refused to rule out a U.S. recession, leading to a decline driven by tech stocks. The NASDAQ 100 suffered its worst trading day since 2022, while the Magnificent Seven has already fallen 20% from its December peaks.

Donald Trump stated that the U.S. economy is in a transition period and that investors should not focus on the stock market. This starkly contradicts the expectations investors had following the presidential election. The Republican had promised that the U.S. would be fine, as higher tariffs would offset tax cuts. However, in early spring, the White House dramatically changed its stance, now arguing that the path to future prosperity and a new "Golden Age" requires some short-term sacrifices.

Saying that the stock market is not worth watching could be considered a betrayal. During his first presidential term, Trump used stock market performance as a benchmark of his administration's success. Investors now understand why—back then, the S&P 500 was rising, which pleased the Republican leader. Now that the index is falling, it is no longer a valid measure? Repeating his past rhetoric would mean admitting failure.

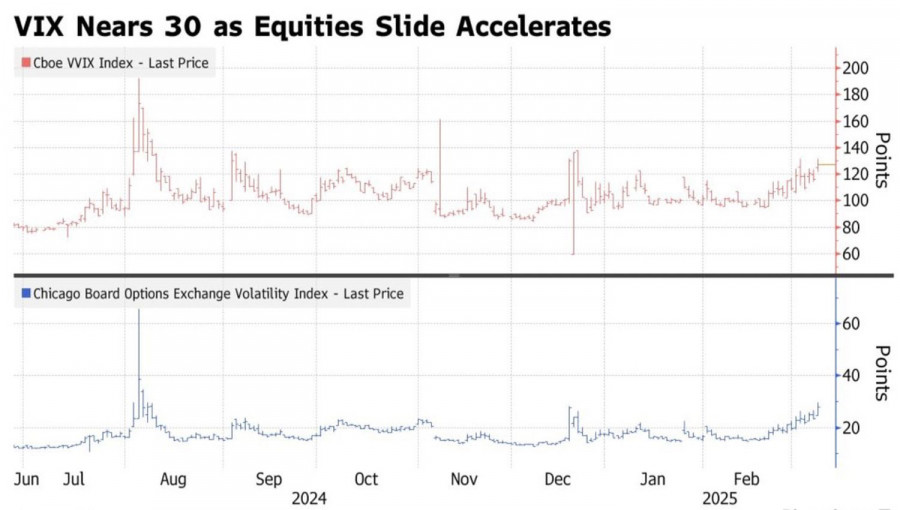

The market is increasingly fearful that tariffs could devastate the U.S. economy, leading to the first surge in the volatility index (VIX) since August. The VIX is now above 30. According to Nomura Securities, the gradual rise in the "fear index," rather than a sharp spike as seen in past market corrections, signals an increasing likelihood of further stock market declines. JP Morgan has abandoned its S&P 500 target of 6,500, which was approximately 13% above current levels, arguing that greater uncertainty creates a wider range of possible market outcomes.

Both Citigroup and HSBC Holdings have advised clients to reduce their exposure to U.S. stocks and seek opportunities elsewhere, particularly in China and Europe. Unlike the United States, these regions are pursuing fiscal stimulus measures to mitigate the effects of ongoing or potential trade wars with the U.S.

Meanwhile, recession risks in the U.S. are soaring.

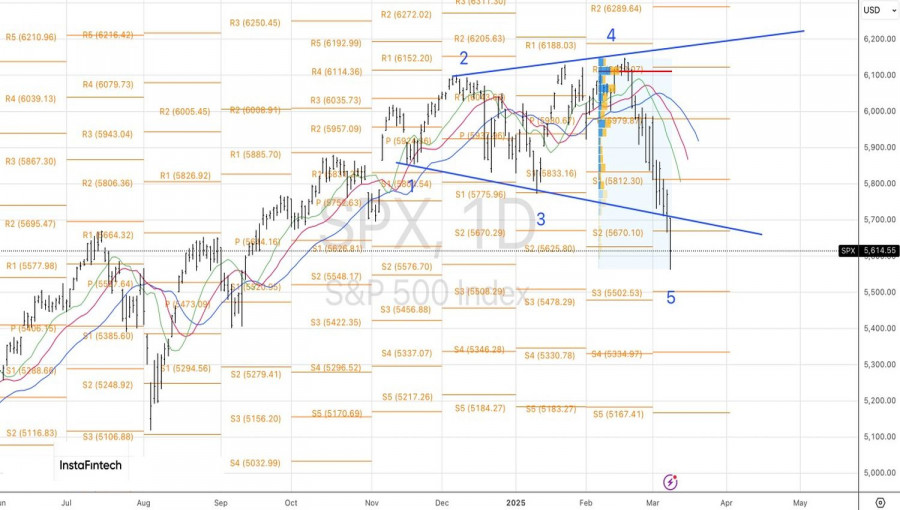

The daily chart of the S&P 500 indicates that the market remains in a correction within a broader uptrend. The index's distance from its EMA suggests growing bearish momentum. Traders should continue following the previously outlined short-selling strategy, at least as long as the index remains below 5,800. Pullbacks that fail at the 5,670 and 5,750 resistance levels could provide new short-selling opportunities.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

No macroeconomic events are scheduled for Monday—not in the U.S., the Eurozone, Germany, or the U.K. Therefore, even if the market was paying attention to the macroeconomic backdrop, today, there

On Friday, the EUR/USD currency pair made no notable movements whatsoever. This was unsurprising, as Friday marked Good Friday, and Sunday was Easter. Many banks and trading venues were closed

Today is Good Friday, a day Christians observe worldwide across all denominations. Market activity has noticeably decreased ahead of the Easter holiday, but this isn't the main reason for market

InstaFutures

Make money with a new promising instrument!

InstaFutures

Make money with a new promising instrument!

E-mail/SMS

notifications

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.