See also

Bitcoin and Ethereum are currently consolidating within channels, creating conditions that may lead to further declines. While many experts agree that the lows have already been reached and an unstoppable rally is on the horizon, I remain skeptical. I believe that we are not entirely safe from another major sell-off.

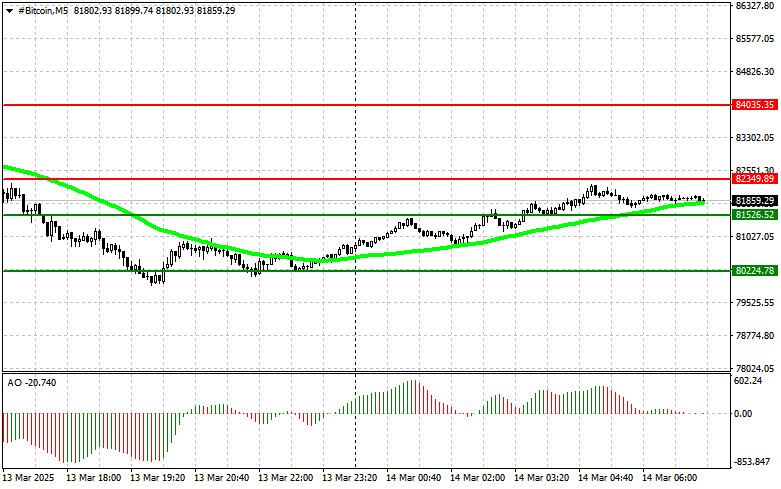

Bitcoin, after hitting a low of around $80,200, is now trading at approximately $82,400. Ethereum also experienced a drop to around $1,821 but was quickly bought back, resulting in a recovery to $1,897.

Regarding whether the bottom has truly been reached, the updated trends in global M2 liquidity and BTC prices suggest that a return to a bull market is quite possible in the near future. In early March, many analysts indicated that the local bottom of the cryptocurrency market might have already passed, and that demand for risk assets could soon resurface, potentially driving Bitcoin and other altcoins higher.

This optimistic outlook is supported by several key factors. Firstly, there is a consistent increase in global M2 liquidity, which indicates an influx of new money into the economy. Historically, periods of M2 growth have often preceded or coincided with asset market rallies, including in cryptocurrencies. Secondly, the strong correlation between M2 liquidity and BTC prices remains significant. When liquidity rises, investors typically seek riskier assets like Bitcoin, which drives its price upwards. Conversely, a decline in liquidity usually leads to decreases in BTC prices.

As for the intraday trading strategy, I will focus on significant dips in Bitcoin and Ethereum, anticipating continuing the bullish trend in the medium term.

For short-term trading, the strategy and conditions are outlined below.

Scenario #1: I plan to buy Bitcoin today if the entry point reaches around $82,400, aiming for a rise to $84,000. Around $84,000, I will exit my buy positions and immediately sell on a rebound. Before buying on a breakout, ensuring that the 50-day moving average is below the current price and that the Awesome Indicator is in positive territory is essential.

Scenario #2: Buying Bitcoin is also possible from the lower boundary at $81,500 if there is no market reaction to its breakout in the opposite direction, with targets at $82,400 and $84,000.

Scenario #1: I plan to sell Bitcoin today if the entry point reaches around $81,500, targeting a decline to $80,200. Around $80,200, I will exit my sell positions and immediately buy on a rebound. Before selling on a breakout, ensuring that the 50-day moving average is above the current price and that the Awesome Indicator is in negative territory is essential.

Scenario #2: Selling Bitcoin is also possible from the upper boundary at $82,400 if there is no market reaction to its breakout in the opposite direction, with targets at $81,500 and $80,200.

Scenario #1: I plan to buy Ethereum today if the entry point reaches around $1,897, aiming for a rise to $1,928. Around $1,928, I will exit my buy positions and immediately sell on a rebound. Before buying on a breakout, ensuring that the 50-day moving average is below the current price and that the Awesome Indicator is in positive territory is essential.

Scenario #2: Buying Ethereum is also possible from the lower boundary at $1,880 if there is no market reaction to its breakout in the opposite direction, with targets at $1,897 and $1,928.

Scenario #1: I plan to sell Ethereum today if the entry point reaches around $1,880, targeting a decline to $1,842. Around $1,842, I will exit my sell positions and immediately buy on a rebound. Before selling on a breakout, ensuring that the 50-day moving average is above the current price and that the Awesome Indicator is in negative territory is essential.

Scenario #2: Selling Ethereum is also possible from the upper boundary at $1,897 if there is no market reaction to its breakout in the opposite direction, with targets at $1,880 and $1,842.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Forex Chart

Web-version

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.