See also

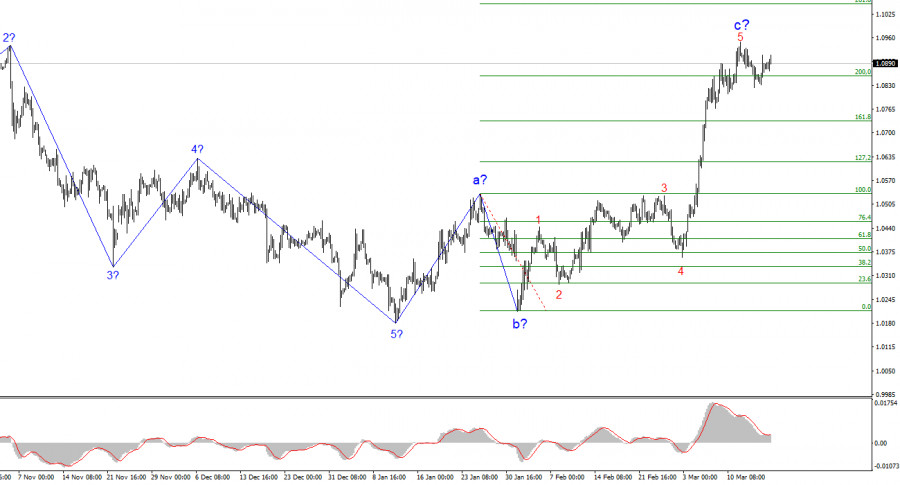

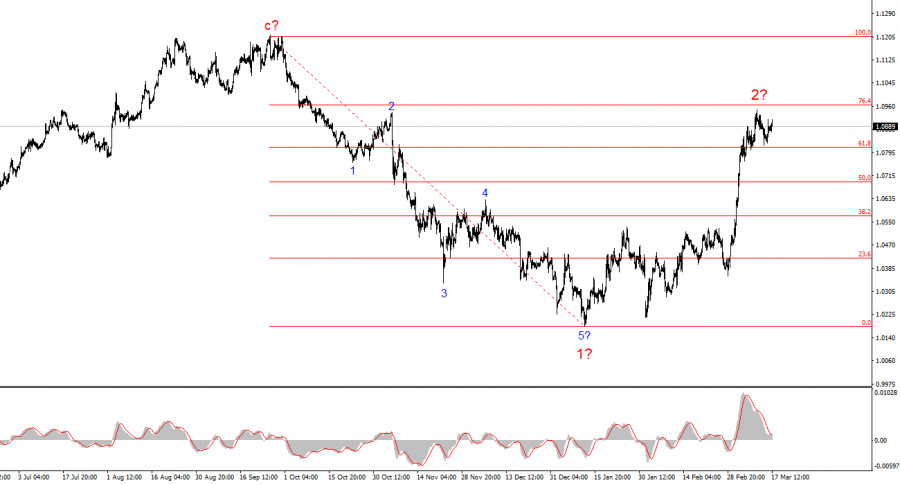

The 4-hour wave analysis for EUR/USD is at risk of transforming into a more complex structure. A new downward trend began on September 25, taking the form of a five-wave impulse structure. Two months ago, a bullish corrective phase started, which should consist of at least three waves. The first wave's structure was well-formed, leading me to expect the second wave to take a clear shape as well. However, its size has now grown so significantly that it threatens to alter the overall wave count.

From a fundamental perspective, economic data continues to favor sellers over buyers. Recent U.S. reports indicate that the economy is stable and does not show signs of significant slowdown that would cause concern. However, the situation in the U.S. economy could change drastically in 2025 due to Donald Trump's policies. The Federal Reserve may cut interest rates multiple times, while tariffs and retaliatory measures could harm economic growth.

Had it not been for recent developments, I would have expected a 90% probability of further euro depreciation. However, the situation remains uncertain.

The EUR/USD pair remained unchanged on Monday. The market appears to be focused on upcoming events that could significantly impact both the dollar and the euro.

A full-scale trade war between the European Union and the United States could begin at any moment, marking Trump's third official trade war. The first tariffs were imposed on Chinese imports, followed by Canadian imports. This is in addition to the global tariffs on steel and aluminum. However, Brussels has made it clear that it will not tolerate such broad sanctions. The EU immediately responded with €26 billion in tariffs on U.S. goods. Trump has promised to retaliate, and we now await further developments.

Luis de Guindos, Vice President of the ECB, stated yesterday that economic uncertainty is now even higher than during COVID. He noted that the new U.S. administration is uninterested in maintaining productive cooperation between different jurisdictions. According to de Guindos, Trump and his administration refuse to listen to their counterparts or consider the interests of other countries. This represents a major shift in global politics, which will inevitably lead to changes in the global economy and international order.

From my perspective, Trump's decisions are currently harming only the U.S. stock market and the U.S. dollar.

Based on my EUR/USD analysis, I conclude that the instrument remains in a downward trend, though it could shift to an uptrend in the near future. The second wave may already be complete, but any further rise in prices could transform the entire wave structure.

Since the wave structure is currently ambiguous, I cannot recommend selling EUR/USD with confidence. However, if the current wave count remains valid, these levels are highly attractive for selling.

Trump's policies could further weaken demand for the U.S. dollar, making the formation of a third bearish wave impossible.

On higher timeframes, the wave structure has turned impulsive, suggesting a new long-term bearish wave cycle. However, Trump's policy actions could disrupt this pattern entirely.

Key Principles of My Analysis:

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

E-mail/SMS

notifications

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.