See also

24.03.2025 10:23 AM

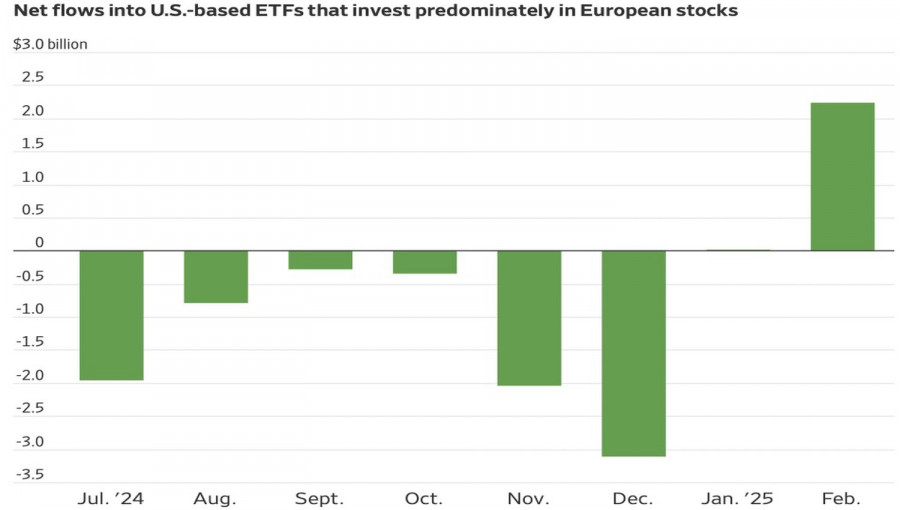

24.03.2025 10:23 AMWhat drives the markets? Fear? Greed? At the moment, disappointment is far more significant. Investors are realizing that Donald Trump's tariff policy will not lead to anything good, and the loss of American exceptionalism is triggering capital outflows from the U.S., keeping the S&P 500 under pressure. According to Morningstar, investors added about $2 billion on a net basis to American funds investing in European stocks in January and February.

Capital flow trends into Europe-focused ETFs

The continued rise of stock indices in Europe suggests that markets do not believe White House tariffs will trigger a recession across the Atlantic. Perhaps the risks of a trade war are being underestimated. The upcoming new round of import tariffs, which the U.S. administration is expected to announce on April 2, seemed to knock the S&P 500 to the floor. However, rumors of a more limited scope of protectionism allowed the broad equity index to rise from the ashes.

According to Bloomberg insiders, tariffs in April will target two groups of countries: those with significant trade surpluses with the U.S. and those whose tariffs against the U.S. are deemed too high. The blacklist, or as Scott Bessent puts it, the "Dirty 15" list, includes Australia, Brazil, Canada, China, the EU, India, Japan, South Korea, Mexico, and others.

The fewer the tariffs, the less the disappointment. Donald Trump promised to accelerate the U.S. economy, yet Wall Street Journal experts are now downgrading their U.S. GDP forecasts from over 2% to 1–1.5% for 2025. The same goes for the OECD, Fitch Ratings, and the Federal Reserve. The Republican's policy is aimed at creating problems for other countries, but in reality, thanks to fiscal stimulus, Europe is gaining momentum, and China intends to meet its ambitious 5% growth target in 2025.

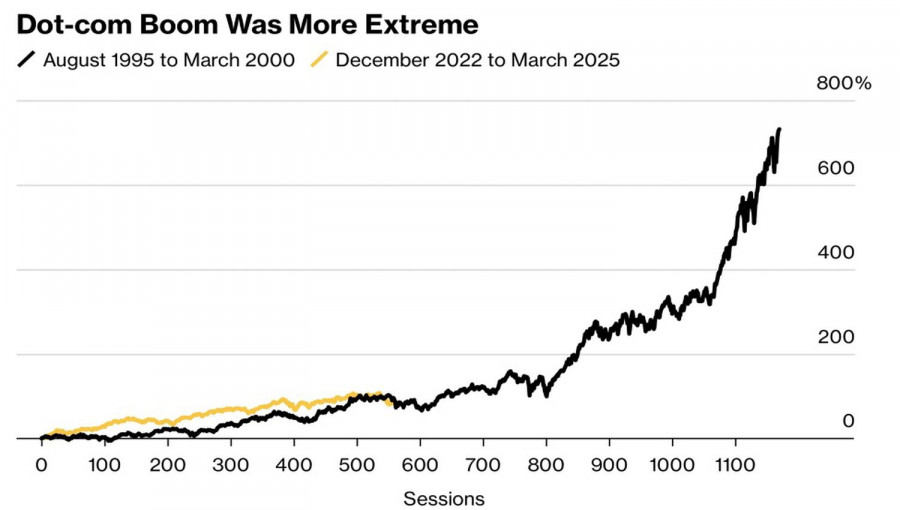

Adding to the disappointment is the loss of American exceptionalism. Investors increasingly recall that U.S.-issued securities are fundamentally overpriced and that a bubble has formed in the market—similar to the dot-com bubble at the turn of the 21st century. Twenty-five years ago, the S&P 500 rally was also driven by technology, specifically the internet. Now, that role has been taken over by artificial intelligence.

S&P 500 performance in different years

A quarter-century ago, the broad equity index collapsed. It only returned to record highs in 2007. Today, the S&P 500 has risen 72% from its October 2022 low to record highs. Then came a 10% drop, and few expect the stock market to recover before the second half of 2025.

Technically, forming a candlestick with a long lower shadow on the S&P 500 daily chart signals that the bulls may be ready to counterattack. The 5670 level remains the red line. Above this level, buying becomes a sensible strategy. Conversely, if it falls below, selling is the appropriate action.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

There are relatively few macroeconomic events scheduled for Thursday, but that no longer matters much. Yesterday, there were plenty of important publications from the Eurozone, Germany, and the U.S. Even

InstaFutures

Make money with a new promising instrument!

InstaFutures

Make money with a new promising instrument!

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.