See also

27.03.2025 11:55 AM

27.03.2025 11:55 AMGold was not a market favorite following Donald Trump's victory in the November elections. In fact, it pulled back once the red wave became clear and the Republican's return to the White House appeared imminent. Many investors believed that deregulation and tax cuts were a direct path to a stronger U.S. dollar and a rally in Treasury yields. However, by spring it became clear that the 47th president of the United States is a dangerous man doing dangerous things. All the better for the precious metal, which typically rises in anticipation of disruptive events in financial markets.

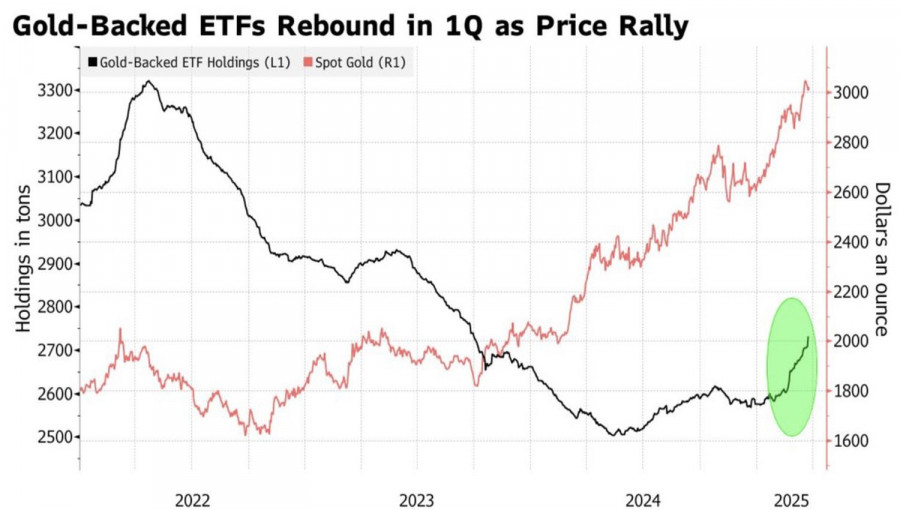

And the disruptions didn't take long to arrive. Trump's announcement of a 25% tariff on foreign cars dealt another blow to the S&P 500 and reignited demand for XAU/USD. Goldman Sachs immediately raised its gold forecast from $3,100 to $3,300 by the end of 2025, citing strong capital inflows into ETFs and insatiable demand from central banks. In response to the West freezing Russia's gold and foreign currency reserves, central banks have increased their gold purchases fivefold since 2022. Holdings in specialized exchange-traded funds (ETFs) have grown by 154 tonnes since the beginning of the year.

Gold and ETF Holdings Dynamics

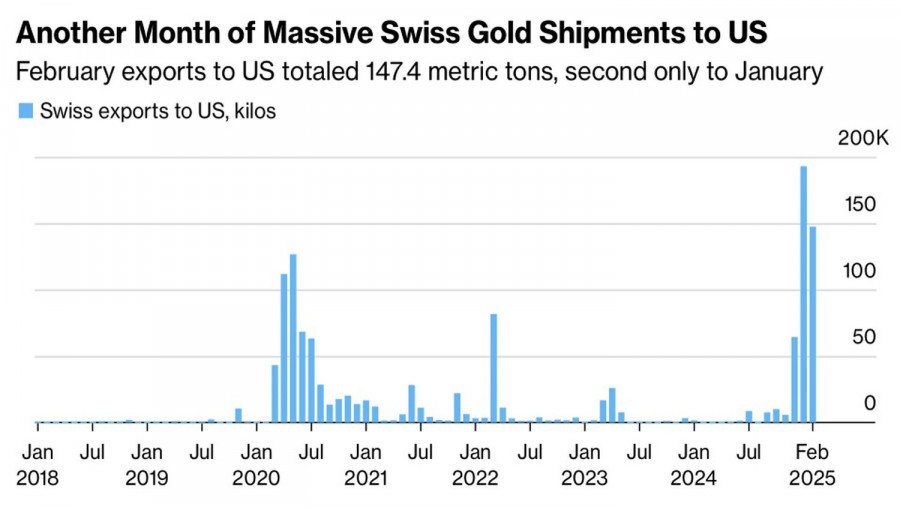

In truth, gold simply knows the system very well. Its flow from Europe to the U.S. on the back of tariff expectations from the White House triggered a record U.S. trade deficit in January of $155.6 billion. And the situation didn't improve in February. According to Santander US Capital Markets, the negative trade balance is projected to reach $162 billion. Gold exports from Switzerland—a key transit point between the Old and New Worlds—reached 147.4 tonnes in February, the second-highest monthly volume on record after January's 193-tonne peak.

As a result, net U.S. exports are falling deep into negative territory, which is contributing to a sharp economic slowdown. Early estimates from the Atlanta Fed's GDPNow indicator suggested a 2.8% contraction in GDP for Q1. These have since been revised to just +0.2%, a stark contrast to the 3% economic expansion seen throughout most of 2024. That's bad news for markets—but good news for gold.

Switzerland's Gold Exports to the U.S.

The closer the U.S. gets to recession, the more reasons there are to buy XAU/USD. The worse the global economy performs due to the White House's protectionist policies, the better gold tends to do. In this regard, the return of Donald Trump—a dangerous man doing dangerous things—to power creates a strong tailwind for the precious metal. Who knows, perhaps gold will aim for $4,000 per ounce, as forecast by Societe Generale.

Technically, on the daily chart, gold is showing a recovery of its uptrend following a minor pullback. A breakout above resistance at the pivot level of $3,045 per ounce would justify opening long positions. Targets for these positions lie at $3,105 and $3,135.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Today is Good Friday, a day Christians observe worldwide across all denominations. Market activity has noticeably decreased ahead of the Easter holiday, but this isn't the main reason for market

There are no macroeconomic events scheduled for Friday—not in the US, the Eurozone, Germany, or the UK. Therefore, even if the market were paying any attention to the macroeconomic backdrop

The GBP/USD currency pair continued to trade relatively calmly on Thursday, showing only a minimal downward bias. We still can't classify the current movement as a "pullback" or "correction."

The EUR/USD currency pair spent most of the day moving sideways. When the European Central Bank meeting results were released, the market saw a small emotional reaction, but nothing fundamentally

Ferrari F8 TRIBUTO

from InstaTrade

InstaTrade

video analytics

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.