See also

09.04.2025 06:47 AM

09.04.2025 06:47 AMOn Tuesday, the GBP/USD pair traded with a slight upward bias. There were no major news events throughout the day, and only in the evening did news emerge about increased tariffs on China, which triggered a renewed rise in the pair. After a 500-pip drop in the pound, assuming the uptrend is over would be premature. Trump can easily "fix" this issue. At this point, we're almost afraid to imagine how far Trump might go—but watching the situation unfold is becoming fascinating. Whereas many once aspired to get to the U.S. and be part of its economy, more and more people are now trying to stay away. A recession is forecasted for the U.S.; in our view, that might not even be the worst outcome. Trump has gone all-in, showing no concern for the economic consequences, while taking joy in victories at the golf club. In short, the dollar's decline continues, and the trade war keeps escalating.

On the 5-minute chart, at least three solid signals were formed on Tuesday. The price bounced twice from the 1.2791–1.2798 zone and once from the 1.2723 level. In two out of three cases, the target level was reached. The third trade likely closed at breakeven via a Stop Loss. Thus, even on relatively modest intraday movements, one could have earned around 70–80 pips on Tuesday.

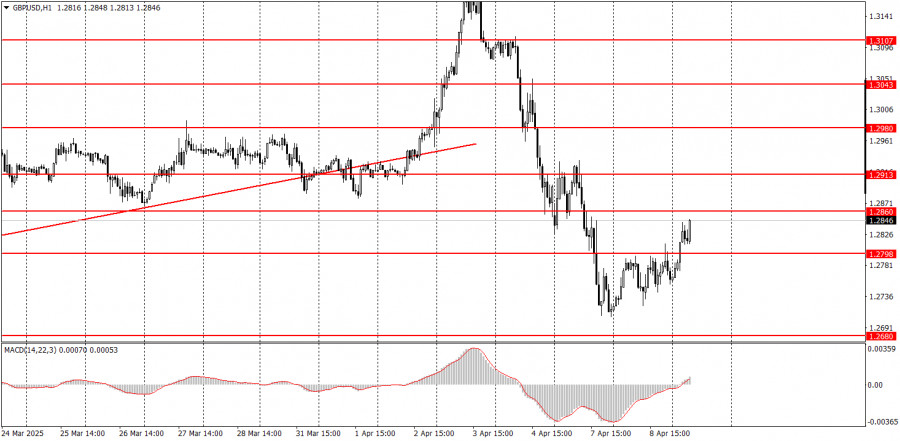

On the hourly chart, GBP/USD should have started a downtrend long ago, but Trump continues to do everything to bring the dollar down. Since the official start of the global trade war, we no longer attempt to predict long-term movements. On Friday, we witnessed a sharp decline in the pair that could be the beginning of a substantial correction. However, the market remains under Trump's control and decisions. Once Trump announces new tariffs, the dollar falls again. And who still believes this will be the last escalation?

On Wednesday, GBP/USD may remain volatile and stormy. Predicting where the pound and dollar will go today is nearly impossible. For now, the pair is rising fairly logically, and this upward move is likely to continue throughout the day.

On the 5-minute chart, you can trade using the following levels: 1.2502–1.2508, 1.2547, 1.2613, 1.2680–1.2685, 1.2723, 1.2791–1.2798, 1.2848–1.2860, 1.2913, 1.2980–1.2993, 1.3043, 1.3102–1.3107, 1.3145–1.3167, 1.3225, 1.3272.

There are no scheduled significant events in the UK or U.S. on Wednesday, but rest assured—significant developments will likely surface during the day. Volatility is expected to remain high, and the U.S. dollar has a strong chance of registering another decline.

Support and Resistance Levels: These are target levels for opening or closing positions and can also serve as points for placing Take Profit orders.

Red Lines: Channels or trendlines indicating the current trend and the preferred direction for trading.

MACD Indicator (14,22,3): A histogram and signal line used as a supplementary source of trading signals.

Important Events and Reports: Found in the economic calendar, these can heavily influence price movements. Exercise caution or exit the market during their release to avoid sharp reversals.

Forex trading beginners should remember that not every trade will be profitable. Developing a clear strategy and practicing proper money management are essential for long-term trading success.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

On Monday, the GBP/USD currency pair predictably failed to continue its downward movement. Recall that earlier, the price again formed a signal for a trend reversal to bearish—a consolidation below

The EUR/USD currency pair traded mixed throughout Monday. Despite breaking through the trendline, the downward movement (i.e., strengthening the US dollar) never actually began. Thus, technical signals still hold little

Analysis of Friday's Trades 1H Chart of GBP/USD The GBP/USD pair also traded lower on Friday for the same reasons as the EUR/USD pair. The dollar received minimal market support

Analysis of Friday's Trades 1H Chart of EUR/USD The EUR/USD currency pair traded lower on Friday, and there were objective reasons for this. However, it's important to note that

On Friday, the EUR/USD currency pair continued its relatively mild decline and ended the day near the familiar ascending trendline. Recall that about 10 days ago, this line was broken

In my morning forecast, I highlighted the 1.1407 level and planned to make market entry decisions based on it. Let's look at the 5-minute chart and see what happened. There

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.