See also

14.04.2025 12:59 AM

14.04.2025 12:59 AMThere will be a few significant events in the upcoming week. Of course, reports such as industrial production, retail sales, and new home sales should be noted. At first glance, they do not appear to be able to change market sentiment. While the European Central Bank meeting and UK inflation data at least have some potential to influence the market, the US data do not appear to carry such weight.

As a result, everything will come down to Donald Trump's decisions. The president may take a break, as endlessly imposing tariffs isn't feasible — it simply makes no sense. All countries have been granted a 90-day grace period, so we will likely not see new tariffs against them. China has so far stopped tariffs at 125% and has not yet responded to Trump's most recent increase to 145%. Therefore, a pause is also possible here. If the pause lasts at least a week, the US dollar may get a chance to recover slightly.

Unfortunately, we are talking about Trump, meaning making forecasts is essentially pointless. The current wave markings for both instruments suggest a new prolonged uptrend. However, if Trump pauses, it will be extremely difficult for the euro and the pound to continue rising. New tariffs have triggered every drop in the dollar in recent months. As I've said, wave analysis cannot be a primary reference point in forecasting under current conditions.

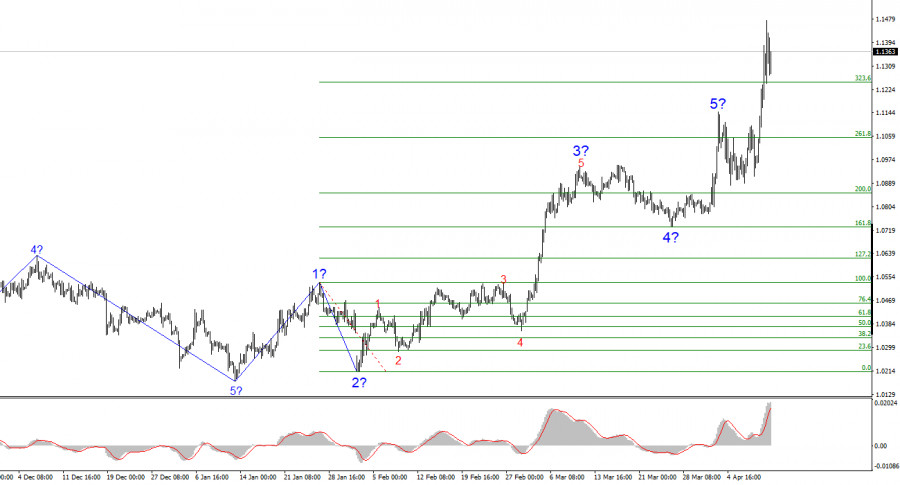

Based on the analysis of EUR/USD, I conclude that the instrument is continuing to form a new upward trend segment. Donald Trump's actions have reversed the previous downward trend. As a result, the upcoming wave structure will entirely depend on the US president's stance and actions — something that must always be kept in mind.

From a purely wave-based perspective, a corrective wave structure is likely forming, typically consisting of three waves. However, wave 2 may already be complete. If this assumption is correct, wave 3 of the upward trend may have already begun — with potential targets reaching as high as the 1.25 area.

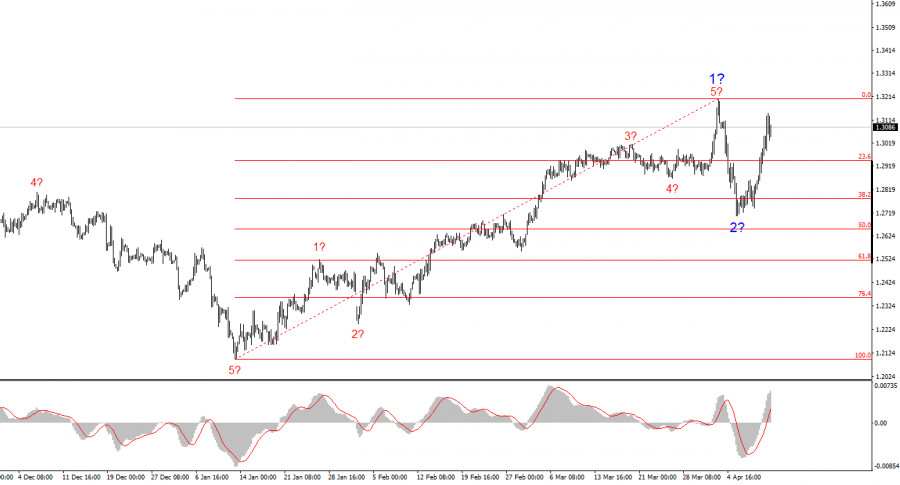

The wave structure of the GBP/USD instrument has transformed. We are now dealing with an upward impulsive trend segment. Unfortunately, under Trump, markets may face numerous shocks and reversals that do not align with wave patterns or technical analysis. Therefore, at the moment, a corrective wave structure should be expected, the size of which will also depend on Trump. Afterward, the formation of wave 3 of the uptrend could follow — but only if Trump's trade policy doesn't make a complete U-turn, which currently seems unlikely.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.