Voir aussi

11.10.2023 03:00 PM

11.10.2023 03:00 PMAfter a 5-day strengthening streak, the EUR/USD pair has slowed its ascent today, trading near the 1.0600 level as of writing.

Market participants prefer not to engage in significant trading activities and exercise caution in the lead-up to important publications. Additionally, on Thursday (at 11:30 GMT), the ECB will release a report containing information about the September meeting of the Bank's Governing Council.

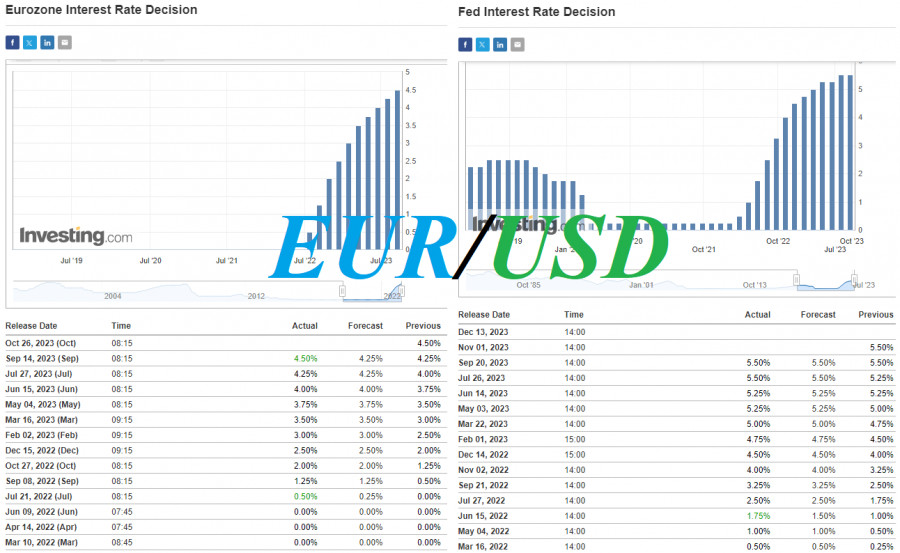

This document also provides an overview of the current ECB policy with planned changes in the financial and monetary spheres. As known, following the September meeting, the European Central Bank announced a 25-basis-point increase in key rates, bringing them to 4.50% for main refinancing operations and 4.75% for the marginal lending facility. The accompanying statement from the meeting mentioned that the "Governing Council considers that the key ECB interest rates have reached levels that, maintained for a sufficiently long duration, will make a substantial contribution to the timely return of inflation to the target."

Investors will closely examine the minutes from this ECB meeting to catch additional signals regarding future monetary policy.

Moreover, yesterday, the International Monetary Fund downgraded its economic growth forecasts for the Eurozone. This year, it could be 0.7% (down from the previous expectation of 0.9%), and next year, 1.2% (versus the previous forecast of 1.5%), with the possibility of a recession.

However, from the perspective of ECB officials, there have been quite hawkish statements regarding the prospects of further tightening monetary policy. For instance, the head of the Bank of France, Francois Villeroy de Galhau, recently noted that inflation in the Eurozone needs to decrease to the target level of 2.0%. Also, a member of the ECB's Governing Council, Klaas Knot, stated on Wednesday that "inflation is still too high," and the bank is "prepared for further rate adjustments if disinflation persists."

Therefore, the dynamics of the EUR/USD pair at the moment are influenced by both the dollar and the euro. It is also important not to overlook the role of the dollar as a safe-haven asset. Given the complex geopolitical situation in the world and the new hotspot of tension in the Middle East, investor attention to the role of the safe-haven dollar may again shift after the publication of all the aforementioned documents and macroeconomic indicators.

From a technical perspective, EUR/USD continues to trade within the medium-term and long-term bearish markets, below the key resistance levels of 1.0760 and 1.1040, respectively. In our previous review, we noted that after breaking the resistance level of 1.0542, if the upward correction continues, targets at the levels of 1.0633 and 1.0676 may be reasonable when planning your trading strategy. As we can see, the first target is almost reached, with only 5 points remaining to reach it. A break of today's low at 1.0593 could be the first signal to resume short positions.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Les marchés ont complètement intégré le résultat des discussions entre les États-Unis et la Chine, qui ont abouti à une trêve commerciale de 90 jours. Des données économiques américaines plus

Peu d'événements macroéconomiques sont prévus pour vendredi, et ils ne sont pas plus significatifs que les rapports publiés jeudi, qui n'ont provoqué aucune réaction du marché. En substance, l'unique événement

InstaFutures

Make money with a new promising instrument!

InstaFutures

Make money with a new promising instrument!

Club InstaForex

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.