CADPLN (Canadian Dollar vs Polish Zloty). Exchange rate and online charts.

Currency converter

16 Jun 2025 21:38

(0%)

Closing price, the previous day.

Opening price.

The highest price over the last trading day.

The lowest price over the last trading day

Price range high in the last week

Price range low in the last week

The CAD/PLN pair is not in high demand in the forex market. The pair is a cross rate against the US dollar. The Canadian dollar is the base currency, while the Polish zloty is the quoted one. The cross rate indicates how many units of PLN should be paid for one unit of CAD. The quote of the pair is based on the exchange rate of each of these currencies against the US dollar.

Features of CAD/PLN

The CAD/PLN pair hinges on world oil prices, as Canada is one of the largest oil exporters.

Therefore, the Canadian dollar strengthens when the value of the commodity rises and weakens when oil falls.

Poland is a developed European country with a relatively high level of economy. In addition to active financial support from the EU, the state's main sources of income are engineering, chemicals, coal mining, and shipbuilding, as the country has access to the Baltic Sea.

Although Poland is part of the European Union, its national currency is the Polish zloty. The exchange rate of Poland's national currency depends on such factors as the country's international credit rating, as well as the state of the major sectors of the Polish economy and the European Union.

How to trade CAD/PLN

When trading cross rates, speculators should be aware that brokers usually set higher spreads on them than on the more popular currency pairs. Therefore, you should carefully read the terms and conditions offered by the broker for this trading instrument.

The CAD/PLN pair is significantly influenced by the US dollar. This can be seen by combining USD/CAD and USD/PLN price charts. This way, we can get an estimated chart for the CAD/PLN pair. When forecasting the price movement of this financial instrument, such economic indicators as GDP, discount rate, unemployment rate, etc. must be taken into account.

See Also

- Today, gold is holding on to its intraday losses

Author: Irina Yanina

12:18 2025-06-16 UTC+2

4198

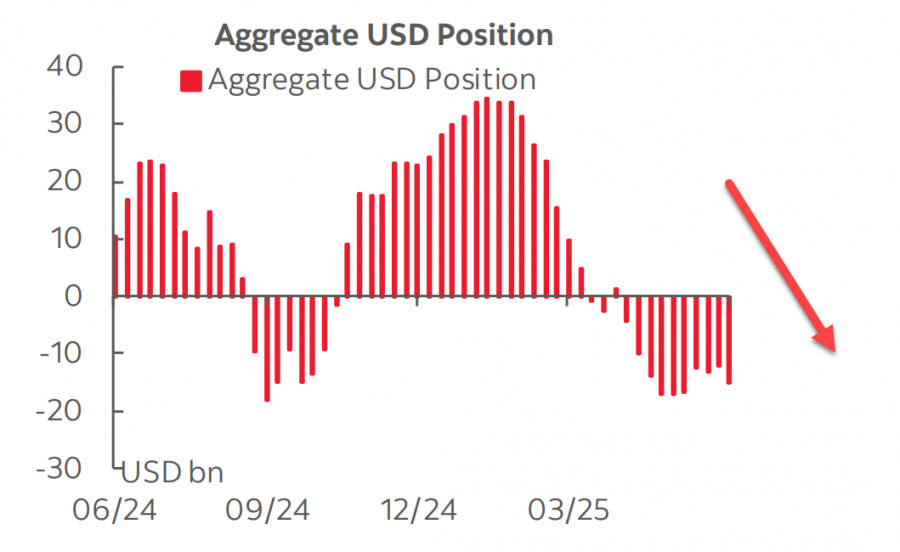

Fundamental analysisCFTC Report: The Dollar Is Being Sold Off Again. Awaiting New Revelations from Trump

CFTC Report: The Dollar Is Being Sold Off Again. Awaiting New Revelations from TrumpAuthor: Kuvat Raharjo

12:14 2025-06-16 UTC+2

1618

Fundamental analysisThe Israel-Iran Confrontation. Fed Meeting. What's Next? (I expect further decline in USD/CAD and a local pullback in gold before a new wave of growth)

Israel and Iran are exchanging missile strikes, but it seems markets are trying to play their own game, assuming that this conflict will not cross the nuclear threshold. In the meantime, investors are shifting their focus to key events this weekAuthor: Pati Gani

10:51 2025-06-16 UTC+2

1558

- GBP/USD. Analysis and Forecast

Author: Irina Yanina

12:10 2025-06-16 UTC+2

1543

Bears still struggling to find supportAuthor: Samir Klishi

12:02 2025-06-16 UTC+2

1468

Stock Market on May 16th: S&P 500 and NASDAQ Closed LowerAuthor: Jakub Novak

10:43 2025-06-16 UTC+2

1453

- US equity indices ended Friday's session in the red as escalating tensions between Israel and Iran drove oil prices higher and fueled market uncertainty. The S&P 500 fell by 1.13%, the Nasdaq 100 dropped by 1.30%, and the Dow Jones lost 1.79%

Author: Ekaterina Kiseleva

13:50 2025-06-16 UTC+2

1423

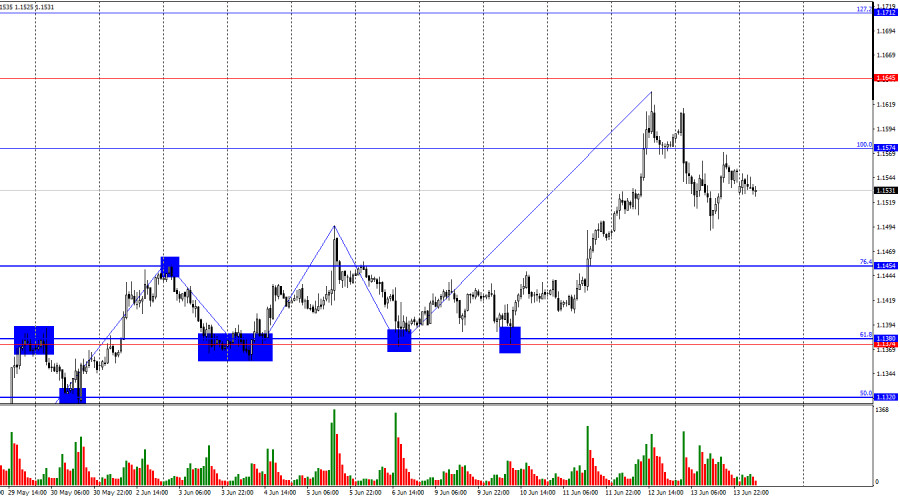

EUR/USD. Analysis and ForecastAuthor: Irina Yanina

12:08 2025-06-16 UTC+2

1303

Bitcoin pauses above $105,000, but breakout occursAuthor: Ekaterina Kiseleva

17:22 2025-06-16 UTC+2

928

- Today, gold is holding on to its intraday losses

Author: Irina Yanina

12:18 2025-06-16 UTC+2

4198

- Fundamental analysis

CFTC Report: The Dollar Is Being Sold Off Again. Awaiting New Revelations from Trump

CFTC Report: The Dollar Is Being Sold Off Again. Awaiting New Revelations from TrumpAuthor: Kuvat Raharjo

12:14 2025-06-16 UTC+2

1618

- Fundamental analysis

The Israel-Iran Confrontation. Fed Meeting. What's Next? (I expect further decline in USD/CAD and a local pullback in gold before a new wave of growth)

Israel and Iran are exchanging missile strikes, but it seems markets are trying to play their own game, assuming that this conflict will not cross the nuclear threshold. In the meantime, investors are shifting their focus to key events this weekAuthor: Pati Gani

10:51 2025-06-16 UTC+2

1558

- GBP/USD. Analysis and Forecast

Author: Irina Yanina

12:10 2025-06-16 UTC+2

1543

- Bears still struggling to find support

Author: Samir Klishi

12:02 2025-06-16 UTC+2

1468

- Stock Market on May 16th: S&P 500 and NASDAQ Closed Lower

Author: Jakub Novak

10:43 2025-06-16 UTC+2

1453

- US equity indices ended Friday's session in the red as escalating tensions between Israel and Iran drove oil prices higher and fueled market uncertainty. The S&P 500 fell by 1.13%, the Nasdaq 100 dropped by 1.30%, and the Dow Jones lost 1.79%

Author: Ekaterina Kiseleva

13:50 2025-06-16 UTC+2

1423

- EUR/USD. Analysis and Forecast

Author: Irina Yanina

12:08 2025-06-16 UTC+2

1303

- Bitcoin pauses above $105,000, but breakout occurs

Author: Ekaterina Kiseleva

17:22 2025-06-16 UTC+2

928