GBPMXN (British Pound vs Mexican Peso). Exchange rate and online charts.

Currency converter

14 Jul 2025 18:36

(0.02%)

Closing price, the previous day.

Opening price.

The highest price over the last trading day.

The lowest price over the last trading day

Price range high in the last week

Price range low in the last week

GBP/MXN is not popular currency pair on the Forex market, it is the cross rate against the U.S. dollar. It can be observed that the U.S. dollar has a great influence on GBP/MXN. Thus, by combining GBP/USD and USD/MXN price chart, we can get an approximate GBP/MXN price chart.

In such a way, the U.S. dollar has a great impact on both currencies. Thuswise, such U.S. economic indices as the discount rate, GDP, unemployment, new created workplaces should be carefully scrutinized to project a future movements of the pair. However, GBP and MXN can response with different speed toward the changes in the U.S. economy, therefore, GBP/MXN can be a specific indicator for the currencies.

Currently, Mexico is one of the most developed countries in Latin America. It ranks first among Latin American countries in terms of income per capita. The Mexican economy is based mostly on private sector due to mass privatization of state enterprises in the 1980s that was made to overcome the economic crisis. Most of the former state enterprises now belong to foreign companies.

Mexico is a member of NAFTA - the North American Free Trade Agreement. For this reason, the country trades actively with the United States and Canada, which brings good revenue for the Mexican government.

Mexico is the largest exporter of oil in its region. Its oil sector yields significant profits for the country. However, despite this, the main source of income for Mexico is the service sector.

Although Mexico has huge oil and gas reserves, its natural hydrocarbons are strongly depleted. The government has to reduce the amount of extracted oil and natural gas in order to avoid new problems in the economy. According to forecasts, Mexico will soon be forced to import oil from abroad to meet the needs of its economy. Such news has a significant impact on the Mexican currency which is highly dependent on world oil prices. In addition, the Mexican peso exchange rate is affected by the international ranking of the country which is based on complex economic formulas.

It should be noted that brokers set a higher spread for cross rates than for basic currency pairs. So before you start working with the crosses, get familiarized with the terms and conditions offered by the broker.

See Also

- The USD/JPY pair continues to consolidate near a three-week high amid U.S. dollar strength and mixed market signals

Author: Irina Yanina

12:17 2025-07-14 UTC+2

1003

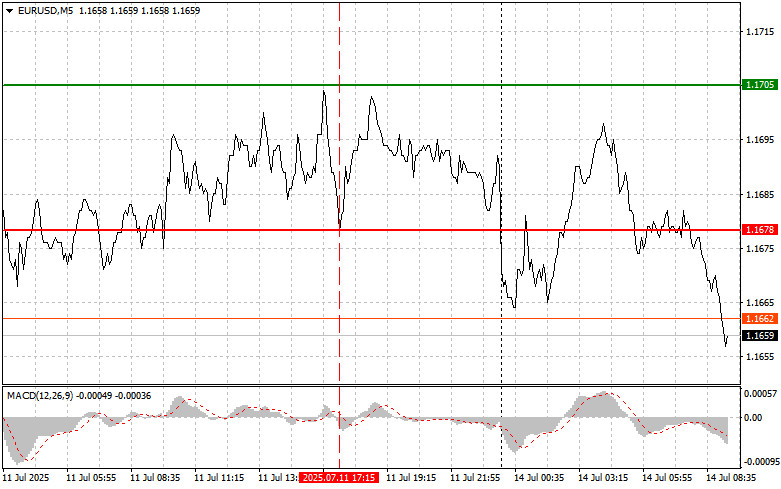

Type of analysisEUR/USD: Simple Trading Tips for Beginner Traders on July 14. Analysis of Yesterday's Forex Trades

EUR/USD: Simple Trading Tips for Beginner Traders on July 14. Analysis of Yesterday's Forex TradesAuthor: Jakub Novak

09:15 2025-07-14 UTC+2

988

Wave analysisWeekly Forecast Using Simplified Wave Analysis for EUR/USD, USD/JPY, GBP/JPY, USD/CAD, NZD/USD, and Gold as of July 14th

A sideways price movement is expected to continue in the upcoming week. A downward move toward the support zone is more likely in the first days, followed by a potential reversal and resumption of the upward trend. A change in direction may trigger a sharp increase in volatility.Author: Isabel Clark

10:57 2025-07-14 UTC+2

823

- Last week, the pair moved downward and nearly tested the 23.6% retracement level at 1.1647 (blue dashed line), after which the price turned upward and closed the weekly candle at 1.1689. In the upcoming week, the price may continue its downward movement.

Author: Stefan Doll

11:34 2025-07-14 UTC+2

808

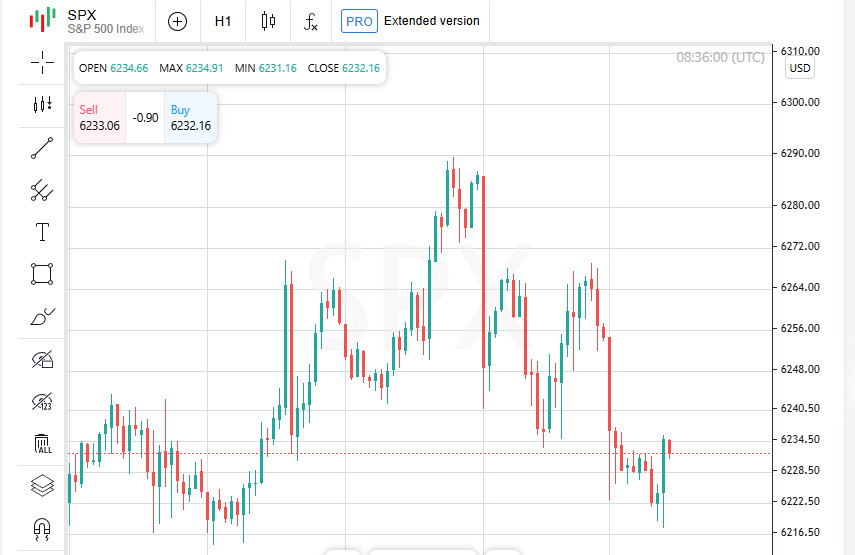

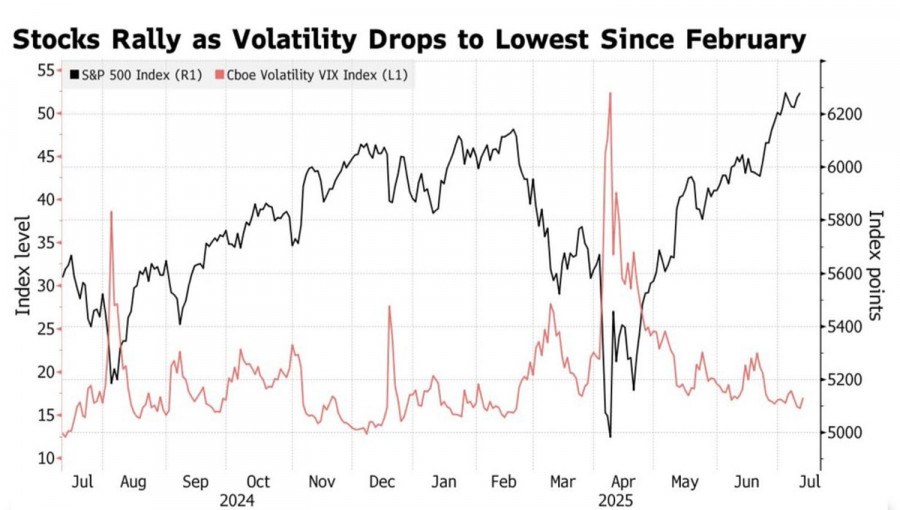

S&P 500 and EU futures fall, Nikkei steady Euro falls after Trump threatens 30% EU tariff US inflation and China growth data loom this weekAuthor: Thomas Frank

10:40 2025-07-14 UTC+2

808

The White House is convinced that S&P 500 records are the result of its protectionist policiesAuthor: Marek Petkovich

09:06 2025-07-14 UTC+2

778

- Trading Recommendations for the Cryptocurrency Market on July 14

Author: Miroslaw Bawulski

09:53 2025-07-14 UTC+2

733

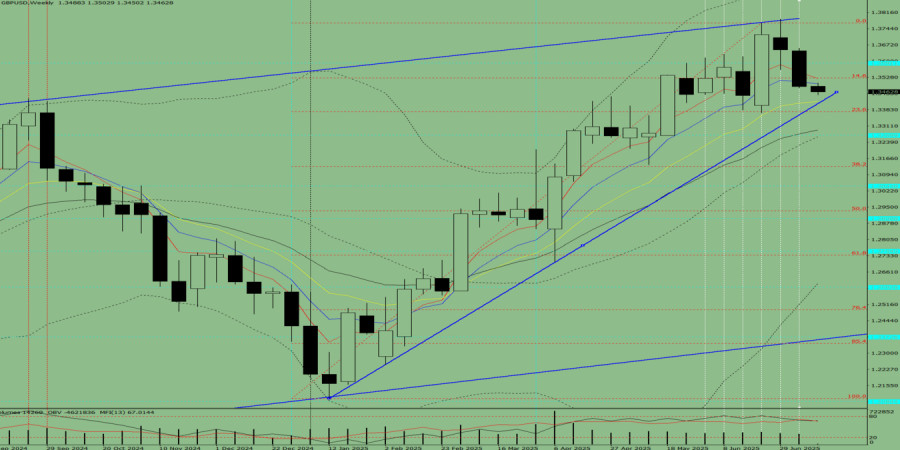

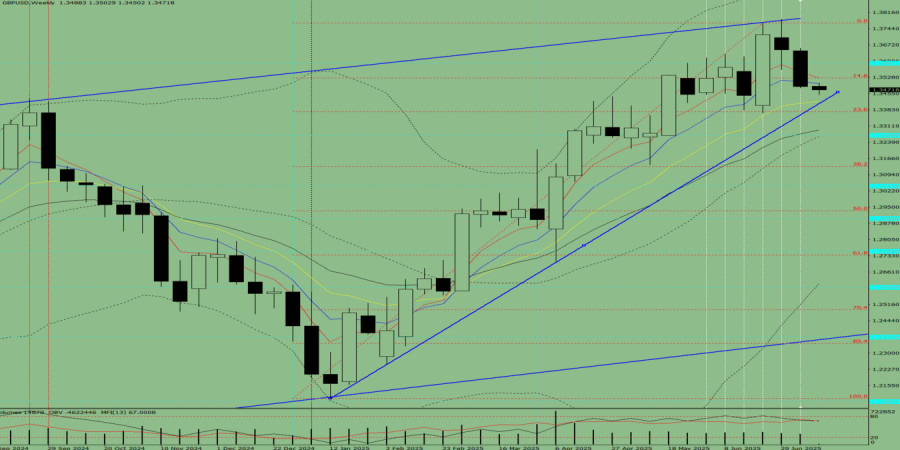

Last week, the pair moved downward and broke below the 8-period EMA at 1.3509 (thin blue line), closing the weekly candle at 1.3487. In the upcoming week, the price may continue to move lower.Author: Stefan Doll

11:40 2025-07-14 UTC+2

718

Wave analysisWeekly Forecast Using Simplified Wave Analysis for GBP/USD, AUD/USD, USD/CHF, EUR/JPY, AUD/JPY, and the US Dollar Index as of July 14th

Throughout the upcoming week, the British pound is expected to move in a generally sideways trajectory. A decline toward the support zone is likely in the first few days, followed by a potential reversal and the beginning of an upward movement. The highest volatility is anticipated toward the end.Author: Isabel Clark

11:12 2025-07-14 UTC+2

703

- The USD/JPY pair continues to consolidate near a three-week high amid U.S. dollar strength and mixed market signals

Author: Irina Yanina

12:17 2025-07-14 UTC+2

1003

- Type of analysis

EUR/USD: Simple Trading Tips for Beginner Traders on July 14. Analysis of Yesterday's Forex Trades

EUR/USD: Simple Trading Tips for Beginner Traders on July 14. Analysis of Yesterday's Forex TradesAuthor: Jakub Novak

09:15 2025-07-14 UTC+2

988

- Wave analysis

Weekly Forecast Using Simplified Wave Analysis for EUR/USD, USD/JPY, GBP/JPY, USD/CAD, NZD/USD, and Gold as of July 14th

A sideways price movement is expected to continue in the upcoming week. A downward move toward the support zone is more likely in the first days, followed by a potential reversal and resumption of the upward trend. A change in direction may trigger a sharp increase in volatility.Author: Isabel Clark

10:57 2025-07-14 UTC+2

823

- Last week, the pair moved downward and nearly tested the 23.6% retracement level at 1.1647 (blue dashed line), after which the price turned upward and closed the weekly candle at 1.1689. In the upcoming week, the price may continue its downward movement.

Author: Stefan Doll

11:34 2025-07-14 UTC+2

808

- S&P 500 and EU futures fall, Nikkei steady Euro falls after Trump threatens 30% EU tariff US inflation and China growth data loom this week

Author: Thomas Frank

10:40 2025-07-14 UTC+2

808

- The White House is convinced that S&P 500 records are the result of its protectionist policies

Author: Marek Petkovich

09:06 2025-07-14 UTC+2

778

- Trading Recommendations for the Cryptocurrency Market on July 14

Author: Miroslaw Bawulski

09:53 2025-07-14 UTC+2

733

- Last week, the pair moved downward and broke below the 8-period EMA at 1.3509 (thin blue line), closing the weekly candle at 1.3487. In the upcoming week, the price may continue to move lower.

Author: Stefan Doll

11:40 2025-07-14 UTC+2

718

- Wave analysis

Weekly Forecast Using Simplified Wave Analysis for GBP/USD, AUD/USD, USD/CHF, EUR/JPY, AUD/JPY, and the US Dollar Index as of July 14th

Throughout the upcoming week, the British pound is expected to move in a generally sideways trajectory. A decline toward the support zone is likely in the first few days, followed by a potential reversal and the beginning of an upward movement. The highest volatility is anticipated toward the end.Author: Isabel Clark

11:12 2025-07-14 UTC+2

703