NZDNOK (New Zealand Dollar vs Norwegian Krone). Exchange rate and online charts.

Currency converter

14 Jul 2025 23:22

(-0%)

Closing price, the previous day.

Opening price.

The highest price over the last trading day.

The lowest price over the last trading day

Price range high in the last week

Price range low in the last week

The NZD/NOK pair is a cross rate against the US dollar, which means that the two currencies in the pair are valued against USD. Therefore, the US dollar has a significant impact on the currency pair. The approximate dynamics of NZD/NOK can be seen by combining the trading charts of the two currency pairs, NZD/USD and USD/NOK.

Principal features

Both countries have fairly strong economies. New Zealand is famous for its agriculture that is considered one of the most efficient and highly developed in the world. Most of the manufactured products are exported. That is why the island country's economy is greatly dependent on its export volumes.

Norway's economy characterized by developed industrial and agricultural sectors is regarded as one of the strongest in the world. This Scandinavian state is a major oil and gas producer and supplier to the global market. The export of energy resources represents a significant source of the country's revenue. In addition, Norway ranks among the world's largest exporters of fish and seafood.

How to trade NZD/NOK

In comparison to such major currency pairs as EUR/USD, USD/CHF, GBP/USD, and USD/JPY, the NZD/NOK currency pair is less liquid. When trading this instrument, you should primarily focus on currency pairs that include the US dollar along with each currency under consideration, and only then make a decision on entering the market with NZD/NOK.

It is also important to remember that brokers tend to set higher spreads on cross rates than on more popular trading instruments. Therefore, before starting to work with cross rates, you should thoroughly review all the terms and conditions a broker offers.

As previously mentioned, the greenback has a profound effect on each of the currencies. Thus, to make an accurate forecast of the NZD/NOK pair’s further movement, it is necessary to take into account the key US economic indicators, including GDP growth, producer prices, unemployment data, trade balance, job openings, and others.

Furthermore, do not forget to monitor the economic situation in Norway and New Zealand as well as in the countries that are their main trading partners.

See Also

- The USD/JPY pair continues to consolidate near a three-week high amid U.S. dollar strength and mixed market signals

Author: Irina Yanina

12:17 2025-07-14 UTC+2

1063

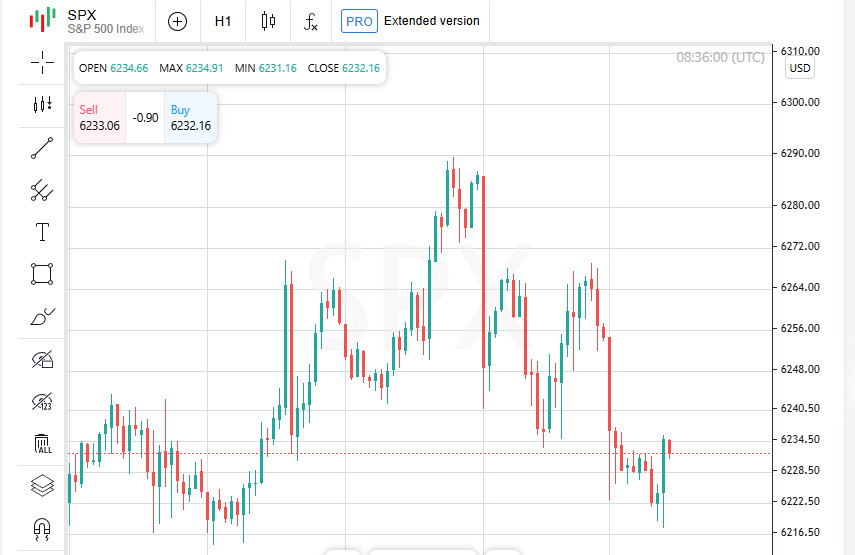

S&P 500 and EU futures fall, Nikkei steady Euro falls after Trump threatens 30% EU tariff US inflation and China growth data loom this weekAuthor: Thomas Frank

10:40 2025-07-14 UTC+2

943

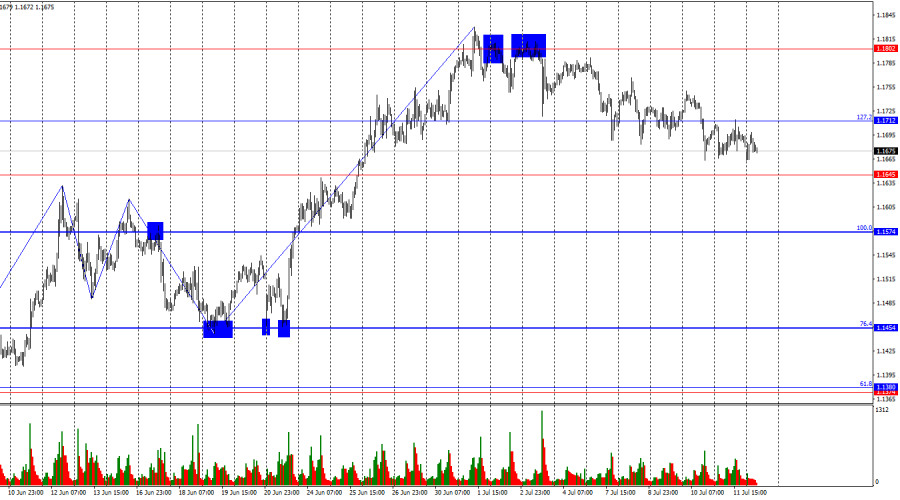

Last week, the pair moved downward and nearly tested the 23.6% retracement level at 1.1647 (blue dashed line), after which the price turned upward and closed the weekly candle at 1.1689. In the upcoming week, the price may continue its downward movement.Author: Stefan Doll

11:34 2025-07-14 UTC+2

898

- Wave analysis

Weekly Forecast Using Simplified Wave Analysis for EUR/USD, USD/JPY, GBP/JPY, USD/CAD, NZD/USD, and Gold as of July 14th

A sideways price movement is expected to continue in the upcoming week. A downward move toward the support zone is more likely in the first days, followed by a potential reversal and resumption of the upward trend. A change in direction may trigger a sharp increase in volatility.Author: Isabel Clark

10:57 2025-07-14 UTC+2

853

Bears still lack optimismAuthor: Samir Klishi

11:31 2025-07-14 UTC+2

778

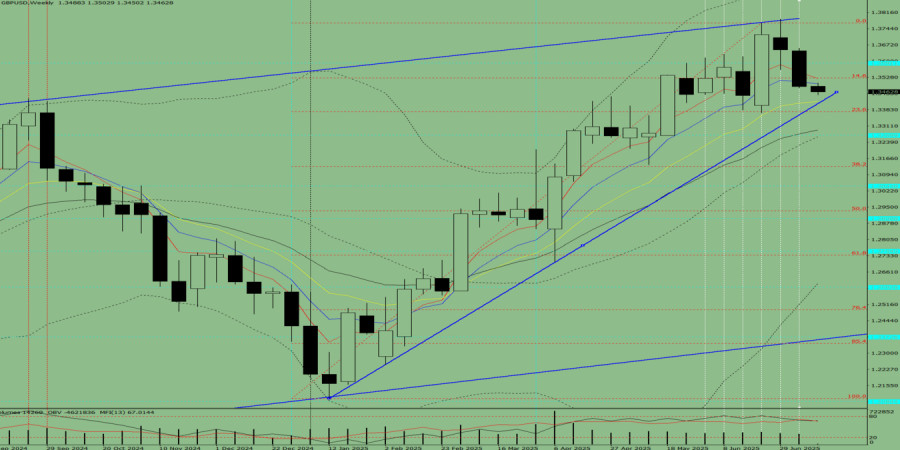

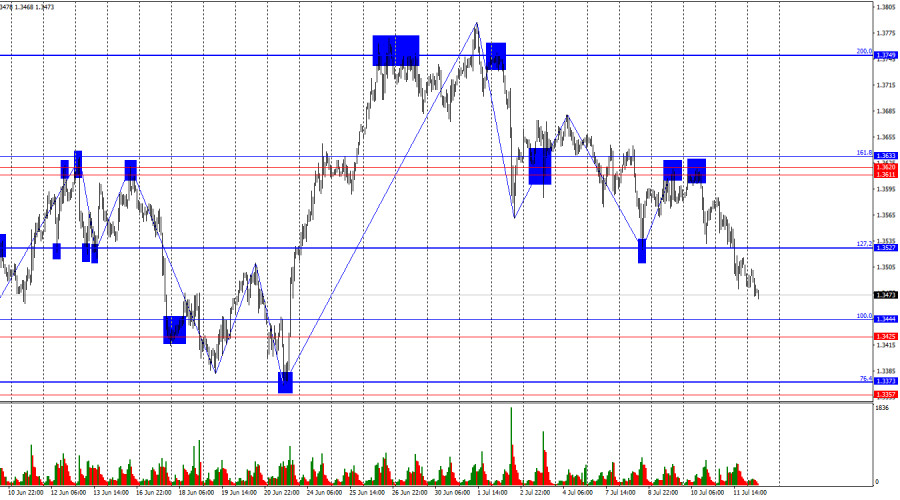

Last week, the pair moved downward and broke below the 8-period EMA at 1.3509 (thin blue line), closing the weekly candle at 1.3487. In the upcoming week, the price may continue to move lower.Author: Stefan Doll

11:40 2025-07-14 UTC+2

763

- Donald Trump announced 30% tariffs on goods from the EU and Mexico. The initial market reaction was negative, but the S&P 500 partially rebounded thanks to gains in large-cap stocks

Author: Ekaterina Kiseleva

14:36 2025-07-14 UTC+2

733

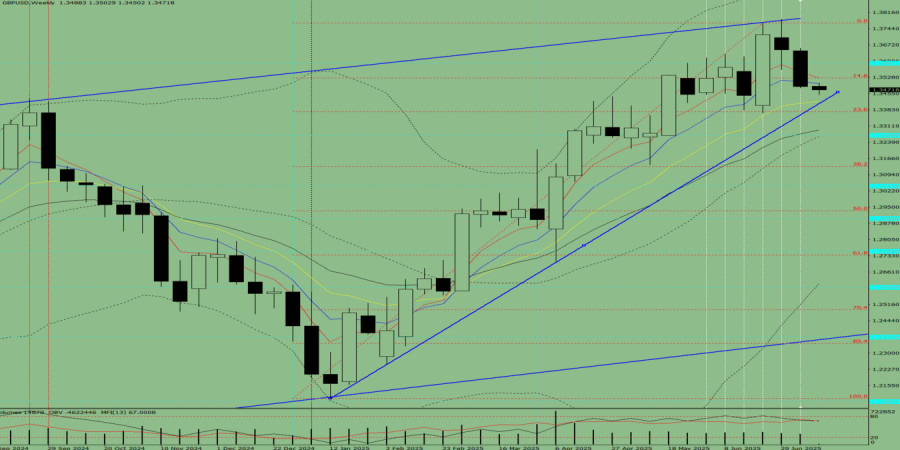

Wave analysisWeekly Forecast Using Simplified Wave Analysis for GBP/USD, AUD/USD, USD/CHF, EUR/JPY, AUD/JPY, and the US Dollar Index as of July 14th

Throughout the upcoming week, the British pound is expected to move in a generally sideways trajectory. A decline toward the support zone is likely in the first few days, followed by a potential reversal and the beginning of an upward movement. The highest volatility is anticipated toward the end.Author: Isabel Clark

11:12 2025-07-14 UTC+2

718

Bears are attacking, but this is a temporary phenomenon.Author: Samir Klishi

11:25 2025-07-14 UTC+2

703

- The USD/JPY pair continues to consolidate near a three-week high amid U.S. dollar strength and mixed market signals

Author: Irina Yanina

12:17 2025-07-14 UTC+2

1063

- S&P 500 and EU futures fall, Nikkei steady Euro falls after Trump threatens 30% EU tariff US inflation and China growth data loom this week

Author: Thomas Frank

10:40 2025-07-14 UTC+2

943

- Last week, the pair moved downward and nearly tested the 23.6% retracement level at 1.1647 (blue dashed line), after which the price turned upward and closed the weekly candle at 1.1689. In the upcoming week, the price may continue its downward movement.

Author: Stefan Doll

11:34 2025-07-14 UTC+2

898

- Wave analysis

Weekly Forecast Using Simplified Wave Analysis for EUR/USD, USD/JPY, GBP/JPY, USD/CAD, NZD/USD, and Gold as of July 14th

A sideways price movement is expected to continue in the upcoming week. A downward move toward the support zone is more likely in the first days, followed by a potential reversal and resumption of the upward trend. A change in direction may trigger a sharp increase in volatility.Author: Isabel Clark

10:57 2025-07-14 UTC+2

853

- Bears still lack optimism

Author: Samir Klishi

11:31 2025-07-14 UTC+2

778

- Last week, the pair moved downward and broke below the 8-period EMA at 1.3509 (thin blue line), closing the weekly candle at 1.3487. In the upcoming week, the price may continue to move lower.

Author: Stefan Doll

11:40 2025-07-14 UTC+2

763

- Donald Trump announced 30% tariffs on goods from the EU and Mexico. The initial market reaction was negative, but the S&P 500 partially rebounded thanks to gains in large-cap stocks

Author: Ekaterina Kiseleva

14:36 2025-07-14 UTC+2

733

- Wave analysis

Weekly Forecast Using Simplified Wave Analysis for GBP/USD, AUD/USD, USD/CHF, EUR/JPY, AUD/JPY, and the US Dollar Index as of July 14th

Throughout the upcoming week, the British pound is expected to move in a generally sideways trajectory. A decline toward the support zone is likely in the first few days, followed by a potential reversal and the beginning of an upward movement. The highest volatility is anticipated toward the end.Author: Isabel Clark

11:12 2025-07-14 UTC+2

718

- Bears are attacking, but this is a temporary phenomenon.

Author: Samir Klishi

11:25 2025-07-14 UTC+2

703