#AA (Alcoa Inc). Nilai tukar dan grafik online.

Konverter mata uang

13 Jun 2025 22:59

(0%)

Harga penutupan, hari sebelumnya.

Harga pembukaan.

Harga tertinggi pada hari transaksi terakhir.

Harga terendah pada hari transaksi terakhir

Nilai total perusahaan dalam pasar saham. Umumnya dihitung dengan menggandakan saham-saham yang beredang dengan harga saham saat itu.

Jumlah saham yang dipegang oleh para investor dan insider perusahaan, diluar sekuritas dilutif (dilutive securities) seperti non-vested RSU dan unexercised options.

Alcoa Inc. (Alcoa), incorporated in 1888, is engaged in the production and management of primary aluminum, fabricated aluminum, and alumina combined, through its participation in technology, mining, refining, smelting, fabricating, and recycling. Alcoa’s products are used worldwide in aircraft, automobiles, commercial transportation, packaging, building and construction, oil and gas, defense, consumer electronics, and industrial applications. Alcoa is a global company operating in 31 countries. Alcoa’s operations consist of four worldwide reportable segments: Alumina, Primary Metals, Flat-Rolled Products, and Engineered Products and Solutions. On March 9, 2011, Alcoa completed an acquisition of the aerospace fastener business of TransDigm Group Inc.

Alumina

The segment represents a portion of Alcoa’s upstream operations and consists of the Company’s worldwide refinery system, including the mining of bauxite, which is then refined into alumina. Alumina is mainly sold directly to internal and external smelter customers worldwide or is sold to customers who process it into industrial chemical products. A portion of the segment’s third-party sales are completed through the use of agents, alumina traders, and distributors. Slightly more than half of Alcoa’s alumina production is sold under supply contracts to third parties worldwide, while the remainder is used internally by the Primary Metals segment.

Primary Metals

The segment represents a portion of Alcoa’s upstream operations and consists of the Company’s worldwide smelter system. Primary Metals receives alumina, mostly from the Alumina segment, and produces primary aluminum used by Alcoa’s fabricating businesses, as well as sold to external customers, aluminum traders, and commodity markets. Results from the sale of aluminum powder, scrap, and excess power are also included in this segment, as well as the results of aluminum derivative contracts and buy/resell activity. The sale of primary aluminum represents more than 90% of this segment’s third-party sales. At December 31, 2011, Alcoa had 644 kilo-metric tons of idle capacity on a base capacity of 4,518 kilo-metric tons.

Flat-Rolled Products

The segment represents Alcoa’s midstream operations, whose principal business is the production and sale of aluminum plate and sheet. A small portion of this segment’s operations relate to foil produced at one plant in Brazil. The segment includes rigid container sheet (RCS), which is sold directly to customers in the packaging and consumer market and is used to produce aluminum beverage cans. The segment also includes sheet and plate used in the aerospace, automotive, commercial transportation, and building and construction markets (mainly used in the production of machinery and equipment and consumer durables), which is sold directly to customers and through distributors. Approximately one-half of the third-party sales in this segment consist of RCS, while the other one-half of third-party sales are derived from sheet and plate and foil used in industrial markets.

Engineered Products and Solutions

The segment represents Alcoa’s downstream operations and includes titanium, aluminum, and super alloy investment castings; forgings and fasteners; aluminum wheels; integrated aluminum structural systems; and architectural extrusions used in the aerospace, automotive, building and construction, commercial transportation, and power generation markets. The products are sold directly to customers and through distributors. Additionally, hard alloy extrusions products, which are also sold directly to customers and through distributors, serve the aerospace, automotive, commercial transportation, and industrial products markets. Engineered Products and Solutions business is a global designer, producer, and supplier of engineered aircraft components, with three locations (one in the state of California and two in the United Kingdom). Specifically, this business provides a variety of nickel alloy specialty engine fasteners, airframe bolts, and slotted entry bearings.

Lihat juga

- EUR/USD: Kiat-kiat Trading Sederhana untuk Trader Pemula – 13 Juni (Sesi AS).

Penulis: Jakub Novak

12:41 2025-06-13 UTC+2

2608

Crypto-currenciesAnalisis Teknikal Pergerakan Harga Intraday Mata Uang Kripto Filecoin, Jumat 13 Juni 2025.

Tidak berbeda jauh dengan mata uang kripto lainnya seperti Solana, Filecoin jugaPenulis: Arief Makmur

05:23 2025-06-13 UTC+2

2383

Fundamental analysisSerangan Rudal Israel terhadap Iran Akan Mengguncang Pasar Global (Saya Memperkirakan Bitcoin dan #NDX Akan Melanjutkan Penurunan Setelah Koreksi Naik Lokal)

Seperti yang saya perkirakan, kurangnya hasil positif yang luas dalam negosiasi antara Tiongkok dan AS serta tekanan inflasi yang baru menyebabkan penurunan tajam dalam permintaan saham korporasi.Penulis: Pati Gani

10:10 2025-06-13 UTC+2

1753

- Crypto-currencies

Analisis Teknikal Pergerakan Harga Intraday Mata Uang Kripto Solana, Jumat 13 Juni 2025.

Dengan munculnya Divergensi antara pergerakan harga mata uang kripto Solana padaPenulis: Arief Makmur

05:16 2025-06-13 UTC+2

1723

Banyak orang akan dihukum karena terlalu percaya diri dalam membeli penurunan S&P 500.Penulis: Marek Petkovich

09:35 2025-06-13 UTC+2

1588

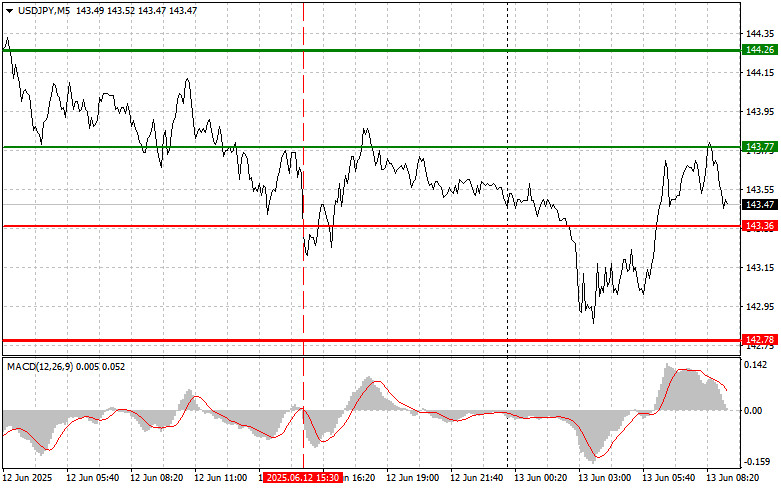

Tipe analisisUSD/JPY: Kiat-kiat Trading Sederhana untuk Trader Pemula pada 13 Juni. Tinjauan Trading Forex Kemarin

USD/JPY: Kiat-kiat Trading Sederhana untuk Trader Pemula pada 13 Juni. Tinjauan Trading Forex Kemarin.Penulis: Jakub Novak

09:04 2025-06-13 UTC+2

1543

- Rekomendasi Trading untuk Pasar Cryptocurrency pada 13 Juni.

Penulis: Miroslaw Bawulski

09:04 2025-06-13 UTC+2

1528

Pasar Cryptocurrency Ambruk — Inilah Alasannya.Penulis: Jakub Novak

11:12 2025-06-13 UTC+2

1513

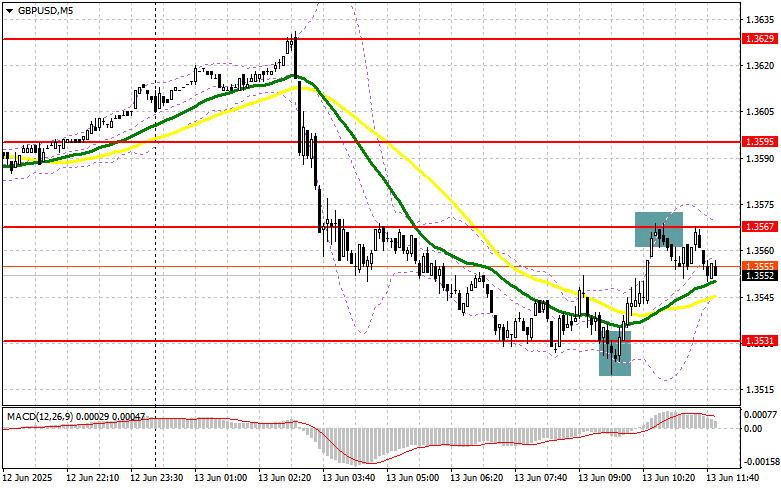

GBP/USD: Rencana Trading untuk Sesi AS pada 13 Juni (Tinjauan Tarding Pagi).Penulis: Miroslaw Bawulski

12:37 2025-06-13 UTC+2

1483

- EUR/USD: Kiat-kiat Trading Sederhana untuk Trader Pemula – 13 Juni (Sesi AS).

Penulis: Jakub Novak

12:41 2025-06-13 UTC+2

2608

- Crypto-currencies

Analisis Teknikal Pergerakan Harga Intraday Mata Uang Kripto Filecoin, Jumat 13 Juni 2025.

Tidak berbeda jauh dengan mata uang kripto lainnya seperti Solana, Filecoin jugaPenulis: Arief Makmur

05:23 2025-06-13 UTC+2

2383

- Fundamental analysis

Serangan Rudal Israel terhadap Iran Akan Mengguncang Pasar Global (Saya Memperkirakan Bitcoin dan #NDX Akan Melanjutkan Penurunan Setelah Koreksi Naik Lokal)

Seperti yang saya perkirakan, kurangnya hasil positif yang luas dalam negosiasi antara Tiongkok dan AS serta tekanan inflasi yang baru menyebabkan penurunan tajam dalam permintaan saham korporasi.Penulis: Pati Gani

10:10 2025-06-13 UTC+2

1753

- Crypto-currencies

Analisis Teknikal Pergerakan Harga Intraday Mata Uang Kripto Solana, Jumat 13 Juni 2025.

Dengan munculnya Divergensi antara pergerakan harga mata uang kripto Solana padaPenulis: Arief Makmur

05:16 2025-06-13 UTC+2

1723

- Banyak orang akan dihukum karena terlalu percaya diri dalam membeli penurunan S&P 500.

Penulis: Marek Petkovich

09:35 2025-06-13 UTC+2

1588

- Tipe analisis

USD/JPY: Kiat-kiat Trading Sederhana untuk Trader Pemula pada 13 Juni. Tinjauan Trading Forex Kemarin

USD/JPY: Kiat-kiat Trading Sederhana untuk Trader Pemula pada 13 Juni. Tinjauan Trading Forex Kemarin.Penulis: Jakub Novak

09:04 2025-06-13 UTC+2

1543

- Rekomendasi Trading untuk Pasar Cryptocurrency pada 13 Juni.

Penulis: Miroslaw Bawulski

09:04 2025-06-13 UTC+2

1528

- Pasar Cryptocurrency Ambruk — Inilah Alasannya.

Penulis: Jakub Novak

11:12 2025-06-13 UTC+2

1513

- GBP/USD: Rencana Trading untuk Sesi AS pada 13 Juni (Tinjauan Tarding Pagi).

Penulis: Miroslaw Bawulski

12:37 2025-06-13 UTC+2

1483