Lihat juga

08.02.2023 08:17 PM

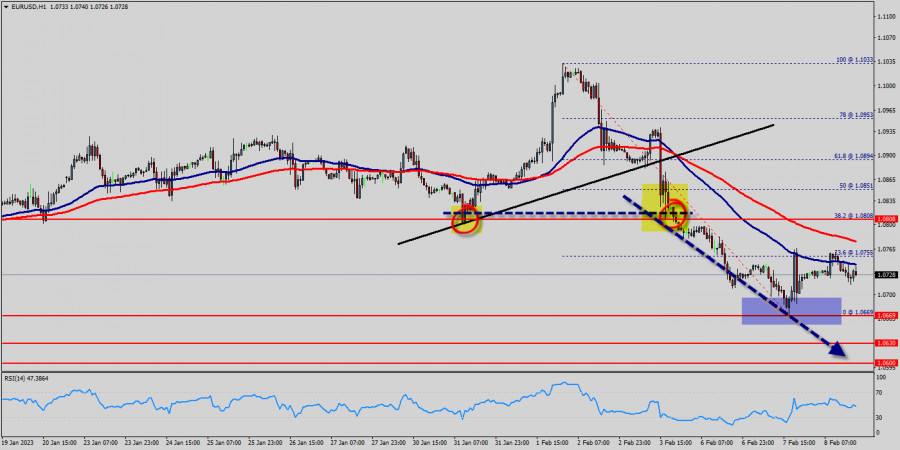

08.02.2023 08:17 PMThe EUR/USD pair has faced strong resistances at the levels of 1.0880 because support had become resistance last week. So, the strong resistance has been already formed at the level of 1.0880 and the pair is likely to try to approach it in order to test it again. However, if the pair fails to pass through the level of 1.0880, the market will indicate a bearish opportunity below the new strong resistance level of 1.0880 (the level of 1.0880 coincides with a ratio of 38.2% Fibonacci - last bullish wave - double top).

Moreover, the RSI starts signaling a downward trend, as the trend is still showing strength above the moving average (100) and (50). The trend of EUR/USD pair movement was controversial as it took place in the downtrend channel.

Due to the previous events, the price is still set between the levels of 1.0808 and 1.0669, so it is recommended to be careful while making deals in these levels because the prices of 1.0808 and 1.0669 are representing the resistance and support respectively.

Therefore, it is necessary to wait till the downtrend channel is passed through. Then the market will probably show the signs of a bearish market.

It should be noted that the volatility is very high for that the price of the EUR/USD pair is still trading between the prices of 1.0669 and 1.0808 in the coming hours.

Furthermore, the price has been set below the strong resistance at the levels of 1.0808 and 1.0851 which coincide with the 38.2% and 50% Fibonacci retracement levels respectively.

Thus, the market is indicating a bearish opportunity below 1.0808 so it will be good to sell at 1.0808 with the first target of 1.0669.

It will also call for a downtrend in order to continue towards 1.0630. The daily strong support is seen at 1.0600.

However, the stop loss should always be taken into account, for that it will be reasonable to set your stop loss at the level of 1.0851.

Moving averages, in the meantime, maintain their bearish slope way above the current level. Furthermore, although the news is bearish for the EUR/USD pair, professional may not want to sell weakness, but rather following a rebound rally.

Additionally, some aggressive counter-trend buyers may be defending parity. In case a continuousion takes place and the EUR/USD pair breaks through the support level of 1.0669 , a further decline to 1.0600 can occur which would indicate a bearish market.

Signal :

It should be noted that the 1.0808 price will act as a major resistance on Feb. 08th, 2023. Therefore, it will be too gainful to sell short below 1.0808 and look for further downside with 1.0669, 1.0630 and 1.0600 targets. It should also be reminded that stop loss must never exceed the maximum exposure amounts. Thus, stop loss should be placed at the 1.0851 level today.

You have already liked this post today

*Analisis pasar yang diposting disini dimaksudkan untuk meningkatkan pengetahuan Anda namun tidak untuk memberi instruksi trading.

Pada hari Jumat, pasangan EUR/USD melanjutkan penurunan moderatnya. Penutupan di bawah level Fibonacci 127,2% di 1,1181 tercatat, tetapi penjual gagal memanfaatkan keberhasilan tersebut. Latar belakang berita saat ini beragam

Pada grafik per jam, pasangan GBP/USD terus bergerak menyamping pada hari Jumat, berfluktuasi antara level 1.,3205 dan 1,3344. Setelah penolakan dari zona resistance 1,3344–1,3357, masih ada kemungkinan penurunan berlanjut menuju

Pada chart 4 jamnya, indikator Stochastic Oscillator nampak tengah terjadi crossing BUY, ditambah dengan pergerakan harganya yang bergerak diatas WMA (21) serta munculnya pola Bullish 123, maka selama tidak terjadi

Meski Seller masih mendominasi EUR/JPY di chart 4 jamnya, dimana hal ini dikonfirmasi oleh pergerakan harganya yang bergerak dibawah WMA (21) yang juga memiliki kemiringan menukik turun, namun dengan kemunculan

Pada sesi Amerika awal, pasangan EUR/USD trading di sekitar 1.1178, di bawah 200 EMA, dan di bawah 21 SMA dengan tekanan bearish. Setelah mencapai area 1.1270, euro gagal menembus saluran

Pada awal sesi Amerika, emas trading sekitar 3,174.33, mundur setelah mencapai puncak saluran tren menurun. Kemarin, emas jatuh ke level terendah 3,120 dan pulih lebih dari $130 dalam waktu kurang

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.