Lihat juga

30.03.2023 03:40 PM

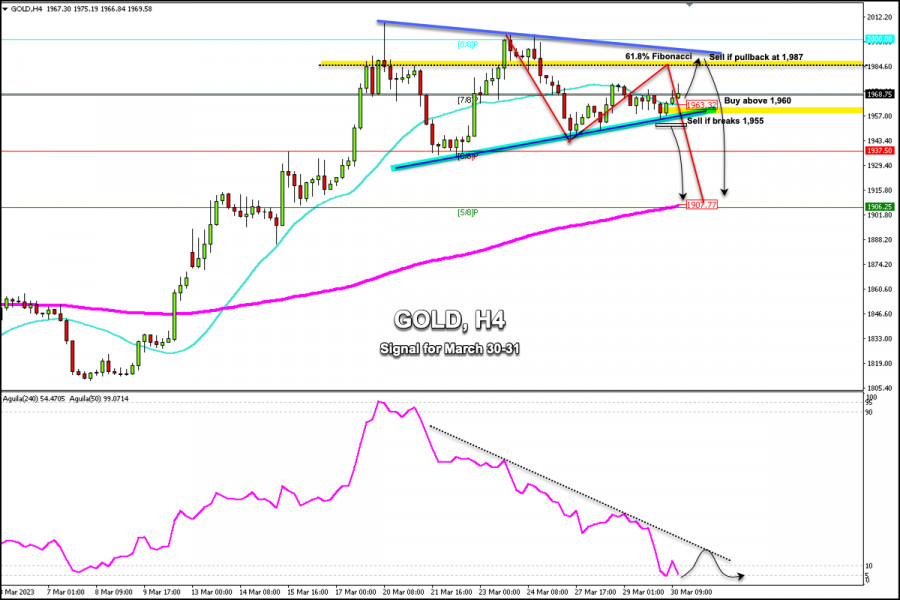

30.03.2023 03:40 PMEarly in the American session, Gold (XAU/USD) is trading around 1,968 above 7/8 Murray and above the 21 SMA located at 1,963.32.

According to the 4-hour chart, we can see that gold is making a technical rebound after falling from the high of 2,003.21 to the low of 1,943.86.

This movement could mean a correction towards the 61.8% Fibonacci, located around 1,984. A pullback towards this area could be a sign for gold to resume its bearish cycle and it could reach the 200 EMA located at 1,907 in the next few days.

XAU/USD is currently trading above the 21 SMA located at 1,963 which favors a bullish movement. If it consolidates above this level, it could continue to rise until it reaches 1,975 and 1,987.

A pullback to the resistance zone of the downtrend channel formed between the high of 2009 and 2003 could be a point to sell around 1,987, with targets at 1,950 and 1,907 (200 EMA).

For gold to resume its bullish cycle, we should expect a sharp break above 1,990 and consolidation above 8/8 Murray (2000). Then, the metal could reach +1/8 Murray located at 2,031.25.

Conversely, for gold to turn more bearish, it will need to break the bottom of the uptrend channel formed between the low of 1,934 and 1,943. Then, it could reach 1,937 (6/8 Murray) and 1,907 (200 EMA).

The Eagle indicator has reached the extremely oversold zone around 5 points which is likely to be followed by any technical bounce. As long as it does not break its pressure line, it could be a signal to sell.

You have already liked this post today

*Analisis pasar yang diposting disini dimaksudkan untuk meningkatkan pengetahuan Anda namun tidak untuk memberi instruksi trading.

Penurunan suku bunga oleh Reserve Bank of Australia kemarin dari 4,10% menjadi 3,85%, meskipun sudah diperkirakan secara luas, tidak memungkinkan dolar Australia untuk mengkonsolidasikan di atas level resistensi 0,6444. Namun

Meski di chart 4 jamnya pasangan mata uang silang AUD/JPY tengah melemah, namun nampaknya pelemahan ini hanya bersifat koreksi sesaat selama tidak sampai tembus dan menutup dibawah level 91,47 maka

Pasangan USD/CAD turun secara bertahap selama lima hari berturut-turut, tetap berada di bawah garis indikator keseimbangan harian. Pergerakan di bawah level support 1,3898 akan mempercepat penurunan menuju support pertama

Pada chart 4 jamnya, instrumen komoditi Perak nampak terlihat kemunculan Konvergen antara pergerakan harga instrument komoditi Perak dengan indikator Stochastic Oscillator, sehingga dalam waktu dekat ini Perak berpotensi untuk menguat

Jika harga turun di bawah 3.281, instrumen ini diprediksi akan menutup celah di 3.201, atau sebaliknya, konsolidasi di atas 3.290 diharapkan akan menutup celah yang ditinggalkannya sekitar 3.325 pada

Euro telah meninggalkan celah di sekitar 1,1170. Jika EUR/USD jatuh di bawah level 6/8 Murray yang terletak di 1,1230, tekanan bearish dapat meningkat, dengan harga berpotensi menutupi celah

Notifikasi

E-mail/SMS

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.