Lihat juga

29.11.2023 10:56 PM

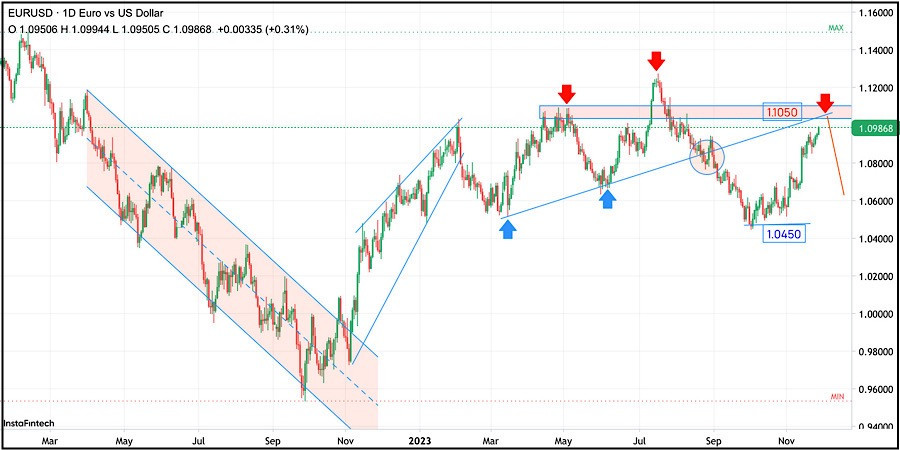

29.11.2023 10:56 PMSince March 2023, the EUR/USD pair has been following an uptrend line, reaching higher peaks around (1.1080 and 1.1260) and higher valleys around (1.0520 and 1.0650).

However, in July 2023, the pair failed to maintain its bullish momentum and bounced back from the resistance zone near 1.1270, falling below 1.1050.

The pair continued to decline and broke the uptrend line in August 2023, reaching the next target near 1.0450, where it found some previous demand levels.

This triggered another bullish wave that lasted for several weeks, pushing the pair towards the current level of 1.0990.

The pair is likely to keep rising until it hits 1.1050, where it may face either a short-term or a long-term bearish correction.

Therefore, selling the EUR/USD around 1.1050 (the backside of the broken uptrend line) could be a good opportunity, with Stop Loss Levels just above 1.1170. The expected bearish target levels are 1.0840 and 1.0670.

You have already liked this post today

*Analisis pasar yang diposting disini dimaksudkan untuk meningkatkan pengetahuan Anda namun tidak untuk memberi instruksi trading.

Dari apa yang nampak di chart hariannya, pasangan mata uang Eksotik USD/IDR nampak muncul pola Bearish 123 yang diikuti oleh munculnya 2 Bearish Ross Hook (RH) dimana ini memberi petunjuk

Bila Kita perhatikan chart 4 jamnya indeks Nasdaq 100 yang bergerak diatas WMA (21) yang memiliki kemiringan menukik keatas, memberi petunjuk kalau saat ini Buyers masih cukup dominan sehingga dalam

Euro diperkirakan akan terus turun dalam beberapa jam ke depan. Oleh karena itu, kita harus mengantisipasi penutupan di bawah 1,1186 pada grafik H4. Kemudian, harga mungkin turun ke 1,1080

Di awal sesi Amerika, XAU/USD diperdagangkan di sekitar 3.180, naik setelah mencapai 3.175, level yang bertepatan dengan level support harian 3 (S_3). Rebound teknikal diharapkan terjadi dalam beberapa

Harga minyak mentah AS West Texas Intermediate (WTI) sedang berkonsolidasi mendekati level tertinggi satu bulan, menghentikan tren kenaikan selama empat hari, meskipun penurunan intraday tidak menunjukkan keyakinan bearish yang kuat

Meski di chart 4 jamnya pasangan mata uang silang AUD/JPY masih bergerak diatas WMA (30 Shift 2) yang juga memiliki kemiringan yang menukik naik keatas, namun oleh karena indikator Stochastic

Indikator pola

grafis.

Lihat hal-hal

yang belum pernah anda lihat!

Klub InstaTrade

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.