Lihat juga

28.01.2025 01:24 PM

28.01.2025 01:24 PMThe U.S. stock market partially rebounded after a sharp decline triggered by the Chinese startup DeepSeek, which caused many investors to question whether the AI market might be in a bubble—especially considering the valuation of a single company, NVIDIA. Notably, NVIDIA lost $600 billion in market capitalization yesterday.

S&P 500 and NASDAQ ended the day down 2% to 3%, and today, futures for these indices are trading with minimal volatility, slightly in the red. This indicates continued uncertainty about how investors and traders will act moving forward, seemingly waiting for statements or decisions from Donald Trump's new administration.

As noted earlier, shares of the chip manufacturer fell nearly 17% as the performance of DeepSeek's language model raised questions about the volume of investments in artificial intelligence. With these developments, the high-profile name in artificial intelligence is heading for its worst day since March 2020.

Investor concerns are growing as competition in the AI space becomes increasingly fierce. The emergence of new players like DeepSeek, capable of showcasing high-performing language models, challenges the dominance of major companies. These changes are prompting a reevaluation of investment strategies and possibly even project plans. While AI investments have been at the peak of popularity for some time, yesterday's events question these established norms and create market uncertainty. For many tech companies, this is a warning sign: the AI landscape is shifting, and caution is the best defense.

NVIDIA was not the only semiconductor company whose shares plummeted due to DeepSeek's developments.

The VanEck Semiconductor ETF (SMH) slid nearly 10%.

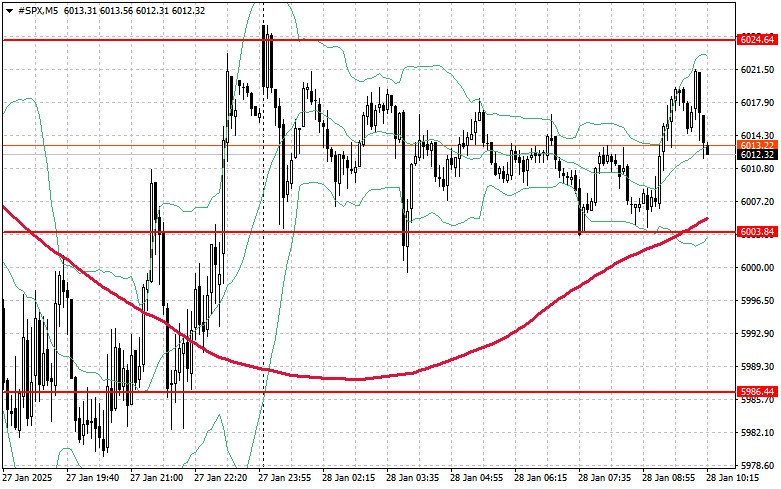

Demand for the S&P 500 remains strong. Buyers' main goal today will be to break through the nearest resistance level at $6024, which would help sustain the upward trend and pave the way for a move toward $6038. A secondary but equally important target for bulls will be holding $6047, which would strengthen buyers' positions.

If the index moves downward amid reduced risk appetite, buyers will need to step up around $6003. A breakout below this level could quickly push the instrument back to $5986 and potentially open the door to $5967.

You have already liked this post today

*Analisis pasar yang diposting disini dimaksudkan untuk meningkatkan pengetahuan Anda namun tidak untuk memberi instruksi trading.

Pada penutupan sesi perdagangan reguler terakhir, indeks saham AS ditutup lebih rendah. S&P 500 turun sebesar 0,27%, sementara Nasdaq 100 turun 0,50%. Dow Jones Industrial Average ditutup datar pada 0,00%

Pasar AS bertahan tetapi tidak lagi mengalami kemajuan. Pasar telah mencapai puncak yang diproyeksikan namun belum menemukan energi baru untuk kenaikan berikutnya. Minggu ini berlangsung dalam mode "pengintaian tenang": investor

Pasar saham AS terus mempertahankan momentum kenaikannya, tetapi suasana semakin dipenuhi dengan antisipasi. Laporan inflasi pada hari Rabu dan pendapatan perusahaan dari pemain kunci sedang mempersiapkan panggung untuk kenaikan volatilitas

Pada penutupan sesi reguler sebelumnya, indeks saham AS ditutup di wilayah positif. S&P 500 naik sebesar 0,55%, sementara Nasdaq 100 melonjak sebesar 0,63%. Dow Jones industri menguat 0,25%. Selama perdagangan

Indeks saham AS mengakhiri sesi reguler sebelumnya dengan lonjakan yang signifikan. S&P 500 naik 1,03%, sementara Nasdaq 100 melonjak 1,20%. Dow Jones industri menambahkan 1,05%. Pasar saham Asia juga naik

Pasar AS menunjukkan ketahanan dan pertumbuhan di tengah ketidakpastian. Optimisme masih rapuh, dan setiap rilis data makroekonomi baru seperti melempar dadu. Pertumbuhan indeks cukup mungkin berlanjut berkat harapan retorika dovish

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.