Lihat juga

28.03.2025 07:05 AM

28.03.2025 07:05 AMThe EUR/USD currency pair rose to the 1.0804 level on Thursday. Naturally, such an unexpected and relatively strong rise in the euro (or, more accurately, a drop in the dollar) could only be triggered by one person—Donald Trump. Overnight, he announced new tariffs on imports to the U.S., this time targeting all foreign-manufactured automobiles. Elon Musk is celebrating, and the dollar is falling again, as the market has repeatedly shown a highly negative reaction to the new U.S. president's trade policies. However, it's worth noting that the dollar's decline wasn't particularly sharp this time, and the U.S. currency has been climbing—albeit as part of a correction—for nearly two weeks. We've already said that Trump's tariffs are a short-term negative for the U.S. economy. Still, the dollar can't lose 10 cents over a couple of months if the economy isn't contracting and there is no macroeconomic evidence of deterioration. The U.S. economy showed stronger-than-expected growth in the fourth quarter.

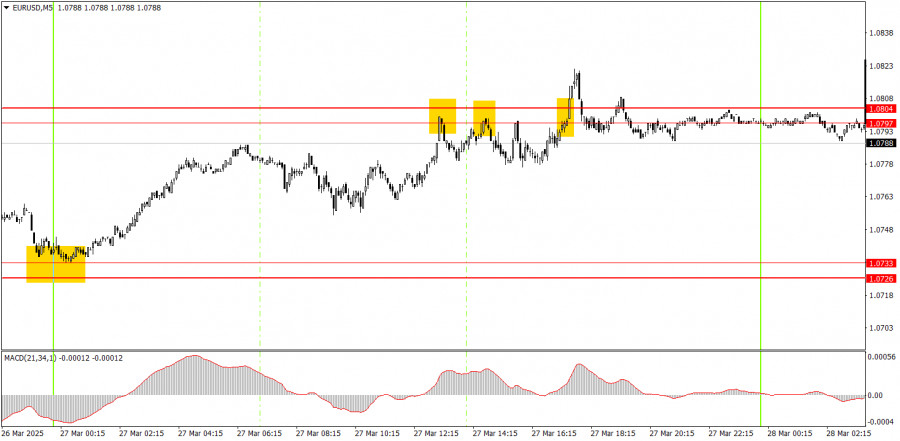

On Thursday, a solid trading signal and three mediocre ones were formed in the 5-minute timeframe. The first rebound from the 1.0733 level alone offered an excellent profit opportunity. Unfortunately, that signal was formed at night, so few traders likely took advantage of it. During the day, the price repeatedly bounced off the 1.0797–1.0804 area and broke through it once. But by then, the upward momentum had already faded.

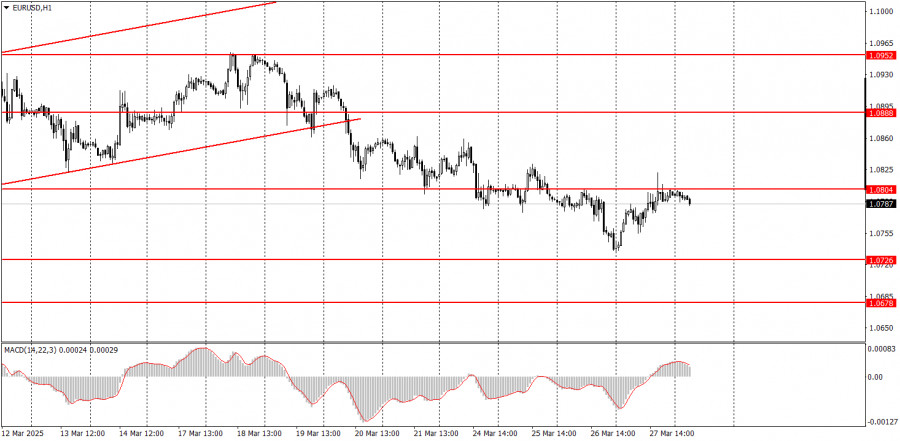

On the hourly timeframe, the EUR/USD pair remains in a medium-term downtrend, although the chances of its continuation are dwindling. Since the fundamental and macroeconomic background still favors the U.S. dollar much more than the euro, we continue to expect a decline. However, Trump keeps pushing the dollar downward with his recurring tariff decisions and statements about how the world should be organized to suit the U.S. Fundamentals and macroeconomics remain overshadowed by politics and geopolitics, so we are not expecting any strong dollar growth for now.

On Friday, the euro may resume its decline, as a downward trend has started forming on the hourly timeframe. The dollar is oversold and has depreciated too sharply and unjustifiably in recent weeks. A continued correction seems likely.

On the 5-minute timeframe, the following levels should be monitored: 1.0433–1.0451, 1.0526, 1.0596, 1.0678, 1.0726–1.0733, 1.0797–1.0804, 1.0859–1.0861, 1.0888–1.0896, 1.0940–1.0952, 1.1011, and 1.1048. For Friday, the only notable release in the Eurozone is Germany's unemployment rate, while in the U.S., attention will turn to the PCE index and the University of Michigan consumer sentiment index. We believe the latter is the more important of the two.

Support and Resistance Levels: These are target levels for opening or closing positions and can also serve as points for placing Take Profit orders.

Red Lines: Channels or trendlines indicating the current trend and the preferred direction for trading.

MACD Indicator (14,22,3): A histogram and signal line used as a supplementary source of trading signals.

Important Events and Reports: Found in the economic calendar, these can heavily influence price movements. Exercise caution or exit the market during their release to avoid sharp reversals.

Forex trading beginners should remember that not every trade will be profitable. Developing a clear strategy and practicing proper money management are essential for long-term trading success.

You have already liked this post today

*Analisis pasar yang diposting disini dimaksudkan untuk meningkatkan pengetahuan Anda namun tidak untuk memberi instruksi trading.

Pada hari Selasa, pasangan GBP/USD sebagian besar diperdagangkan mendatar, tetapi pada Rabu pagi, pasangan ini melonjak ke atas. Pada timeframe 4 jam, tampak jelas bahwa harga masih berada dalam channel

Pada hari Selasa, pasangan mata uang EUR/USD bergerak mendatar, tetapi kembali melanjutkan pergerakan naiknya pada Rabu pagi. Ini menunjukkan bahwa tren naik yang sedang berlangsung, yang kini memasuki bulan keempat

Pada hari Selasa, pasangan mata uang GBP/USD terus trading dalam batasan saluran mendatar yang telah ada selama lebih dari sebulan dan terlihat jelas. Sementara pada hari Senin pasar memiliki setidaknya

Pada hari Selasa, pasangan mata uang EUR/USD sebagian besar diperdagangkan mendatar. Berbeda dengan hari Senin, para trader tidak memiliki alasan formal untuk menjual dolar, sesuatu yang sering mereka lakukan belakangan

Sepanjang hari Senin, pasangan GBP/USD melanjutkan pergerakan naiknya, dan sekilas, mungkin tampak bahwa tren naik yang baru sedang terbentuk pada timeframe per jam. Pada prinsipnya, memang demikian, seperti yang dibuktikan

Pada hari Senin, pasangan mata uang EUR/USD melonjak naik dengan kekuatan baru. Namun, apa yang membenarkan pergerakan ini, mengingat latar belakang makroekonomi dan fundamental pada hari Senin praktis tidak

Pada hari Senin, pasangan mata uang GBP/USD melanjutkan pergerakan naik yang dimulai minggu lalu. Harga berhasil menembus kedua garis indikator Ichimoku, sehingga dari sudut pandang teknikal, tren pada timeframe

Pada hari Senin, pasangan mata uang EUR/USD menunjukkan kenaikan yang cukup signifikan. Kami percaya tidak ada justifikasi makroekonomi atau fundamental untuk depresiasi tajam dolar AS pada hari itu. Namun, seperti

Pada hari Jumat, pasangan mata uang EUR/USD mengalami penurunan harga yang signifikan, meskipun tidak ada alasan makroekonomi atau fundamental. Namun, tren penurunan pada kerangka waktu per jam tetap bertahan

Pada hari Jumat, pasangan mata uang GBP/USD sebagian besar diperdagangkan menurun sepanjang hari, tetapi ditutup dengan penurunan kecil. Ini terutama karena dolar melemah selama sesi Asia dan kembali melemah

InstaTrade dalam angka

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.