Lihat juga

03.04.2025 07:26 AM

03.04.2025 07:26 AMThe EUR/USD currency pair traded with gains on Wednesday, though this had nothing to do with the macroeconomic backdrop. The U.S. dollar began weakening again during the American trading session, and the market likely started to sense something very negative coming from Trump. As it turned out, that feeling was entirely justified. It's worth noting that we did not expect Trump to impose such sweeping and high tariffs. We had assumed they would be capped at around 10–15%. However, Trump has imposed tariffs on imports from almost every country globally, and in some cases, the rates are approaching 100%. Therefore, the overnight "storm" across markets is hardly surprising.

The U.S. dollar is again plunging, and the market shows how it views Trump's initiative to "Make America Great Again." The technical picture on higher timeframes is starting to break down, as no one could have foreseen the onset of a global trade war a few months ago. We should expect retaliatory measures from countries affected by Trump's actions. We should also expect a new wave of declines in the U.S. stock market, a sell-off in U.S. Treasuries, and rising yields. The formation of trade alliances against the U.S. is also possible. In short, 2025 continues to surprise us with new shocks.

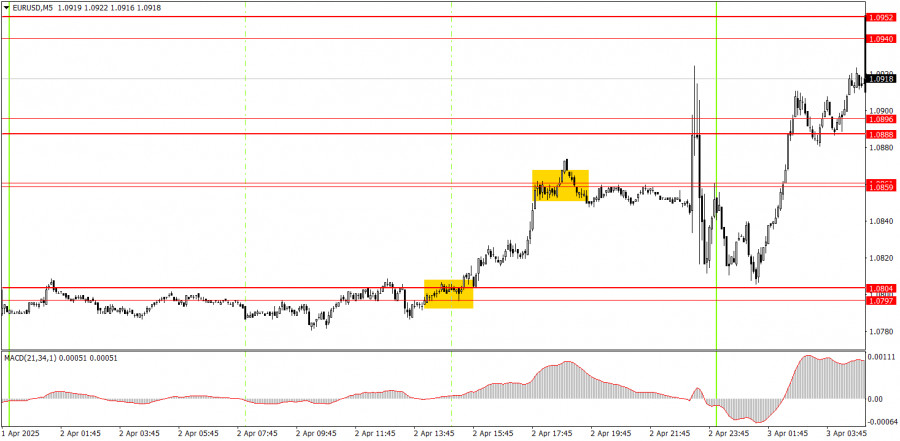

On the 5-minute timeframe on Wednesday, two trading signals were formed. It's worth noting that there were virtually no market movements before the U.S. session began. The "takeoff" started in the second half of the day, while we saw near-parabolic movements by night. Thus, novice traders could only attempt to work with the signal on the breakout of the 1.0797–1.0804 zone, after which the 1.0859–1.0861 area was reached and processed.

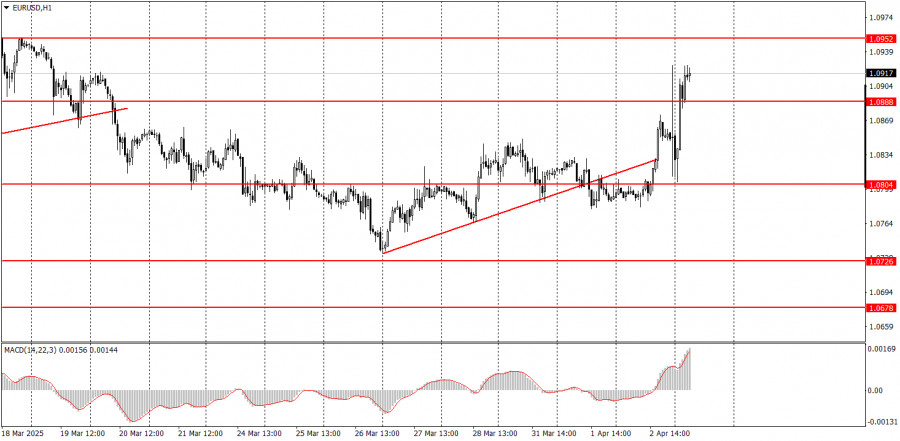

On the hourly timeframe, the EUR/USD pair remains in a medium-term downtrend, but the chances of that trend resuming are dwindling. At this point, fundamental and macroeconomic factors have no weight. Only political and geopolitical developments matter. Trump has been imposing tariffs for two months now, and that alone is driving the dollar downward. Now, other countries may begin to impose tariffs on U.S. exports, and Trump has already promised to respond with even more tariffs to any countermeasures.

On Thursday, all markets will be in a state of shock. We're not even going to attempt forecasting movements, and the economic calendar can be ignored—it holds no relevance at this point. The coming days will be important in terms of the global response to the U.S.'s new trade policy.

On the 5-minute chart, the levels to watch are: 1.0433–1.0451, 1.0526, 1.0596, 1.0678, 1.0726–1.0733, 1.0797–1.0804, 1.0859–1.0861, 1.0888–1.0896, 1.0940–1.0952, 1.1011, 1.1048.

On Thursday, we won't highlight any key macroeconomic events. Today and tomorrow, the market will closely watch how countries respond to Trump's sweeping tariff measures.

Support and Resistance Levels: These are target levels for opening or closing positions and can also serve as points for placing Take Profit orders.

Red Lines: Channels or trendlines indicating the current trend and the preferred direction for trading.

MACD Indicator (14,22,3): A histogram and signal line used as a supplementary source of trading signals.

Important Events and Reports: Found in the economic calendar, these can heavily influence price movements. Exercise caution or exit the market during their release to avoid sharp reversals.

Forex trading beginners should remember that not every trade will be profitable. Developing a clear strategy and practicing proper money management are essential for long-term trading success.

You have already liked this post today

*Analisis pasar yang diposting disini dimaksudkan untuk meningkatkan pengetahuan Anda namun tidak untuk memberi instruksi trading.

Pada hari Jumat, pasangan mata uang EUR/USD menunjukkan sedikit penurunan. Meskipun grafik 5-menit mungkin menunjukkan bahwa pasangan ini menghabiskan sepanjang hari dalam tren menurun, dolar AS hanya naik 19 pips

Pada hari Kamis, pasangan GBP/USD menunjukkan pergerakan naik yang minimal; namun, pada kerangka waktu 5 menit, ini sebagian besar merupakan pergerakan menyamping. Inggris merilis laporan PDB dan produksi industri kemarin

Pada hari Kamis, pasangan mata uang EUR/USD diperdagangkan dalam dua arah. Latar belakang makroekonomi cukup kaya, tetapi tidak memiliki dampak yang menentukan seperti yang kami perkirakan. Banyak laporan saling menutupi

Pada hari Kamis, pasangan mata uang GBP/USD diperdagangkan secara mendatar dengan volatilitas rendah. Meskipun kalender makroekonomi padat, pasar mengabaikan sebagian besar data, seperti yang diperkirakan. Di Inggris, laporan PDB untuk

Pada hari Kamis, pasangan mata uang EUR/USD hanya menunjukkan satu hal—ketidakinginan penuh untuk bergerak. Kami mengamati pergerakan menyamping sepanjang hari meskipun kalender makroekonomi cukup padat. Namun, seperti yang disebutkan dalam

Pada hari Rabu, pasangan GBP/USD melanjutkan pergerakan naiknya, meskipun tidak ada alasan fundamental khusus. Sehari sebelumnya, laporan inflasi AS dirilis di bawah ekspektasi, yang secara formal menunjukkan kemungkinan pelonggaran sikap

Pada hari Rabu, pasangan mata uang EUR/USD mengalami pergerakan naik selama sekitar setengah hari. "Lonjakan" terbaru pada euro ini sangat "mengagumkan," meskipun kemungkinan besar hanya merupakan penurunan lain pada dolar

Pada hari Rabu, pasangan mata uang GBP/USD melanjutkan trading dengan kecenderungan naik untuk beberapa waktu, tetapi kembali mengalami penurunan pada sore hari. Dari sudut pandang kami, dolar AS telah melemah

Pada hari Rabu, pasangan mata uang EUR/USD melanjutkan pergerakan naik, tetapi hanya sebentar. Pada sore hari, euro mulai turun, meskipun tidak ada faktor makroekonomi yang mendukung pergerakan tersebut. Donald Trump

Pada hari Selasa, pasangan GBP/USD mengalami pertumbuhan yang signifikan, meskipun tidak ada pemicu yang jelas di baliknya. Pada hari Senin, dolar naik karena alasan tertentu, tetapi pada hari Selasa turun

Video pelatihan

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.