Lihat juga

03.04.2025 11:00 AM

03.04.2025 11:00 AMToday, the GBP/USD pair is showing strong growth, reaching levels last seen in October 2024. This is driven by bearish momentum in the U.S. dollar, which has created favorable conditions for the British pound.

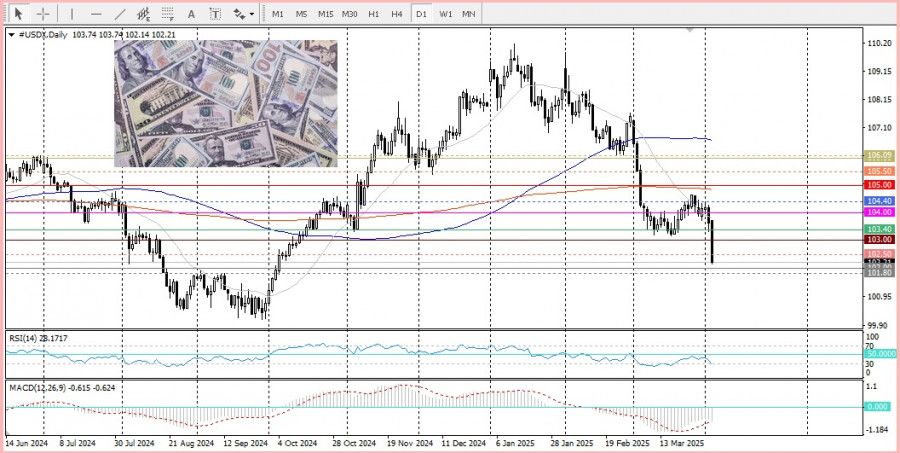

The decline in the U.S. Dollar Index to a new yearly low, in response to trade tariffs introduced by U.S. President Donald Trump, has heightened expectations for the Federal Reserve to begin a rate-cutting cycle sooner. As a result, U.S. Treasury yields have dropped sharply, undermining the dollar.

At the same time, the Bank of England is expected to cut rates more gradually than other central banks, including the Fed, which provides additional support to the pound. This further fuels demand for the British currency, helping the GBP/USD pair to rise.

From a technical perspective, the breakout above the psychological level of 1.3000 confirms the exit from a multi-week trading range, opening the way toward new targets. There is a high probability that GBP/USD could soon reach the 1.3180 area and the round level of 1.3200. However, it's important to note that oscillators on the daily chart are approaching overbought territory. Therefore, initiating new long positions at this moment may be premature—it's better to wait for consolidation or a short-term pullback.

On the other hand, the 1.3000 level now acts as a key support. A break below it would shift the bias in favor of the bears, pushing the pair back into its previous range. The nearest support is located around the 1.3100 round level, which the pair may revisit during consolidation, or to the 1.3056–1.3100 zone before potentially continuing its upward movement.

You have already liked this post today

*Analisis pasar yang diposting disini dimaksudkan untuk meningkatkan pengetahuan Anda namun tidak untuk memberi instruksi trading.

Brent sedang berjuang untuk tetap bertahan, bahkan ketika ancaman serangan terhadap Iran dan perkembangan baru dalam diplomasi sanksi AS mulai terlihat. Sementara itu, gas alam saat ini menghadapi kesulitan karena

Pengujian level 144,86 terjadi ketika indikator MACD baru saja mulai bergerak naik dari garis nol, mengonfirmasi titik masuk yang valid untuk membeli dolar dan menghasilkan kenaikan lebih dari

Uji level 1,3342 pada paruh kedua hari terjadi ketika indikator MACD sudah bergerak jauh di atas garis nol, yang membatasi potensi kenaikan pasangan ini. Uji kedua level ini terjadi

Uji harga pada 1.1312 di paruh kedua hari itu bertepatan dengan indikator MACD yang sudah bergerak jauh di atas garis nol, yang membatasi potensi kenaikan pasangan ini. Uji kedua pada

Euro dan pound kembali mengalami penurunan segera setelah kepercayaan pasar terhadap tercapainya kesepakatan dagang AS dengan mitra utama meningkat. Setelah menandatangani perjanjian dagang dengan Inggris, komentar lembut Donald Trump mengenai

Analisis dan Tips Trading untuk Pound Inggris Uji harga di 1.3330 pada paruh pertama hari ini bertepatan dengan indikator MACD yang baru mulai bergerak turun dari level nol, mengonfirmasi titik

Analisis dan Tips Trading untuk Euro Uji harga di 1.1321 terjadi tepat saat indikator MACD mulai bergerak turun dari titik nol, mengonfirmasi titik masuk yang tepat untuk menjual euro. Akibatnya

Uji harga di 143,18 terjadi ketika indikator MACD bergerak jauh di bawah garis nol, membatasi potensi penurunan pasangan ini. Oleh karena itu, saya tidak menjual dolar. Situasi serupa terjadi dengan

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.