Lihat juga

04.04.2025 09:09 AM

04.04.2025 09:09 AMBitcoin and Ethereum were able to withstand significant pressure again, which was exerted on them yesterday in the latter part of the day following a substantial sell-off in the U.S. stock market—an increasingly correlated counterpart to the cryptocurrency market.

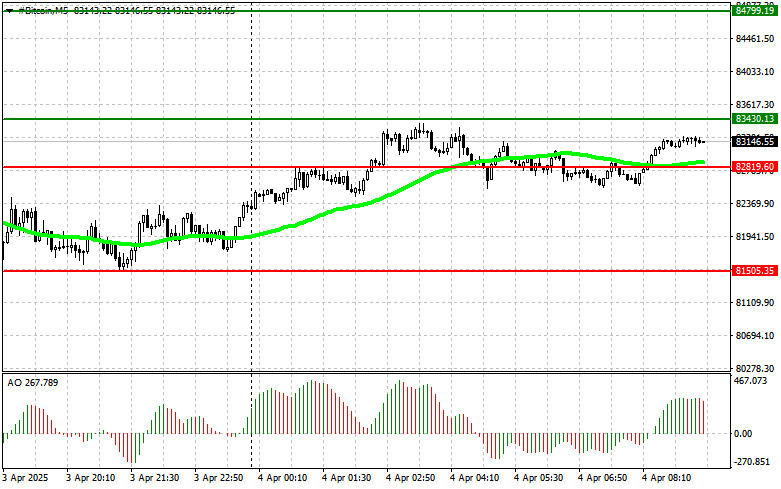

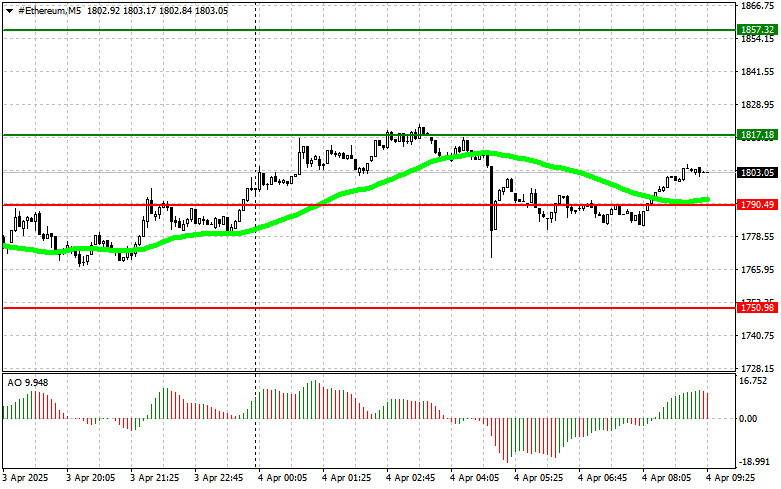

Another unsuccessful attempt by Bitcoin to drop below $81,000 sparked buying interest from large investors. The asset is currently trading at around $83,200. Ethereum was also fortunate: after hitting a low of $1,750 during yesterday's U.S. session, it is now trading around $1,804.

Ethereum may receive support soon, as developers have officially scheduled the Pectra upgrade for launch on the Ethereum mainnet on May 7. Pectra is expected to bring several key improvements aimed at enhancing the efficiency and functionality of the Ethereum network. These include optimization of the Ethereum Virtual Machine (EVM), lower gas fees (transaction costs), and enhanced staking capabilities. Additionally, the update will address network security and privacy. The Pectra launch marks an important milestone in Ethereum's development, showcasing the developers' commitment to continuous improvement and adaptation to changing market demands. Successful deployment could positively influence ETH's price and attract new users and developers to the Ethereum ecosystem.

Regarding intraday strategies in the crypto market, I will continue to focus on large pullbacks in Bitcoin and Ethereum, anticipating the continuation of a mid-term bullish market trend, which remains intact.

For short-term trading, the strategy and conditions are outlined below.

Scenario #1: I plan to buy Bitcoin today upon reaching the entry point around $83,400, targeting a rise to $84,800. Around $84,800, I will exit long positions and sell immediately on the bounce. Before entering a breakout trade, ensure the 50-day moving average is below the current price and the Awesome Oscillator is in the positive zone.

Scenario #2: Buying Bitcoin is also possible from the lower boundary at $82,800 if there is no market reaction to a breakout. Aim for a rebound to $83,400 and $84,800.

Scenario #1: I plan to sell Bitcoin today upon reaching the entry point of around $82,800, targeting a decline to $81,500. Around $81,500, I will exit short positions and buy immediately on the bounce. Before entering a breakout trade, ensure the 50-day moving average is above the current price and the Awesome Oscillator is in the negative zone.

Scenario #2: Selling Bitcoin is also possible from the upper boundary at $83,400 if there is no market reaction to a breakout, aiming for a decline to $82,800 and $81,500.

Scenario #1: I plan to buy Ethereum today upon reaching the entry point around $1,817, targeting a rise to $1,857. Around $1,857, I will exit long positions and sell immediately on the bounce. Before entering a breakout trade, ensure the 50-day moving average is below the current price and the Awesome Oscillator is in the positive zone.

Scenario #2: Buying Ethereum is also possible from the lower boundary at $1,790 if there is no market reaction to a breakout. Aim for a rebound to $1,817 and $1,857.

Scenario #1: I plan to sell Ethereum today upon reaching the entry point of around $1,790, targeting a decline to $1,750. Around $1,750, I will exit short positions and buy immediately on the bounce. Before entering a breakout trade, ensure the 50-day moving average is above the current price and the Awesome Oscillator is in the negative zone.

Scenario #2: Selling Ethereum is also possible from the upper boundary at $1,817 if there is no market reaction to a breakout, aiming for a decline to $1,790 and $1,750.

You have already liked this post today

*Analisis pasar yang diposting disini dimaksudkan untuk meningkatkan pengetahuan Anda namun tidak untuk memberi instruksi trading.

Bitcoin telah naik di atas $100,000, sementara Ethereum mencoba untuk berkonsolidasi di atas $2,000. Setelah reli tajam kemarin, yang berlanjut selama sesi Asia hari ini, Bitcoin sekarang trading pada $103,000

Pada chart 4 jam dari mata uang kripto Bitcoin, nampak terlihat indikator Stochastic Oscillator sudah berada dalam kondisi Overbought dan kini tengah bersiap-siap Crossing SELL dan tembus kebawah level

Bila Kita perhatikan chart 4 jamnya dari mata uang kripto Ethereum, nampak pergerakan harganya bergerak diatas WMA (30 Shift 2) yang juga memiliki kemiringan slope menukik keatas, dimana artinya momentum

Sementara indeks saham tetap stagnan, emas berkonsolidasi mendekati titik tertingginya, dan Bitcoin kembali menarik perhatian. Aset utama pasar kripto ini mendekati level psikologis penting $100.000, bukan karena ledakan atau emosi

Bitcoin mencapai sedikit di bawah $100.000, sementara Ethereum mencapai $1.900. Pertumbuhan besar di pasar cryptocurrency ini sekali lagi mengonfirmasi prospek bullish-nya, yang belakangan ini banyak dibicarakan. Bitcoin saat ini diperdagangkan

Harga Bitcoin saat ini berada di dekat ambang batas psikologis yang signifikan, dan para pelaku pasar bersiap menghadapi lonjakan naik lainnya atau reversal mendadak yang dapat menghapus ekspektasi bullish jangka

Kontrak berjangka indeks saham AS melonjak tajam pada pembukaan sesi perdagangan hari ini setelah berita bahwa perwakilan dari AS dan Tiongkok telah melanjutkan konsultasi mengenai masalah perdagangan. Laporan media mengungkapkan

Bitcoin dan Ethereum Terus Tumbuh Berkat Berita Legislatif Crypto yang Positif Saat ini, Bitcoin diperdagangkan pada $96.700, setelah bangkit dari posisi terendah $93.400, sementara Ethereum telah pulih ke area $1.835

Bitcoin diperdagangkan dalam kisaran $93.000–$94.000, sekitar 0,5% di bawah titik tertinggi lokal terbarunya sebesar $97.900, yang tercatat pada 2 Mei. Volatilitas telah menurun, dan pasar tampaknya berada dalam keadaan jeda

Bitcoin dan Ethereum menghabiskan hari dalam channel mendatar, meskipun tanda-tanda penjualan aktif selama sesi Amerika kemarin menimbulkan beberapa pertanyaan terkait prospek kenaikan jangka pendek dari instrumen trading ini. Bitcoin saat

Indikator pola

grafis.

Lihat hal-hal

yang belum pernah anda lihat!

InstaTrade dalam angka

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.