Lihat juga

07.04.2025 07:03 AM

07.04.2025 07:03 AMThere are very few macroeconomic events scheduled for Monday. After last week's developments, we believe these events will have no impact on the movements of either currency pair. Nonetheless, today's agenda includes reports on retail sales in the Eurozone and industrial production in Germany. But who is paying attention to these figures right now? The world remains at the epicenter of events surrounding Trump's new trade policy. And it cannot be said that the worst is already behind us. Many countries have expressed a desire to reach agreements with the controversial U.S. president, but the largest players are preparing to introduce retaliatory tariffs and sanctions. The European Union is already drafting a new list of goods worth $28 billion to be subject to duties.

At the moment, there is no point discussing anything other than Trump's trade tariffs. The decline of the dollar may continue indefinitely despite Friday's rebound. We advise traders to closely monitor speeches by top officials from major countries and alliances regarding counter-tariffs. Trump has stated that any response to his actions to "eliminate injustice" will be severely punished with new sanctions and tariffs. So, if anyone assumed the tariffs introduced on Wednesday were final and their rates set in stone, they are sorely mistaken. Prolonged and complex negotiations will now begin with all "sanctioned" countries. Retaliatory tariffs from key global players are about to roll out. How will this all end? No one knows.

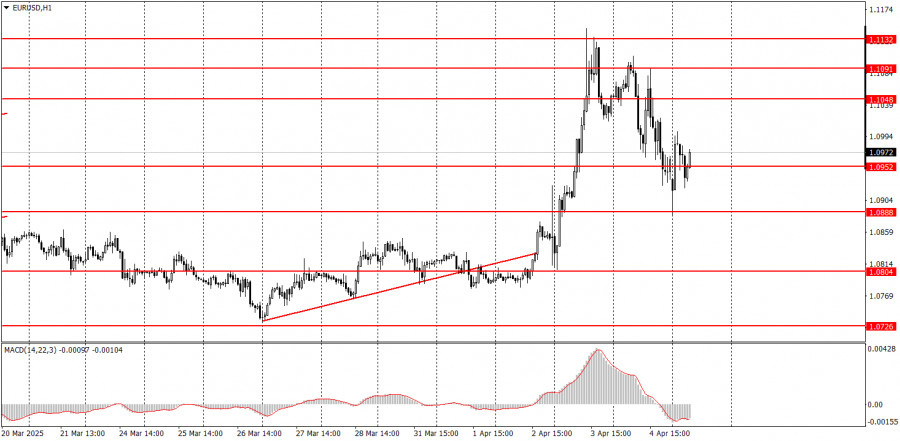

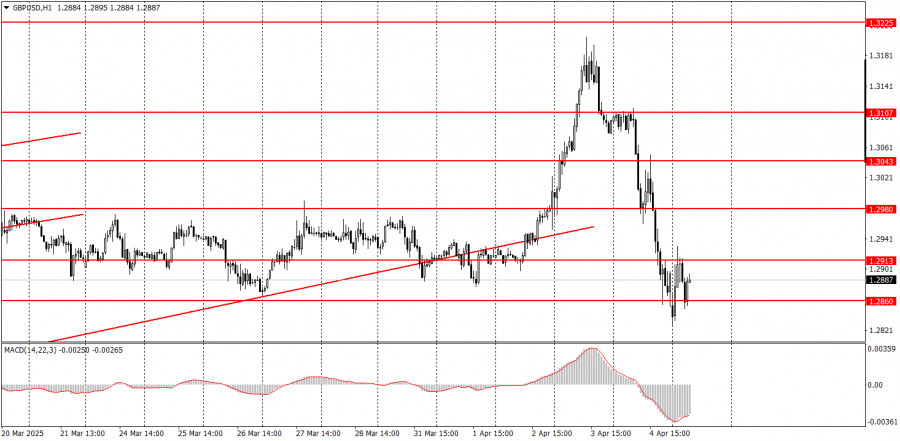

On the first trading day of the new week, both currency pairs may move in any direction. The market is in a state of panic and chaos, so there is no logic behind the price action. Trading should be based solely on levels in the 5-minute timeframe without relying on a clear trend.

Support and Resistance Levels: These are target levels for opening or closing positions and can also serve as points for placing Take Profit orders.

Red Lines: Channels or trendlines indicating the current trend and the preferred direction for trading.

MACD Indicator (14,22,3): A histogram and signal line used as a supplementary source of trading signals.

Important speeches and reports, which are consistently featured in the news calendar, can significantly influence the movement of a currency pair. Therefore, during their release, it is advisable to trade with caution or consider exiting the market to avoid potential sharp price reversals against the prior trend.

Beginners in the Forex market should understand that not every transaction will be profitable. Developing a clear trading strategy and practicing effective money management are crucial for achieving long-term success in trading.

You have already liked this post today

*Analisis pasar yang diposting disini dimaksudkan untuk meningkatkan pengetahuan Anda namun tidak untuk memberi instruksi trading.

Pasar semakin peka terhadap berita baik, tetapi hari-hari terbaiknya sudah berlalu. Nilai ekuitas AS sebagai persentase dari MSCI All Country World Index mencapai puncaknya pada bulan Desember. Menurut Jefferies Financial

Yen Jepang tetap menunjukkan nada bullish meskipun ada beberapa tantangan dan tetap menjadi fokus karena pembaruan aversi risiko global mendorong permintaan terhadap aset safe-haven. Semakin berkurangnya harapan untuk resolusi cepat

Emas menunjukkan momentum positif saat mencoba bertahan di atas level $3300, mengindikasikan minat investor yang semakin meningkat terhadap aset safe haven tradisional ini. Ketidakpastian seputar hubungan dagang AS-Tiongkok—yang disoroti oleh

Menurut seorang pejabat senior di Bank Sentral Eropa, Presiden Donald Trump telah menarik seluruh dunia ke dalam permainan di mana semua orang akhirnya kalah — merujuk pada kebijakan perdagangannya, yang

Dolar AS melonjak tajam terhadap sebagian besar mata uang utama setelah Presiden Donald Trump menyatakan bahwa ia berencana untuk bersikap sangat "sopan" dengan Tiongkok dalam setiap pembicaraan dagang dan tarif

Sementara Donald Trump berusaha untuk mencapai kesepakatan dengan Tiongkok, Gubernur Federal Reserve Adriana Kugler menyatakan bahwa kebijakan tarif saat ini kemungkinan akan memberikan tekanan ke atas pada harga dan mungkin

Sementara pasar tetap fokus pada perang dagang, terutama antara AS dan Tiongkok, data ekonomi yang masuk menunjukkan masalah struktural yang kuat pada perekonomian maju Eropa dan Amerika Serikat. Pasar bereaksi

Hanya sedikit peristiwa makroekonomi yang dijadwalkan untuk hari Kamis, tetapi perkembangan kemarin menunjukkan bahwa pasar terus mengabaikan sebagian besar rilis data. Hanya segelintir laporan yang cukup beruntung untuk diperhitungkan. Meskipun

Pada hari Rabu, pasangan mata uang GBP/USD berhasil menghindari penurunan yang signifikan, meskipun sehari sebelumnya tampaknya tren penurunan akhirnya dimulai. Namun, pasar dengan cepat bangkit kembali, menyadari bahwa tidak

Klub InstaTrade

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.