Lihat juga

07.04.2025 07:25 PM

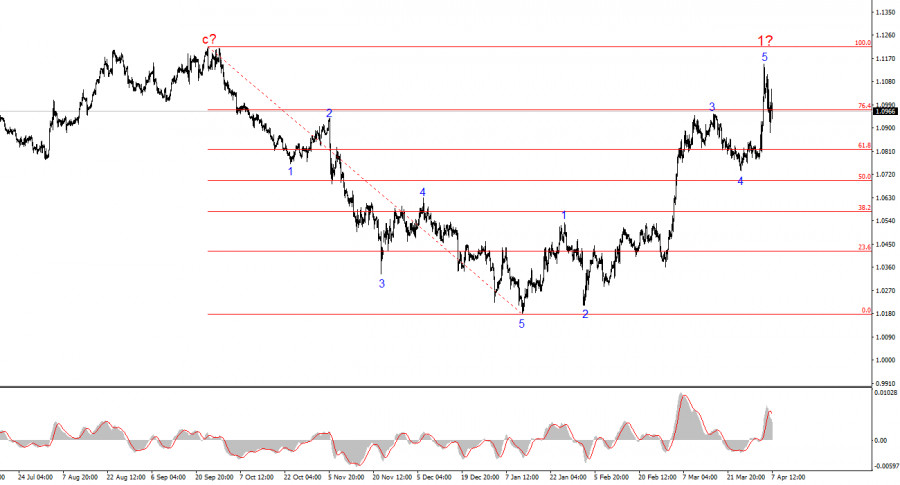

07.04.2025 07:25 PMThe wave structure on the 4-hour chart for EUR/USD has transformed into a bullish one. I believe no one doubts that this transformation occurred solely due to the new U.S. trade policy. Up until February 28, when the U.S. dollar began to decline sharply, the entire wave pattern looked like a convincing downward trend segment — the formation of corrective wave 2. However, Trump's weekly announcements of various tariffs took their toll. Demand for the U.S. dollar dropped rapidly, and now the entire trend segment that began on January 13 has taken on the form of a five-wave impulse.

Based on this, we should now expect the formation of corrective wave 2 in the new upward trend segment, which may consist of three waves. After that, the dollar's decline should continue — unless Donald Trump completely reverses his adopted trade policy. We've witnessed a case where the news background has changed the wave structure.

The EU Prepares Its Response

The EUR/USD exchange rate remained virtually unchanged on Monday, but that doesn't reflect the market's actual volatility. The pair opened with a gap down, then rose by 160 points, then dropped by 110. As we can see, the movement amplitude remains very high. But what's strange about that, considering what's happening globally?

To briefly reiterate my position on Trump's tariffs: the U.S. President has chosen a strategy — declare war on everyone, and eventually they'll crawl to us on their knees, begging for mercy and a trade deal. Trump believes that tariffs won't harm the U.S., given its power and its President. A temporary downturn is possible, but he sees nothing wrong with that — because afterward will come a Period of Prosperity. Personally, I have serious doubts that this period will begin while Trump remains president. As I've said before, I don't believe that any major country or global alliance will simply accept Trump's protectionist policies and agree to pay whatever he demands. For example, the European Union is already preparing a retaliatory tariff package worth 28 billion dollars. And that certainly won't be the last package — nor the last escalation of the trade war. Well, Trump wanted war — and Trump will get war. It's important to say "Trump wants war," not "the U.S. wants war," because no one in the U.S. government before Trump had such an aggressive stance. Trump "wants to fix the situation" and claims that all countries are eager to make trade deals with America. Yet I don't see any lines forming at the White House.

Based on my EUR/USD analysis, I conclude that the pair has begun forming a new upward trend segment. The only serious concern here is Donald Trump. If his actions were able to reverse one trend, they can certainly reverse another. Therefore, the upcoming wave structure will completely depend on the U.S. President's stance and decisions. This must be kept in mind at all times. Currently, we should expect the formation of a corrective wave set, which by classical standards may consist of three waves. After that, a new upward wave should form, and buying opportunities should be sought with targets well above the 1.10 area.

In the larger wave timeframe, the wave pattern has shifted to bullish. A long-term upward wave structure is likely ahead — but news flow from Trump alone could turn everything upside down once more.

Core Principles of My Analysis:

You have already liked this post today

*Analisis pasar yang diposting disini dimaksudkan untuk meningkatkan pengetahuan Anda namun tidak untuk memberi instruksi trading.

Struktur gelombang untuk GBP/USD juga telah berubah menjadi pola bullish yang impulsif—"berkat" Donald Trump. Gambaran gelombang ini hampir identik dengan EUR/USD. Hingga 28 Februari, kami mengamati pembentukan struktur korektif yang

Pola gelombang untuk GBP/USD juga telah berubah menjadi struktur impulsif yang bullish—"berkat" Donald Trump. Gambaran gelombang ini sangat mirip dengan EUR/USD. Hingga 28 Februari, kami mengamati struktur korektif yang meyakinkan

Pola wave pada grafik 4 jam EUR/USD telah beralih menjadi struktur bullish. Saya yakin tidak diragukan bahwa transformasi ini terjadi semata-mata karena kebijakan perdagangan baru yang diambil oleh Amerika Serikat

Struktur gelombang untuk pasangan GBP/USD juga telah berubah menjadi pola impulsif naik — "berkat" Donald Trump. Gambaran gelombang hampir identik dengan pasangan EUR/USD. Hingga 28 Februari, kami mengamati pembentukan struktur

Struktur wave pada grafik 4 jam untuk pasangan EUR/USD telah berubah menjadi bullish. Saya percaya tidak ada keraguan bahwa transformasi ini sepenuhnya disebabkan oleh kebijakan perdagangan baru AS. Hingga

GBP/USD Analisis: Grafik 4 jam pound Inggris menunjukkan bahwa sebuah gerakan datar korektif sementara sedang terbentuk dalam wave naik dominan yang diamati dalam beberapa minggu terakhir. Segmen naik yang belum

EUR/USD Analisis: Grafik per jam pasangan euro utama menunjukkan gelombang naik dominan sejak awal Februari. Koreksi yang terbentuk selama tiga minggu terakhir mendekati penyelesaian. Segmen yang belum selesai dari

Ferrari F8 TRIBUTO

dari InstaTrade

Klub InstaTrade

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.