यह भी देखें

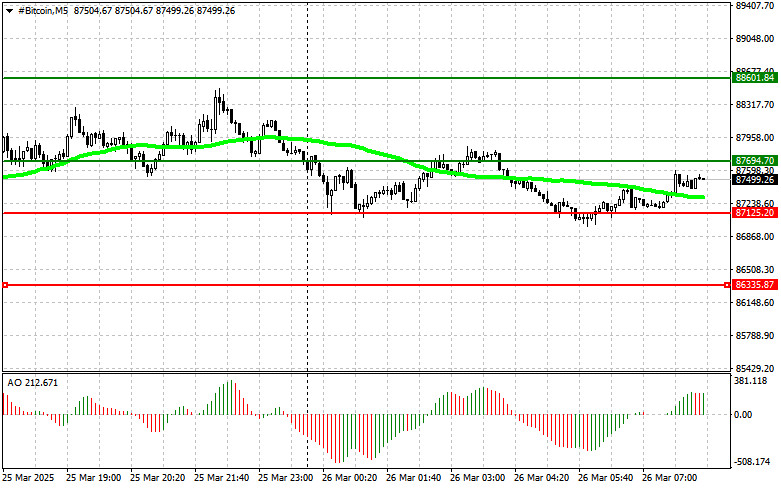

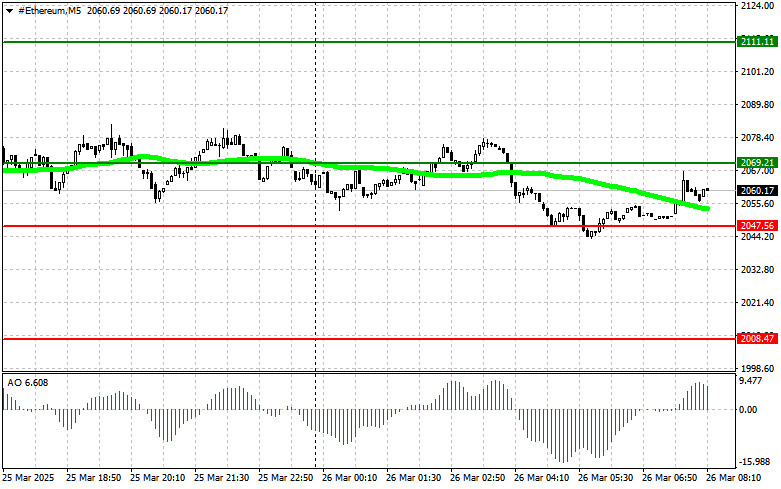

Bitcoin and Ethereum continue to show active growth but face challenges in overcoming major resistance levels. Yesterday, Bitcoin pulled back after reaching $88,400 and is currently trading around $87,600. Ethereum also corrected and, after another failed attempt to break above $2,100 during today's Asian session, fell to around $2,060.

Despite this, according to data from Santiment, bullish sentiment continues to rise in the market. The week started strong: bullish sentiment for BTC reached a six-week high, while optimism for ETH grew steadily.

This optimism may be linked to expectations of further positive news and an improving macroeconomic outlook. Investors likely hope for a continuation of the crypto price rally after the healthy correction seen in early March. However, it's important to remember that the crypto market is volatile, and such sentiment can shift quickly. External factors like regulatory developments across various countries and the global economic environment also play a role.

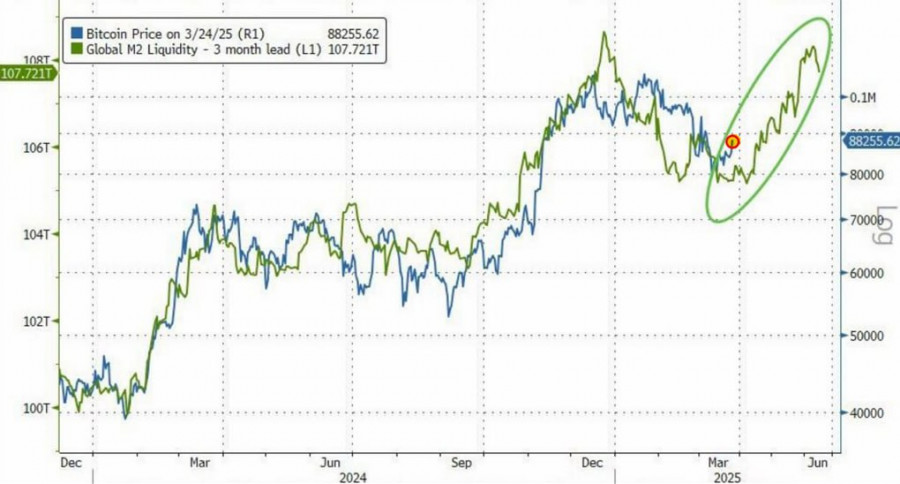

According to updated data on global M2 liquidity trends and BTC price action, the local bottom in BTC may already be behind us. This news will likely support the cryptocurrency market. Recall that the correlation between global M2 liquidity and BTC price has historically shown that increases in money supply typically precede a rise in crypto prices. When more money circulates in the economy, investors tend to seek higher-yielding assets, with BTC often being one of them.

As for intraday strategy in the crypto market, I will continue to rely on major dips in Bitcoin and Ethereum, expecting the medium-term bull market to remain intact.

For short-term trading, the strategy and conditions are outlined below.

Scenario 1: I plan to buy Bitcoin today at the entry point around $87,700, targeting a rise to $88,600. Near $88,600, I will exit long positions and sell on a pullback. Before buying on a breakout, ensure the 50-day moving average is below the current price and the Awesome Oscillator is above the zero line.

Scenario 2: Bitcoin can also be bought from the lower boundary at $87,200, provided there is no market reaction to a breakdown of this level, aiming for a rebound to $87,700 and $88,600.

Scenario 1: I plan to sell Bitcoin today at the entry point of $87,100, targeting a decline to $86,300. Near $86,300, I will exit short positions and buy on a bounce. Before selling on a breakout, ensure the 50-day moving average is above the current price and the Awesome Oscillator is below zero.

Scenario 2: Bitcoin can also be sold from the upper boundary at $87,700 if there is no market reaction to a breakout, targeting $87,100 and $86,300 on a reversal.

Scenario 1: I plan to buy Ethereum today at the entry point of $2,060, targeting a rise to $2,100. Near $2,100, I will exit long positions and sell on a bounce. Before buying on a breakout, ensure the 50-day moving average is below the current price and the Awesome Oscillator is above the zero line.

Scenario 2: Ethereum can also be bought from the lower boundary at $2,047 if there is no reaction to a breakdown, aiming for a rebound to $2,069 and $2,100.

Scenario 1: I plan to sell Ethereum today at the entry point of $2,047, targeting a decline to $2,008. Near $2,008, I will exit short positions and buy on a bounce. Before selling on a breakout, ensure the 50-day moving average is above the current price and the Awesome Oscillator is below zero.

Scenario 2: Ethereum can also be sold from the upper boundary at $2,069 if there is no market reaction to a breakout, targeting $2,047 and $2,008 on a reversal.

You have already liked this post today

*यहां पर लिखा गया बाजार विश्लेषण आपकी जागरूकता बढ़ाने के लिए किया है, लेकिन व्यापार करने के लिए निर्देश देने के लिए नहीं |

ग्राफ़िकल पैटर्न्स

इंडिकेटर।

ऐसी चीज़ों को नोटिस करें

जो आप कभी नहीं करेंगे!

फॉरेक्स (विदेशी मुद्रा) संबंधी चार्ट

वेब-संस्करण

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.