AUDUSD (Australian Dollar vs US Dollar). Exchange rate and online charts.

Currency converter

16 Jun 2025 13:10

(0%)

Closing price, the previous day.

Opening price.

The highest price over the last trading day.

The lowest price over the last trading day

Price range high in the last week

Price range low in the last week

The Australian dollar is one of the most convertible currencies on the international Forex market, along with the U.S. dollar, the euro, the Japanese yen and the British pound. The AUD/USD currency pair is one of the most popular with traders around the world. This trading instrument is very popular because of high interest rates and relative independence of Australia’s monetary policy from the intervention on the foreign exchange market. Australia is a politically stable country with a highly developed economy. The Australian economy is strongly influenced by the situation in East and Southeast Asia, for this reason the Aussie is often considered an Asian currency.

The AUD/USD trading instrument is highly liquid currency pair. Five percent of all deals on the Forex market are made with this financial instrument. Most active trading on this trading symbol occurs during Asian and Pacific trading sessions. The Forex market has its historical highs and lows on this trading instrument, which a trader can use in his trades. When analyzing the AUD/USD currency pair chart, a trader should pay attention to the behavior of price charts of the following currency pairs: the EUR/USD, the GBP/USD and the USD/JPY. These currency pairs determine the future behavior of the Australian dollar’s price, because of close economic ties between Australia and the countries that issue these currencies. In his analysis a trader should take into account the different shapes formed by the price chart, which give clear signals about future market behavior. These figures include: head and shoulders, double top, triple top, flag, triangle, and others. In addition, a trader has to bear in mind the numerous economic indicators of Australia, such as discount rate, GDP, unemployment rate and various indicators of economic activity, and others. With the help of historical levels, a trader can make more accurate forecasts in order to achieve greater profits.

Since there is the U.S. dollar in the AUD/USD currency pair, you need to monitor carefully the situation in the economy of the United States, as well as the release of the most important news of the world's largest economy. For trading this instrument successfully, it is necessary to examine in details the relation between the main economic indicators of both Australia and the United States to be able to determine accurately the further market behavior. In addition, for a more accurate analysis you should also examine the economic indicators of countries in Asia and the Pacific Basin, such as Japan, China, Hong Kong, Taiwan, Malaysia, Indonesia, Singapore, etc. Australia is an active partner with these countries, so they do have a very direct impact on its economy.

See Also

- Technical analysis / Video analytics

Forex forecast 20/05/2025: EUR/USD, AUD/USD, USD/JPY, Ethereum and Bitcoin

Technical analysis of EUR/USD, AUD/USD, USD/JPY, Ethereum and BitcoinAuthor: Sebastian Seliga

10:25 2025-05-20 UTC+2

15238

Technical analysis / Video analyticsForex forecast 03/06/2025: EUR/USD, AUD/USD, NZD/USD, Oil and Bitcoin

Technical analysis of EUR/USD, AUD/USD, NZD/USD, Oil and BitcoinAuthor: Sebastian Seliga

10:47 2025-06-03 UTC+2

12688

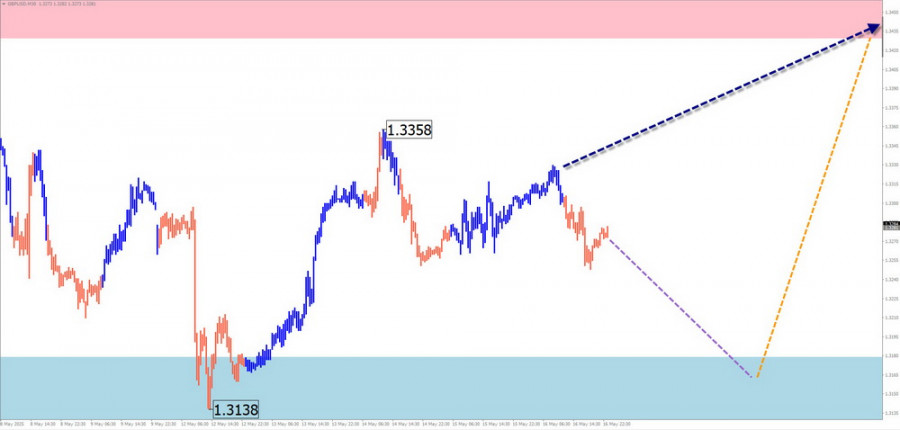

Wave analysisWeekly Forecast Using Simplified Wave Analysis for GBP/USD, AUD/USD, USD/CHF, EUR/JPY, EUR/GBP, and the US Dollar Index on May 19th

Weekly Forecast Using Simplified Wave Analysis for GBP/USD, AUD/USD, USD/CHF, EUR/JPY, EUR/GBP, and the US Dollar Index on May 19thAuthor: Isabel Clark

11:43 2025-05-19 UTC+2

4273

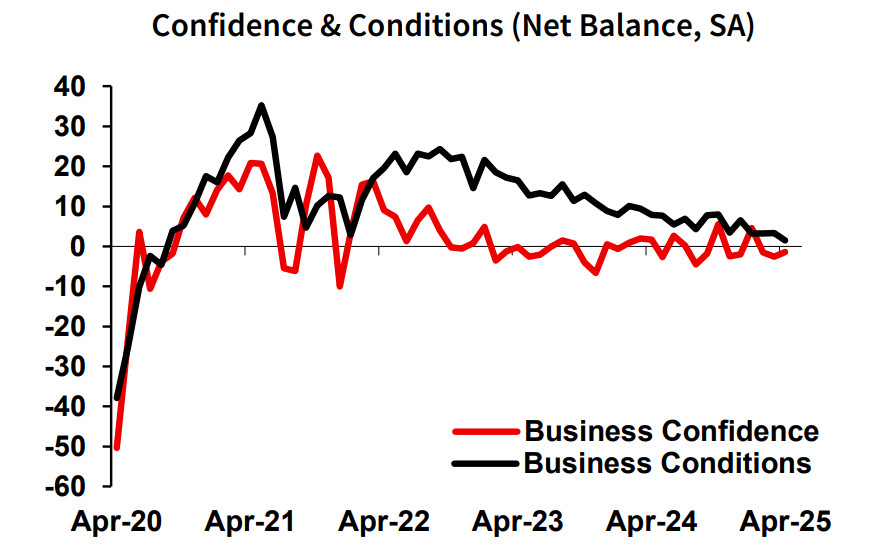

- AUD/USD Outlook: Australia's Economic Momentum Fades

Author: Kuvat Raharjo

19:49 2025-05-15 UTC+2

3913

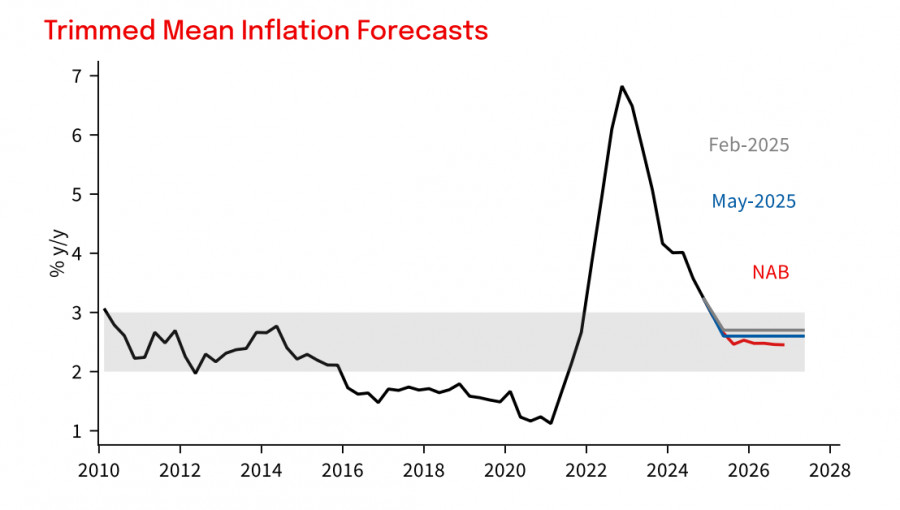

RBA Turns Increasingly Dovish, Reducing Chances of AUD/USD RecoveryAuthor: Kuvat Raharjo

12:26 2025-05-22 UTC+2

3883

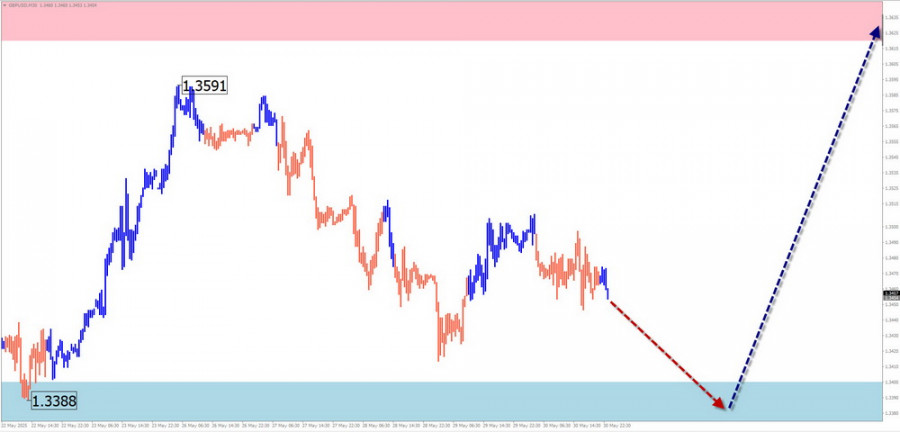

Wave analysisWeekly Forecast Based on Simplified Wave Analysis for GBP/USD, AUD/USD, USD/CHF, EUR/JPY, EUR/GBP, and the US Dollar Index on June 2nd

During the upcoming week, the British pound is expected to move from its current zone toward the calculated resistance area. In the early days, a downward vector with potential pressure toward the support zone is likely. The highest volatility in the pair is expected in the second half of the week.Author: Isabel Clark

11:53 2025-06-02 UTC+2

3838

- Wave analysis

Weekly Forecast Using Simplified Wave Analysis for GBP/USD, AUD/USD, USD/CHF, EUR/JPY, Ethereum, and U.S. Dollar Index on May 26th

Weekly Forecast Using Simplified Wave Analysis for GBP/USD, AUD/USD, USD/CHF, EUR/JPY, Ethereum, and U.S. Dollar Index on May 26thAuthor: Isabel Clark

11:23 2025-05-26 UTC+2

3553

The Australian Dollar Breaks Out of ConsolidationAuthor: Laurie Bailey

05:10 2025-05-21 UTC+2

3493

AUD/USD. RBA Delivers Dovish Scenario, but It's Too Early to Rush into SellingAuthor: Irina Manzenko

11:44 2025-05-20 UTC+2

3463

- Technical analysis / Video analytics

Forex forecast 20/05/2025: EUR/USD, AUD/USD, USD/JPY, Ethereum and Bitcoin

Technical analysis of EUR/USD, AUD/USD, USD/JPY, Ethereum and BitcoinAuthor: Sebastian Seliga

10:25 2025-05-20 UTC+2

15238

- Technical analysis / Video analytics

Forex forecast 03/06/2025: EUR/USD, AUD/USD, NZD/USD, Oil and Bitcoin

Technical analysis of EUR/USD, AUD/USD, NZD/USD, Oil and BitcoinAuthor: Sebastian Seliga

10:47 2025-06-03 UTC+2

12688

- Wave analysis

Weekly Forecast Using Simplified Wave Analysis for GBP/USD, AUD/USD, USD/CHF, EUR/JPY, EUR/GBP, and the US Dollar Index on May 19th

Weekly Forecast Using Simplified Wave Analysis for GBP/USD, AUD/USD, USD/CHF, EUR/JPY, EUR/GBP, and the US Dollar Index on May 19thAuthor: Isabel Clark

11:43 2025-05-19 UTC+2

4273

- AUD/USD Outlook: Australia's Economic Momentum Fades

Author: Kuvat Raharjo

19:49 2025-05-15 UTC+2

3913

- RBA Turns Increasingly Dovish, Reducing Chances of AUD/USD Recovery

Author: Kuvat Raharjo

12:26 2025-05-22 UTC+2

3883

- Wave analysis

Weekly Forecast Based on Simplified Wave Analysis for GBP/USD, AUD/USD, USD/CHF, EUR/JPY, EUR/GBP, and the US Dollar Index on June 2nd

During the upcoming week, the British pound is expected to move from its current zone toward the calculated resistance area. In the early days, a downward vector with potential pressure toward the support zone is likely. The highest volatility in the pair is expected in the second half of the week.Author: Isabel Clark

11:53 2025-06-02 UTC+2

3838

- Wave analysis

Weekly Forecast Using Simplified Wave Analysis for GBP/USD, AUD/USD, USD/CHF, EUR/JPY, Ethereum, and U.S. Dollar Index on May 26th

Weekly Forecast Using Simplified Wave Analysis for GBP/USD, AUD/USD, USD/CHF, EUR/JPY, Ethereum, and U.S. Dollar Index on May 26thAuthor: Isabel Clark

11:23 2025-05-26 UTC+2

3553

- The Australian Dollar Breaks Out of Consolidation

Author: Laurie Bailey

05:10 2025-05-21 UTC+2

3493

- AUD/USD. RBA Delivers Dovish Scenario, but It's Too Early to Rush into Selling

Author: Irina Manzenko

11:44 2025-05-20 UTC+2

3463